Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Imagine you receive a graduation gift of $5,000 from a wealthy uncle with a letter that encourages you to save the money for your

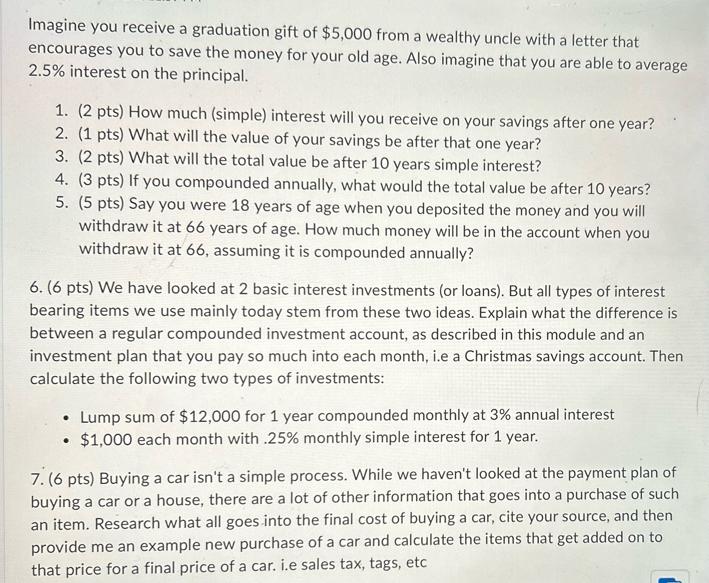

Imagine you receive a graduation gift of $5,000 from a wealthy uncle with a letter that encourages you to save the money for your old age. Also imagine that you are able to average 2.5% interest on the principal. 1. (2 pts) How much (simple) interest will you receive on your savings after one year? 2. (1 pts) What will the value of your savings be after that one year? 3. (2 pts) What will the total value be after 10 years simple interest? 4. (3 pts) If you compounded annually, what would the total value be after 10 years? 5. (5 pts) Say you were 18 years of age when you deposited the money and you will withdraw it at 66 years of age. How much money will be in the account when you withdraw it at 66, assuming it is compounded annually? 6. (6 pts) We have looked at 2 basic interest investments (or loans). But all types of interest bearing items we use mainly today stem from these two ideas. Explain what the difference is between a regular compounded investment account, as described in this module and an investment plan that you pay so much into each month, i.e a Christmas savings account. Then calculate the following two types of investments: Lump sum of $12,000 for 1 year compounded monthly at 3% annual interest $1,000 each month with .25% monthly simple interest for 1 year. 7. (6 pts) Buying a car isn't a simple process. While we haven't looked at the payment plan of buying a car or a house, there are a lot of other information that goes into a purchase of such an item. Research what all goes into the final cost of buying a car, cite your source, and then provide me an example new purchase of a car and calculate the items that get added on to that price for a final price of a car. i.e sales tax, tags, etc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Graduation Gift Calculations 1 Simple Interest after one year Simple Interest Principal x Interest Rate x Time 5000 x 25 x 1 year 125 2 Value of savin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started