Question

Imagine that it is December 2017, and you have just accepted the chief financial officer (CFO) position at Hays County Integrated Delivery System (IDS), hereinafter

Imagine that it is December 2017, and you have just accepted the chief financial officer (CFO) position at Hays County Integrated Delivery System (IDS), hereinafter referred to as County. You will be reporting to Mr. Salter, County’s chief executive officer, a retired schoolteacher who was hired last year. Also reporting to Mr. Salter are Dr. Spok, County’s medical director; Mr. Wannabe, County’s chief operating officer; Ms. Pincher, County’s controller; and Ms. Care, County’s director of nursing. When announcing your appointment, Mr. Salter stated that your primary objective in the coming year (2018) would be to reverse the ominous financial trend that began in 2016 with an operating loss and continued in 2017. Previous operating losses were funded with investment income (investment income was $200,000 in 2017); however, your board recently passed a resolution discontinuing that practice and restricting investment income to capital expenditures in 2017.

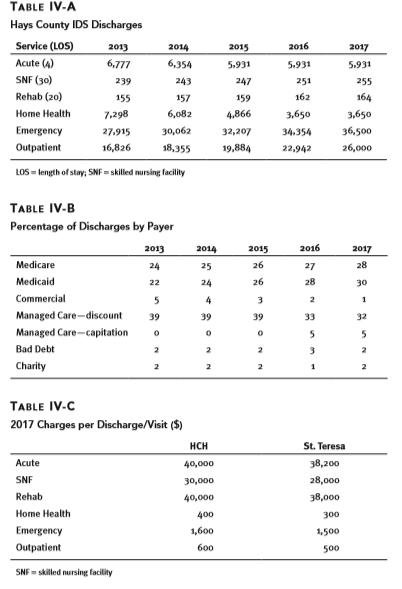

County is a not-for-profit county-owned urban hospital and includes a 130-bed acute care hospital, a 35-bed skilled nursing facility (SNF), a 15-bed rehab facility, a home health care agency, and an outpatient clinic. It has a 40-member medical staff that bills independently. The hospital, Hays County Hospital (HCH), is one of two hospitals in the county (population is 175,000) and the only hospital in San Marcos, Texas, with a population of 50,000. St. Teresa’s, a not-for-profit Catholic-owned hospital, is the only other hospital in Hays County. St. Teresa’s is about 25 miles from Hays County IDS. To acquire background information, you decide to meet first with each member of the executive team and then with selected members of senior management.

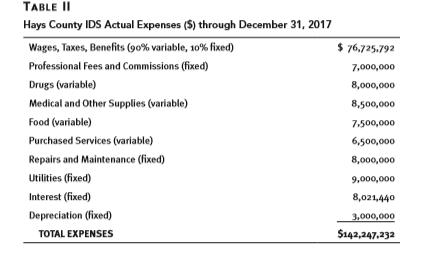

**You will need to use the data in the Tables given in the case. Particularly you will want to use Table II, Table IV-A, Table IV-B, and Table IV-C. You will also need to make some reasonable assumptions as you work through the problem. Your answer should consider financial analysis elements and strategy elements. For example, if you find the capitated contract with the city is losing money, don't jump to the conclusion to cancel the contract. Decide from a strategic perspective whether there is a way forward to renew the contract. There is no absolute right answer, but there are answers that meet the "test of reasonableness". **

Analyze my capitated managed care agreement with the city and tell me the full cost profit / loss. Should we renew the contract for the next year at present rates, or should we ask for a rate increase and if so, how much rate increase do we need to cover our full cost.

TABLE II Hays County IDS Actual Expenses ($) through December 31, 2017 Wages, Taxes, Benefits (90% variable, 10% fixed) Professional Fees and Commissions (fixed) Drugs (variable) Medical and Other Supplies (variable) Food (variable) Purchased Services (variable) Repairs and Maintenance (fixed) Utilities (fixed) Interest (fixed) Depreciation (fixed) TOTAL EXPENSES $ 76,725.792 7,000,000 8,000,000 8,500,000 7,500,000 6,500,000 8,000,000 9,000,000 8,021,440 3,000,000 $142,247,232

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Given the information provided the first step that should be taken by the new chief financial office...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started