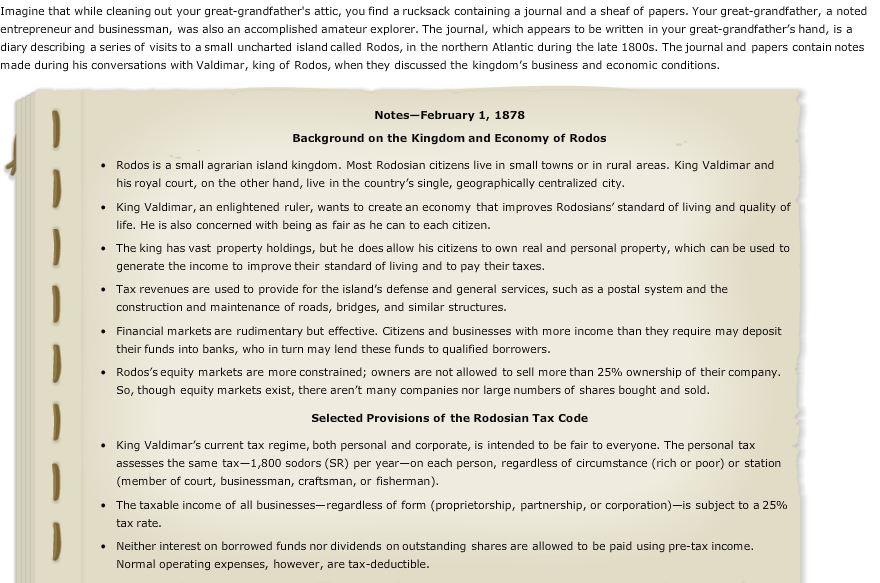

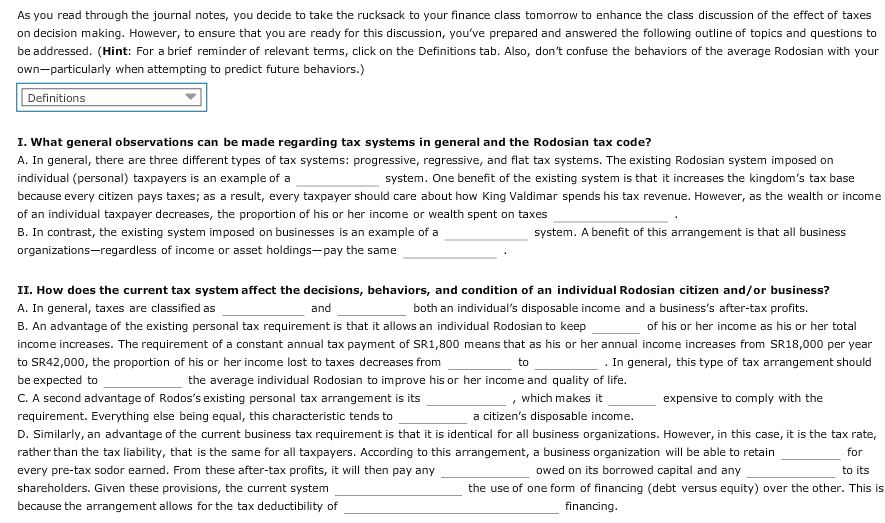

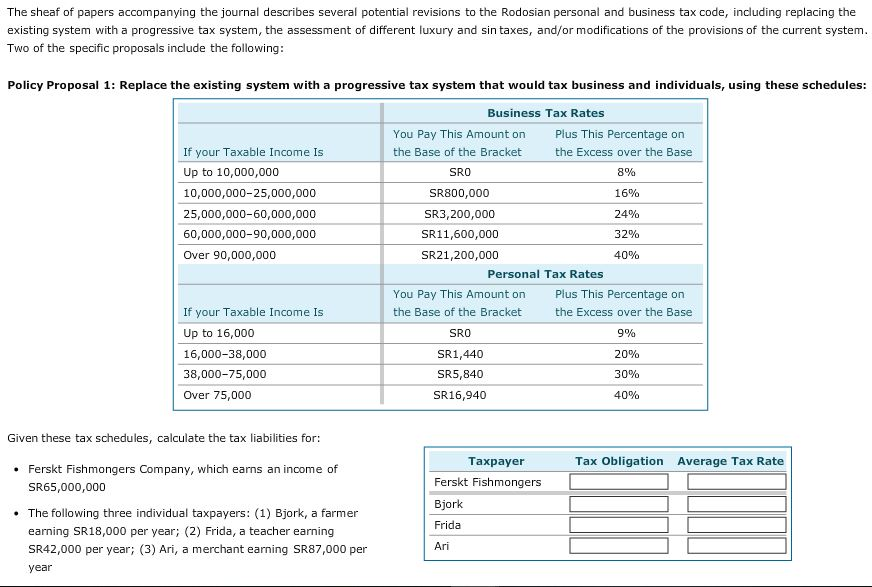

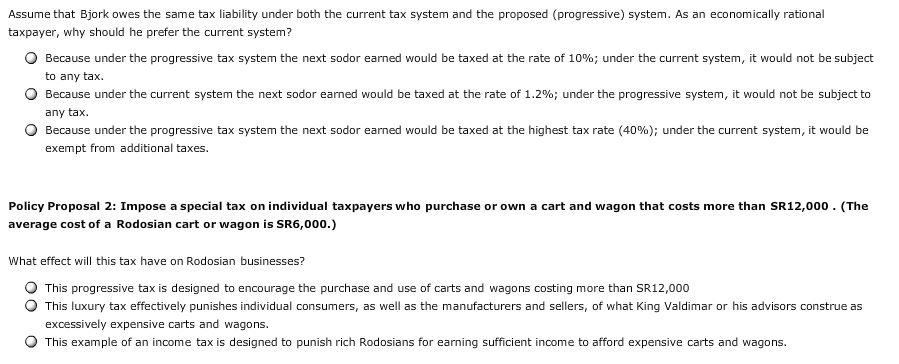

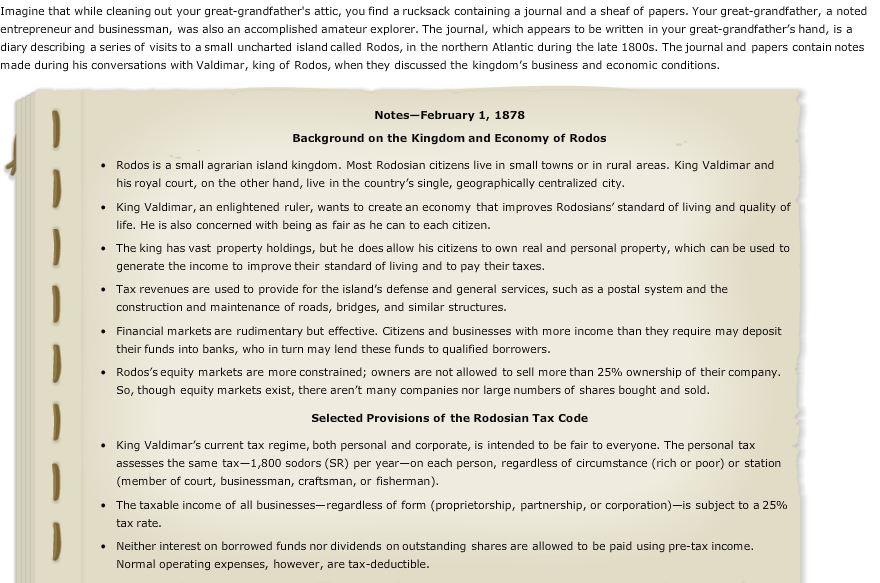

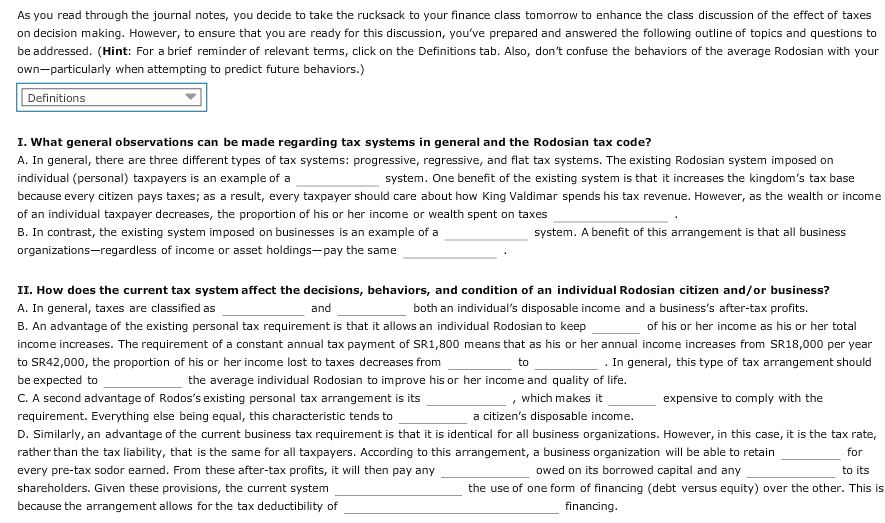

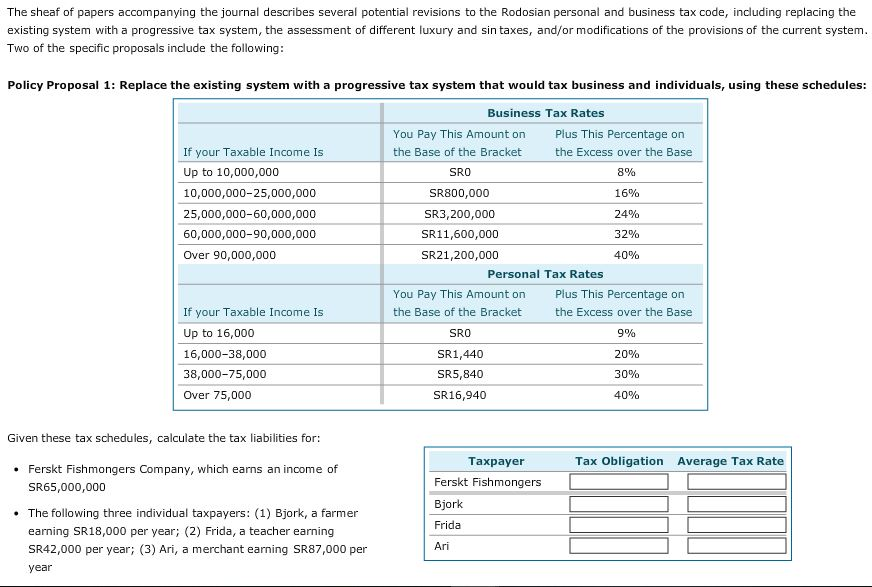

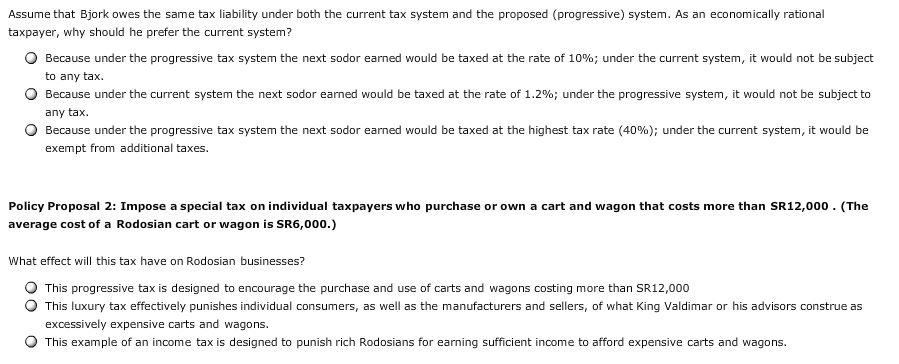

Imagine that while cleaning out your great-grandfather's attic, you find a rucksack containing a journal and a sheaf of papers. Your great-grandfather, a noted entrepreneur and businessman, was also an accomplished amateur explorer. The journal, which appears to be written in your great-grandfather's hand, is a diary desribing a series of visits to a small uncharted island called Rodos, in the northern Atlantic during the late 1800s. The journal and papers contain notes made during his conversations with Valdimar, king of Rodos, when they discussed the kingdom's business and economic conditions Notes-February 1, 1878 Background on the Kingdom and Economy of Rodos . Rodos is a small agrarian island kingdom. Most Rodosian citizens live in small towns or in rural areas. King Valdimar and his royal court, on the other hand, live in the country's single, geographically centralized city King Valdimar, an enlightened ruler, wants to create an economy that improves Rodosians standard of living and quality of life. He is also concerned with being as fair as he can to each citizen. The king has vast property holdings, but he does allow his citizens to own real and personal property, which can be used to generate the income to improve their standard of living and to pay their taxes. Tax revenues are used to provide for the island's defense and general services, such as a postal system and the construction and maintenance of roads, bridges, and similar structures. Financial markets are rudimentary but effective. Citizens and businesses with more income than they require may deposit their funds into banks, who in turn may lend these funds to qualified borrowers. Rodos's equity markets are more constrained; owners are not allowed to sell more than 25% ownership of their company. So, though equity markets exist, there aren't many companies nor large numbers of shares bought and sold . * Selected Provisions of the Rodosian Tax Code King Valdimar's current tax regime, both personal and corporate, is intended to be fair to everyone. The personal tax assesses the same tax-1,800 sodors (SR) per year-on each person, regardless of circumstance (rich or poor) or station (member of court, businessman, craftsman, or fisherman). The taxable income of all businesses-regardless of form (proprietorship, partnership, or corporation)-is subject to a 25% tax rate Neither interest on borrowed funds nor dividends on outstanding shares are allowed to be paid using pre-tax income. Normal operating expenses, however, are tax-deductible. As you read through the journal notes, you decide to take the rucksack to your finance class tomorrow to enhance the class discussion of the effect of taxes on decision making. However, to ensure that you are ready for this discussion, you've prepared and answered the following outline of topics and questions to be addressed. (Hint: For a brief reminder of relevant terms, click on the Definitions tab. Also, don't confuse the behaviors of the average Rodosian with your own-particularly when attempting to predict future behaviors.) Definitions I. What general observations can be made regarding tax systems in general and the Rodosian tax code? A. In general, there are three different types of tax systems: progressive, regressive, and flat tax systems. The existing Rodosian system imposed on individual (persona) taxpayers is an example of a because every citizen pays taxes; as a result, every taxpayer should care about how King Valdimar spends his tax revenue. However, as the wealth or income of an individual taxpayer decreases, the proportion of his or her income or wealth spent on taxes B. In contrast, the existing system imposed on businesses is an example of a organizations-regardless of income or asset holdings-pay the same system. One benefit of the existing system is that it increases the kingdom's tax base system. A benefit of this arrangement is that all business II. How does the current tax system affect the decisions, behaviors, and condition of an individual Rodosian citizen and/or business? A. In general, taxes are classified as B. An advantage of the existing personal tax requirement is that it allows an individual Rodosian to keep income increases. The requirement of a constant annual tax payment of SR1,800 means that as his or her annual income increases from SR18,000 per year to SR42,000, the proportion of his or her income lost to taxes decreases from be expected to C. A second advantage of Rodos's existing personal tax arrangement is its requirement. Everything else being equal, this characteristic tends to D. Similarly, an advantage of the current business tax requirement is that it is identical for all business organizations. However, in this case, it is the tax rate, rather than the tax liability, that is the same for al taxpayers. According to this arrangement, a business organization will be able to retain every pre-tax sodor earned. From these after-tax profits, it will then pay any shareholders. Given these provisions, the current system because the arrangement allows for the tax deductibility of and both an individual's disposable income and a business's after-tax profits. of his or her income as his or her total to . In general, this type of tax arrangement should the average individual Rodosian to improve his or her income and quality of life. which makes it expensive to comply with the a citizen's disposable income for owed on its borrowed capital and any to its the use of one form of financing (debt versus equity) over the other. This is financing The sheaf of papers accompanying the journal describes several potential revisions to the Rodosian personal and business tax code, including replacing the existing system with a progressive tax system, the assessment of different luxury and sin taxes, and/or modifications of the provisions of the current system Two of the specific proposals include the following Policy Proposal 1: Replace the existing system with a progressive tax system that would tax business and individuals, using these schedules: Business Tax Rates You Pay This Amount on the Base of the Bracket SRO SR800,000 SR3,200,000 SR11,600,000 SR21,200,000 Plus This Percentage on If your Taxable Income is Up to 10,000,000 10,000,000-25,000,000 25,000,000-60,000,000 60,000,000-90,000,000 Over 90,000,000 the Excess over the Base 8% 16% 24% 32% 40% Personal Tax Rates You Pay This Amount on the Base of the Bracket SRO SR1,440 SR5,840 SR16,940 Plus This Percentage on If your Taxable Income Is Up to 16,000 16,000-38,000 38,000-75,000 Over 75,000 the Excess over the Base 9% 20% 30% 40% Given these tax schedules, calculate the tax liabilities for: Taxpayer Tax Obligation Average Tax Rate Ferskt Fishmongers Company, which earns an income of SR65,000,000 Ferskt Fishmongers Bjork Frida Ari The following three individual taxpayers: (1) Bjork, a farmer earning SR18,000 per year; (2) Frida, a teacher earning SR42,000 per year; (3) Ari, a merchant earning SR87,000 per year Assume that Bjork owes the same tax liability under both the current tax system and the proposed (progressive) system. As an economically rational taxpayer, why should he prefer the current system? Because under the progressive tax system the next sodor earned would be taxed at the rate of 10%; under the current system, it would not be subject to any tax any tax exempt from additional taxes. O Because under the current system the next sodor earned would be taxed at he rate of 12%,under h progessiesstem, t Hul na be subje t O Because under the progressive tax system the next sodor earned would be taxed at the highest tax rate (40%); under the current system, it would be Policy Proposal 2: Impose a special tax on individual taxpayers who purchase or own a cart and wagon that costs more than SR 12,000(The average cost of a Rodosian cart or wagon is SR6,000.) What effect will this tax have on Rodosian businesses? O This progressive tax is designed to encourage the purchase and use of carts and wagons costing more than SR12,000 O This luxury tax effectively punishes individual consumers, as well as the manufacturers and sellers, of what King Valdimar or his advisors construe as excessively expensive carts and wagons. This example of an income tax is designed to punish rich Rodosians for earning sufficient income to afford expensive carts and wagons