Answered step by step

Verified Expert Solution

Question

1 Approved Answer

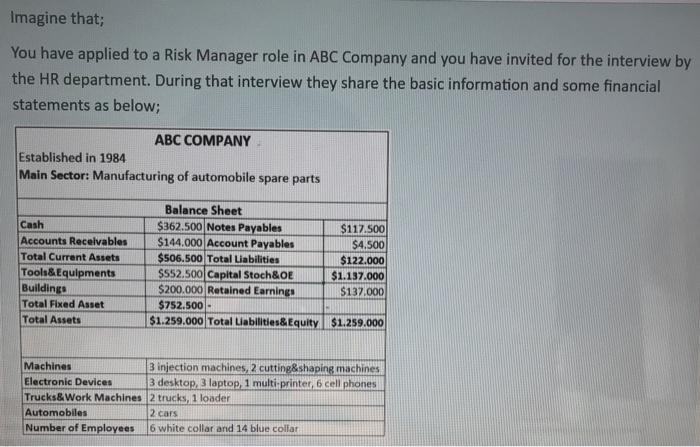

Imagine that; You have applied to a Risk Manager role in ABC Company and you have invited for the interview by the HR department.

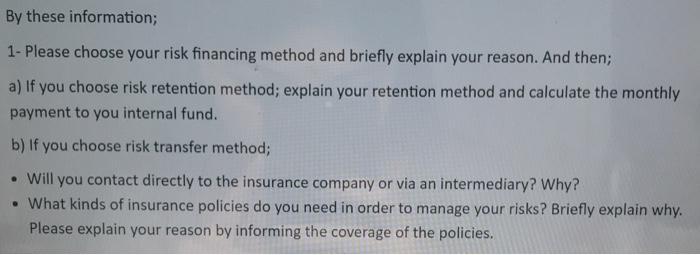

Imagine that; You have applied to a Risk Manager role in ABC Company and you have invited for the interview by the HR department. During that interview they share the basic information and some financial statements as below; ABC COMPANY. Established in 1984 Main Sector: Manufacturing of automobile spare parts Balance Sheet Cash Accounts Recelvables Total Current Assets Tools&Equipments Buildings Total Fixed Asset Total Assets $362.500 Notes Payables $144.000 Account Payables $506.500 Total Liabilities $552.500 Capital Stoch&OE $200.000 Retained Earnings $752.500- $1.259.000 Total Liabilities& Equity $1.259.000 $117.500 $4.500 $122.000 $1.137.000 $137.000 Machines 3 injection machines, 2 cutting&shaping machines Electronic Devices Trucks&Work Machines 2 trucks, 1 loader 3 desktop, 3 laptop, 1 multi-printer, 6 cell phones Automobiles Number of Employees 2 cars 6 white collar and 14 blue collar By these information; 1- Please choose your risk financing method and briefly explain your reason. And then; a) If you choose risk retention method; explain your retention method and calculate the monthly payment to you internal fund. b) If you choose risk transfer method; Will you contact directly to the insurance company or via an intermediary? Why? What kinds of insurance policies do you need in order to manage your risks? Briefly explain why. Please explain your reason by informing the coverage of the policies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

answer Under some businesses the loss is covered out of the pocket and without taking any insurance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started