Question

Imagine yourself as an equity analyst. In this position, your task is to apply relative valuation to figure out the fair value of Apple stock

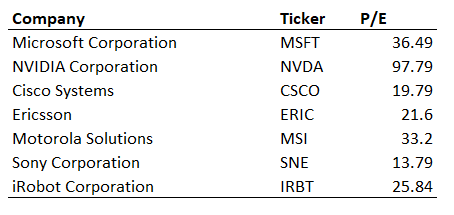

Imagine yourself as an equity analyst. In this position, your task is to apply relative valuation to figure out the fair value of Apple stock and the corresponding upside/downside potential. Based on the market analysis you come up with the following list of Apple competitors (peers). Your senior colleagues suggest that you should use a median P/E ratio for Apple peers as an indicator of what the is the fair P/E multiple for valuing Apple stock.

The current Apple stock price is 135.73 and the EPS for Apple company is 3.69.

Select all that is correct. [you can use the following template as a guidence]

a.

The fair stock price is 95.35

b.

The stock upside is negative 30% (meaning downside 30%)

c.

The fair multiple is 35.5

d.

The fair stock price is 131.00

Company Microsoft Corporation NVIDIA Corporation Cisco Systems Ericsson Motorola Solutions Sony Corporation iRobot Corporation Ticker MSFT NVDA CSCO ERIC MSI SNE IRBT P/E 36.49 97.79 19.79 21.6 33.2 13.79 25.84Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started