Question

Imagine that you just completed a course in Financial Management for Entrepreneurs where you learned various techniques and tools in financial analysis. Your uncle Ben

Imagine that you just completed a course in Financial Management for Entrepreneurs where you learned various techniques and tools in financial analysis. Your uncle Ben wants your advice regarding an investment he is considering. Your uncle owns a furniture company that makes 2 types of furniture: custom-made furniture for consumers and standard furniture for furniture stores.

In the past few years, his sales in both these segments have shown a steady increase of 9% annually. He is considering buying 2 types of manufacturing equipment, 1 to make custom furniture and another to make standard furniture, to be able to supply furniture to both market segments. Each type of equipment requires capital in the range of $120,000. Such equipment is generally depreciated over a 5-year time frame.

Your uncle Ben has applied for a loan of $240,000 from a local bank, and he thinks he will get a loan. However, he is not confident that he will get the loan for the entire $240,000. Also, he is not certain of the interest rate. Based on his current financial obligations, he is confident the bank will loan him at least $120,000. Also, he thinks the interest rate could be in the range of 12% to 15%.

Let's refer to the purchase of custom equipment as Project C and the purchase of standard equipment as Project S. The cash flows for these 2 equipment purchases are provided below:

Cash Flows in $(000)

| Project | Year 0 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| Project C | -120 | 35 | 55 | 90 | 75 | 85 |

| Project S | -120 | 82 | 75 | 65 | 45 | 30 |

Internal Rate of Return (IRR)

Project C IRRC = 40%

Project S IRRS = 50%

Net Present Value (NPV)

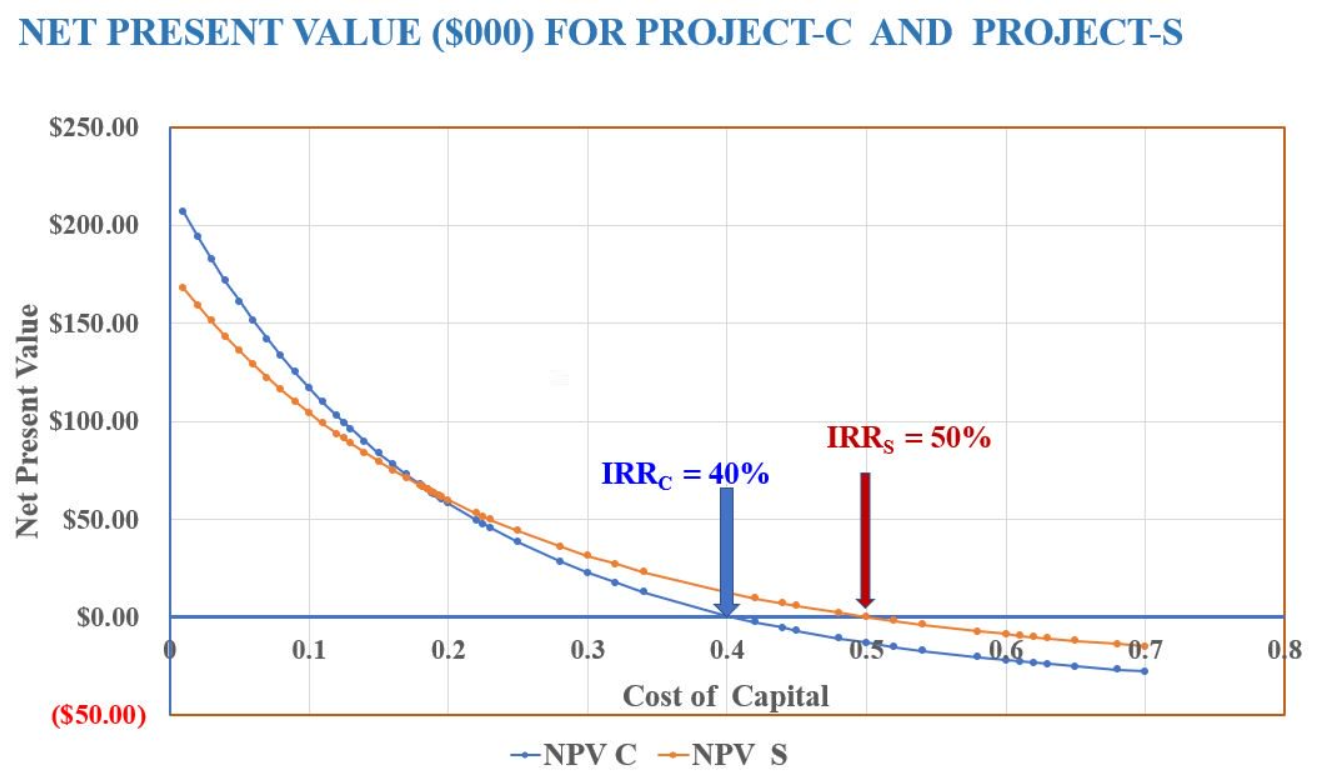

You have also been provided the following chart which shows the net present value of these 2 investment projects at different discount rates:

| Project | NPV | Interest |

|---|---|---|

| Project C | $99.35 | 12.5% |

| Project S | $91.15 | 12.5% |

Write a very detailed analysis that addresses the following questions:

- What is the relevance of capital budgeting in this situation?

- What are some implications for using internal rate of return (IRR) versus net present value (NPV) for deciding on Project C and Project S?

- What is the difference between independent and mutually exclusively projects? Are these projects, Project S and Project C, mutually exclusive projects? Explain why or why not and include rationale to support your response.

- What would you recommend if your uncle Ben gets approval for only a $120,000 loan from the bank and why?

- What would you recommend if your uncle Ben gets approval for a $240,000 loan from the bank and why?

- You do not know what interest rate the bank would charge. In this situation, how would you use the chart given above? Explain.

- How would you incorporate business risk in your analysis of these projects?

NET PRESENT VALUE ($000) FOR PROJECT-C AND PROJECT-S Net Present Value $250.00 $200.00 $150.00 $100.00 $50.00 $0.00 ($50.00) 0.1 0.2 IRRC = 40% 0.3 IRRs = 50% 0.4 Cost of Capital -NPV C-NPV S 0.6 0:7 018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is a detailed analysis of your uncle Bens investment projects 1 Capital budgeting techniques ar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started