Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you have $100,000. You want to build a good portfolio mixed with stocks, bonds, and mutual funds. At least one in each category.

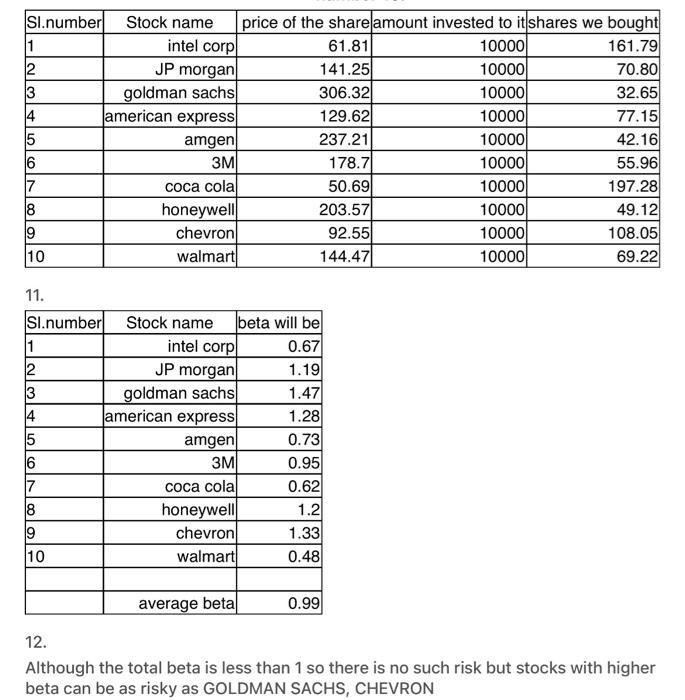

Imagine you have $100,000. You want to build a good portfolio mixed with stocks, bonds, and mutual funds. At least one in each category. Research the market and pick whatever assets you want to purchase, and build a portfolio using your $100,000. Choose at least one asset in each category: (1) stocks, (2) bonds, and (2) mutual funds. You should have a certain goal in mind. You either want something safe, or high-risk-high-yield, etc. Explain why you built your portfolio in the way you did. Explain your specific picks (why that particular asset?) briefly. Sl.number Stock name 1 2 5 16 7 8 19 10 11. SI.number 1 2 3 4 5 6 17 8 9 10 intel corp JP morgan goldman sachs american express amgen 3M coca cola honeywell chevron walmart honeywell chevron walmart price of the share amount invested to it shares we bought 61.81 10000 161.79 141.25 10000 70.80 10000 32.65 10000 77.15 10000 42.16 10000 10000 10000 10000 10000 Stock name beta will be intel corp 0.67 JP morgan 1.19 goldman sachs 1.47 american express 1.28 amgen 0.73 3M 0.95 coca cola 0.62 1.2 1.33 0.48 average beta 306.32 129.62 237.21 178.7 50.69 203.57 92.55 144.47 0.99 55.96 197.28 49.12 108.05 69.22 12. Although the total beta is less than 1 so there is no such risk but stocks with higher beta can be as risky as GOLDMAN SACHS, CHEVRON

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Imagine you have 100000 You want to build a good Portfin Mind with Storld a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started