Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine that Australia and the US are the only 2 countries in the world and that the $A-$US exchange rate is fully flexible. The

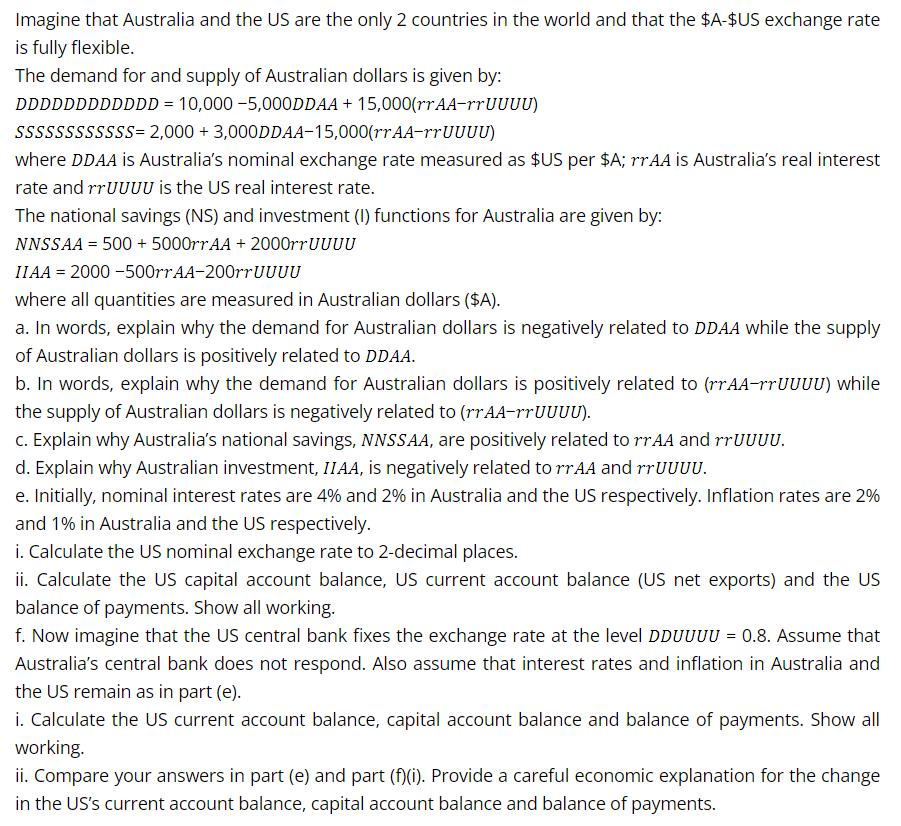

Imagine that Australia and the US are the only 2 countries in the world and that the $A-$US exchange rate is fully flexible. The demand for and supply of Australian dollars is given by: DDDDDDDDDDDD = 10,000 -5,000DDAA +15,000(rr AA-rrUUUU) SSSSSSSSSSSS=2,000 + 3,000DDAA-15,000(rr AA-rrUUUU) where DDAA is Australia's nominal exchange rate measured as $US per $A; rrAA is Australia's real interest rate and rrUUUU is the US real interest rate. The national savings (NS) and investment (1) functions for Australia are given by: NNSSAA = 500 + 5000rr AA + 2000rrUUUU IIAA = 2000-500rr AA-200rrUUUU where all quantities are measured in Australian dollars ($A). a. In words, explain why the demand for Australian dollars is negatively related to DDAA while the supply of Australian dollars is positively related to DDAA. b. In words, explain why the demand for Australian dollars is positively related to (rr AA-rrUUUU) while the supply of Australian dollars is negatively related to (rr AA-rrUUUU). c. Explain why Australia's national savings, NNSSAA, are positively related to rrAA and rrUUUU. d. Explain why Australian investment, IIAA, is negatively related to rr AA and rrUUUU. e. Initially, nominal interest rates are 4% and 2% in Australia and the US respectively. Inflation rates are 2% and 1% in Australia and the US respectively. i. Calculate the US nominal exchange rate to 2-decimal places. ii. Calculate the US capital account balance, US current account balance (US net exports) and the US balance of payments. Show all working. f. Now imagine that the US central bank fixes the exchange rate at the level DDUUUU = 0.8. Assume that Australia's central bank does not respond. Also assume that interest rates and inflation in Australia and the US remain as in part (e). i. Calculate the US current account balance, capital account balance and balance of payments. Show all working. ii. Compare your answers in part (e) and part (f)(i). Provide a careful economic explanation for the change in the US's current account balance, capital account balance and balance of payments.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The demand for Australian dollars is negatively related to DDAA because a higher exchange rate DDAA will make Australian exports more expensive redu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started