Answered step by step

Verified Expert Solution

Question

1 Approved Answer

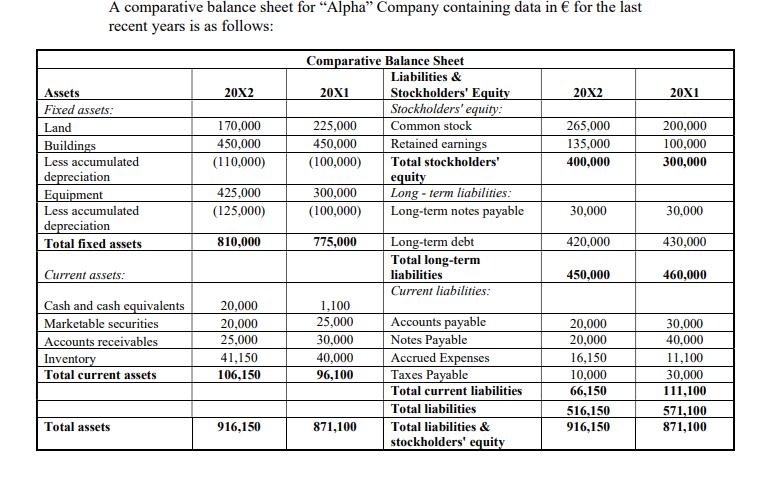

A comparative balance sheet for Alpha Company containing data in for the last recent years is as follows: Assets Fixed assets: Land Buildings Less

A comparative balance sheet for "Alpha" Company containing data in for the last recent years is as follows: Assets Fixed assets: Land Buildings Less accumulated depreciation Equipment Less accumulated depreciation Total fixed assets Current assets: Cash and cash equivalents Marketable securities Accounts receivables Inventory Total current assets Total assets 20X2 170,000 450,000 (110,000) 425,000 (125,000) 810,000 20,000 20,000 25,000 41,150 106,150 916,150 Comparative Balance Sheet Liabilities & 20X1 225,000 450,000 (100,000) 300,000 (100,000) 775,000 1,100 25,000 30,000 40,000 96,100 871,100 Stockholders' Equity Stockholders' equity: Common stock Retained earnings Total stockholders' equity Long-term liabilities: Long-term notes payable Long-term debt Total long-term liabilities Current liabilities: Accounts payable Notes Payable Accrued Expenses Taxes Payable Total current liabilities Total liabilities Total liabilities & stockholders' equity 20X2 265,000 135,000 400,000 30,000 420,000 450,000 20,000 20,000 16,150 10,000 66,150 516,150 916,150 20X1 200,000 100,000 300,000 30,000 430,000 460,000 30,000 40,000 11,100 30,000 111,100 571,100 871,100 The company reported for the current for year 20X2 the following income statement: Sales Cost of goods Gross margin Selling expenses Income Statement 20X2 Administrative expenses Net operating income Gain on sales of land Gain on sales of marketable securities Dividend Revenue Interest Expense Income before taxes Income taxes Net income 1,135,600 (700,000) 435,600 (125,000) (175,000) 135,600 4,000 8,000 4,150 (53,500) 98,250 (33,850) 64,400 Required: 1. Prepare the cash flow statement for "Alpha" Company for this year 20X2, using the indirect method. (10%). 2. Prepare the cash flow statement for "Alpha" Company for this year 20X2, using the direct method. (10%).

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Answer is given below with working notes 1 Cash flows from Operating Activities Cash received from c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d95b4e170e_176998.pdf

180 KBs PDF File

635d95b4e170e_176998.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started