Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you are a financial analyst working for a Malaysian company called Bina Sdn Bhd. The company is considering investing in a new project that

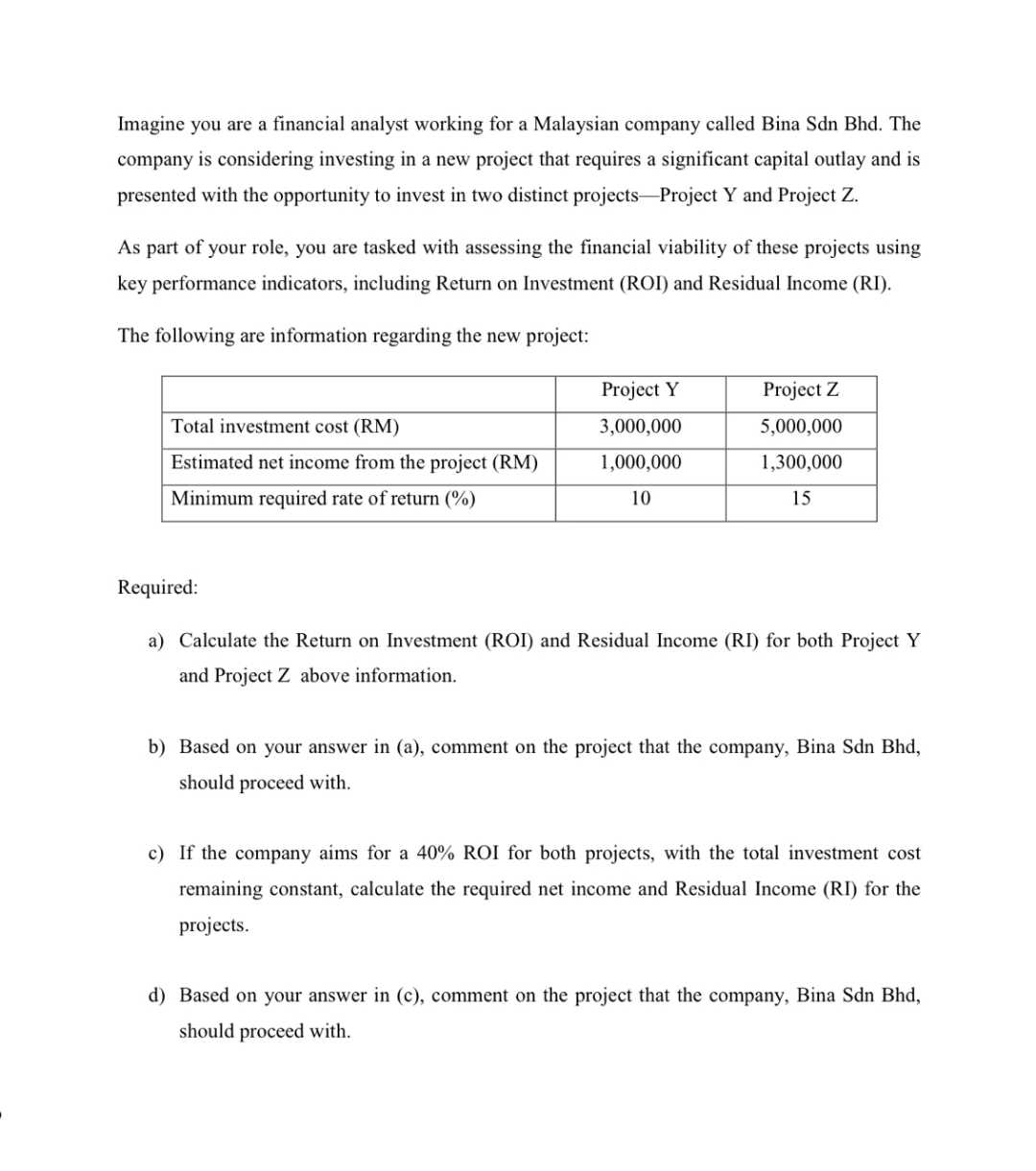

Imagine you are a financial analyst working for a Malaysian company called Bina Sdn Bhd. The company is considering investing in a new project that requires a significant capital outlay and is presented with the opportunity to invest in two distinct projects_-Project Y and Project Z. As part of your role, you are tasked with assessing the financial viability of these projects using key performance indicators, including Return on Investment (ROI) and Residual Income (RI). The following are information regarding the new project: Required: a) Calculate the Return on Investment (ROI) and Residual Income (RI) for both Project Y and Project Z above information. b) Based on your answer in (a), comment on the project that the company, Bina Sdn Bhd, should proceed with. c) If the company aims for a 40% ROI for both projects, with the total investment cost remaining constant, calculate the required net income and Residual Income (RI) for the projects. d) Based on your answer in (c), comment on the project that the company, Bina Sdn Bhd, should proceed with

Imagine you are a financial analyst working for a Malaysian company called Bina Sdn Bhd. The company is considering investing in a new project that requires a significant capital outlay and is presented with the opportunity to invest in two distinct projects_-Project Y and Project Z. As part of your role, you are tasked with assessing the financial viability of these projects using key performance indicators, including Return on Investment (ROI) and Residual Income (RI). The following are information regarding the new project: Required: a) Calculate the Return on Investment (ROI) and Residual Income (RI) for both Project Y and Project Z above information. b) Based on your answer in (a), comment on the project that the company, Bina Sdn Bhd, should proceed with. c) If the company aims for a 40% ROI for both projects, with the total investment cost remaining constant, calculate the required net income and Residual Income (RI) for the projects. d) Based on your answer in (c), comment on the project that the company, Bina Sdn Bhd, should proceed with Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started