Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you manage a balanced portfolio of U.S. investments that primarily consists of passive index ETFs. You typically maintain a 70/30 equity to bond

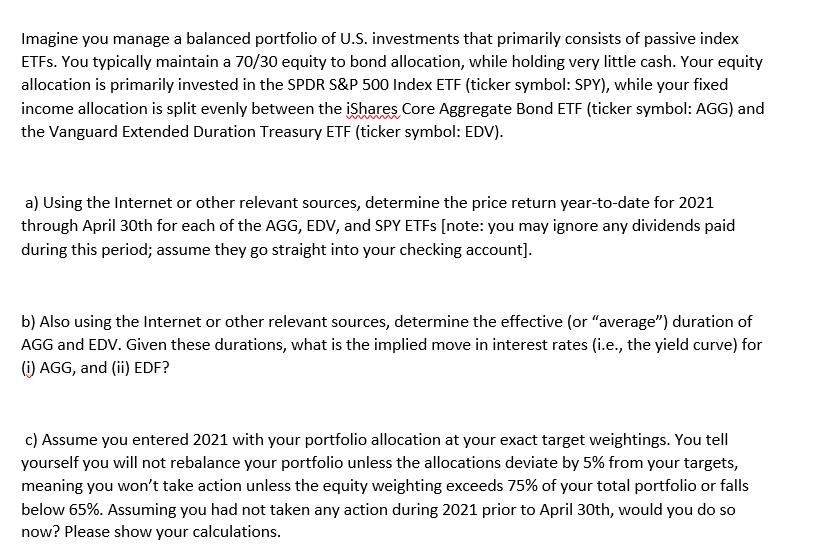

Imagine you manage a balanced portfolio of U.S. investments that primarily consists of passive index ETFs. You typically maintain a 70/30 equity to bond allocation, while holding very little cash. Your equity allocation is primarily invested in the SPDR S&P 500 Index ETF (ticker symbol: SPY), while your fixed income allocation is split evenly between the iShares Core Aggregate Bond ETF (ticker symbol: AGG) and the Vanguard Extended Duration Treasury ETF (ticker symbol: EDV). a) Using the Internet or other relevant sources, determine the price return year-to-date for 2021 through April 30th for each of the AGG, EDV, and SPY ETFs [note: you may ignore any dividends paid during this period; assume they go straight into your checking account]. b) Also using the Internet or other relevant sources, determine the effective (or "average") duration of AGG and EDV. Given these durations, what is the implied move in interest rates (i.e., the yield curve) for (i) AGG, and (ii) EDF? c) Assume you entered 2021 with your portfolio allocation at your exact target weightings. You tell yourself you will not rebalance your portfolio unless the allocations deviate by 5% from your targets, meaning you won't take action unless the equity weighting exceeds 75% of your total portfolio or falls below 65%. Assuming you had not taken any action during 2021 prior to April 30th, would you do so now? Please show your calculations.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

ortfolio Performance and Rebalancing Decision a Price Return YeartoDate YTD as of April 30th 2021 AG...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started