Answered step by step

Verified Expert Solution

Question

1 Approved Answer

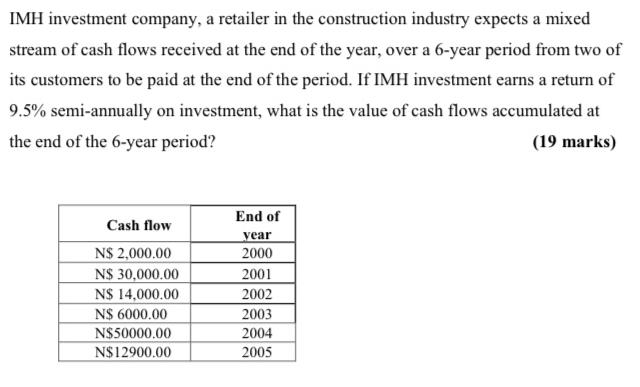

IMH investment company, a retailer in the construction industry expects a mixed stream of cash flows received at the end of the year, over

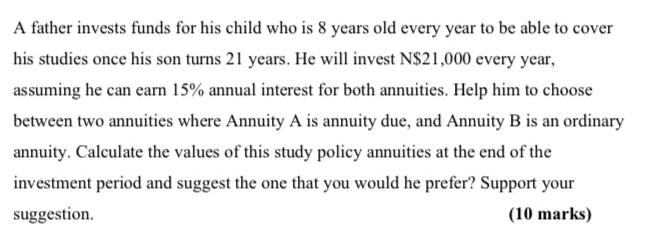

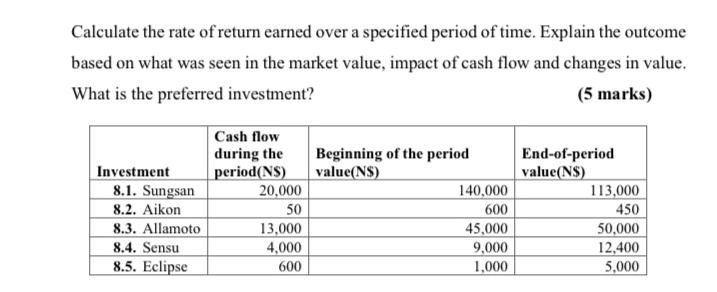

IMH investment company, a retailer in the construction industry expects a mixed stream of cash flows received at the end of the year, over a 6-year period from two of its customers to be paid at the end of the period. If IMH investment earns a return of 9.5% semi-annually on investment, what is the value of cash flows accumulated at the end of the 6-year period? (19 marks) Cash flow N$ 2,000.00 N$ 30,000.00 N$ 14,000.00 N$ 6000.00 N$50000.00 N$12900.00 End of year 2000 2001 2002 2003 2004 2005 A father invests funds for his child who is 8 years old every year to be able to cover his studies once his son turns 21 years. He will invest N$21,000 every year, assuming he can earn 15% annual interest for both annuities. Help him to choose between two annuities where Annuity A is annuity due, and Annuity B is an ordinary annuity. Calculate the values of this study policy annuities at the end of the investment period and suggest the one that you would he prefer? Support your suggestion. (10 marks) Calculate the rate of return earned over a specified period of time. Explain the outcome based on what was seen in the market value, impact of cash flow and changes in value. What is the preferred investment? (5 marks) Investment 8.1. Sungsan 8.2. Aikon 8.3. Allamoto 8.4. Sensu 8.5. Eclipse Cash flow during the period (NS) 20,000 50 13,000 4,000 600 Beginning of the period value(NS) 140,000 600 45,000 9,000 1,000 End-of-period value(NS) 113,000 450 50,000 12,400 5,000

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 The present value of the cash flows received by IMH investment company can be calculated using the present value formula PV CF 1 rn Where P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started