IMG_9124.jpeg

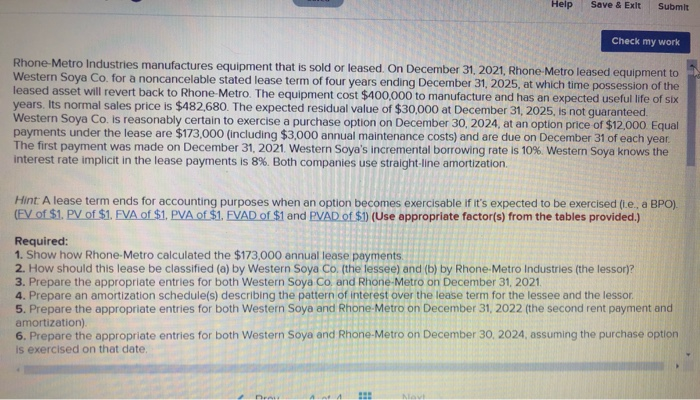

Help Save & Exit Submit Check my work Rhone-Metro Industries manufactures equipment that is sold or leased on December 31, 2021, Rhone-Metro leased equipment to Western Soya Co. for a noncancelable stated lease term of four years ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $400,000 to manufacture and has an expected useful life of six years. Its normal sales price is $482,680. The expected residual value of $30,000 at December 31, 2025, is not guaranteed. Western Soya Co. is reasonably certain to exercise a purchase option on December 30, 2024, at an option price of $12,000 Equal payments under the lease are $173,000 (including $3.000 annual maintenance costs) and are due on December 31 of each year The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 10%. Western Soya knows the interest rate implicit in the lease payments is 8%. Both companies use straight-line amortization Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (.e, a BPO). (EV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $173,000 annual lease payments 2. How should this lease be classified (a) by Western Soya Co. (the lessee) and (b) by Rhone-Metro Industries (the lessor)? 3. Prepare the appropriate entries for both Western Soya Co and Rhone-Metro on December 31, 2021 4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor 5. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second rent payment and amortization) 6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 30, 2024, assuming the purchase option is exercised on that date. 228 Help Save & Exit Submit Check my work Rhone-Metro Industries manufactures equipment that is sold or leased on December 31, 2021, Rhone-Metro leased equipment to Western Soya Co. for a noncancelable stated lease term of four years ending December 31, 2025, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $400,000 to manufacture and has an expected useful life of six years. Its normal sales price is $482,680. The expected residual value of $30,000 at December 31, 2025, is not guaranteed. Western Soya Co. is reasonably certain to exercise a purchase option on December 30, 2024, at an option price of $12,000 Equal payments under the lease are $173,000 (including $3.000 annual maintenance costs) and are due on December 31 of each year The first payment was made on December 31, 2021. Western Soya's incremental borrowing rate is 10%. Western Soya knows the interest rate implicit in the lease payments is 8%. Both companies use straight-line amortization Hint: A lease term ends for accounting purposes when an option becomes exercisable if it's expected to be exercised (.e, a BPO). (EV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. Show how Rhone-Metro calculated the $173,000 annual lease payments 2. How should this lease be classified (a) by Western Soya Co. (the lessee) and (b) by Rhone-Metro Industries (the lessor)? 3. Prepare the appropriate entries for both Western Soya Co and Rhone-Metro on December 31, 2021 4. Prepare an amortization schedule(s) describing the pattern of interest over the lease term for the lessee and the lessor 5. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 31, 2022 (the second rent payment and amortization) 6. Prepare the appropriate entries for both Western Soya and Rhone-Metro on December 30, 2024, assuming the purchase option is exercised on that date. 228