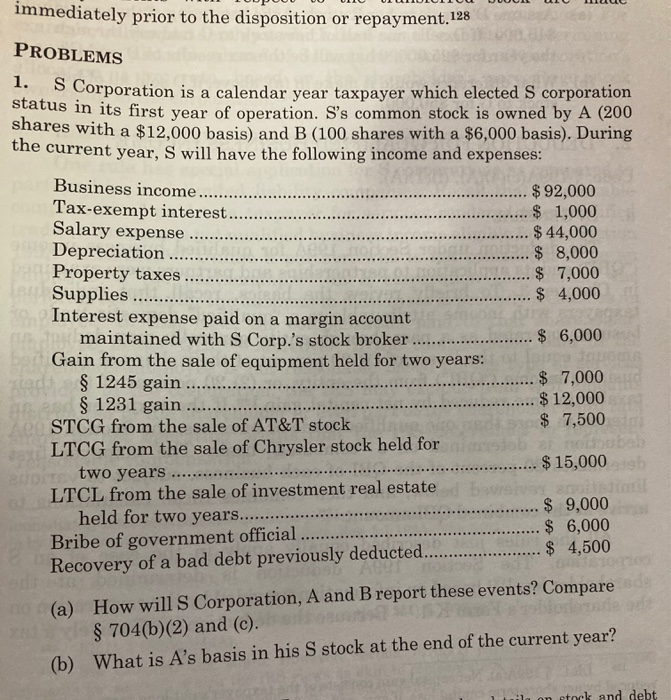

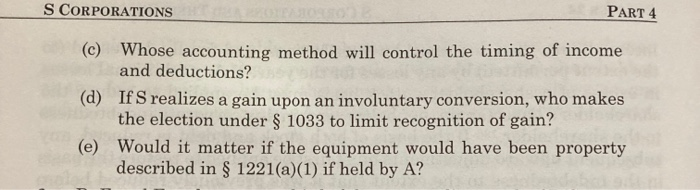

immediately prior to the disposition or repayment.128 PROBLEMS 1. ...... S Corporation is a calendar year taxpayer which elected S corporation status in its first year of operation. S's common stock is owned by A (200 shares with a $12,000 basis) and B (100 shares with a $6,000 basis). During the current year, S will have the following income and expenses: Business income..... $ 92,000 Tax-exempt interest. $ 1,000 Salary expense $ 44,000 Depreciation $ 8,000 Property taxes ..... $ 7,000 Supplies $ 4,000 Interest expense paid on a margin account maintained with S Corp.'s stock broker ............ $ 6,000 Gain from the sale of equipment held for two years: $ 1245 gain ...... $ 7,000 $ 1231 gain ..... $ 12,000 STCG from the sale of AT&T stock $ 7,500 LTCG from the sale of Chrysler stock held for booba two years ..... $ 15,000 LTCL from the sale of investment real estate $ 9,000 held for two years...... $ 6,000 Bribe of government official $ 4,500 Recovery of a bad debt previously deducted... (a) How will S Corporation, A and B report these events? Compared $ (b) What is A's basis in his S stock at the end of the current year? ..... on stock and debt S CORPORATIONS PART 4 (C) Whose accounting method will control the timing of income and deductions? (d) If S realizes a gain upon an involuntary conversion, who makes the election under $ 1033 to limit recognition of gain? (e) Would it matter if the equipment would have been property described in $ 1221(a)(1) if held by A? immediately prior to the disposition or repayment.128 PROBLEMS 1. ...... S Corporation is a calendar year taxpayer which elected S corporation status in its first year of operation. S's common stock is owned by A (200 shares with a $12,000 basis) and B (100 shares with a $6,000 basis). During the current year, S will have the following income and expenses: Business income..... $ 92,000 Tax-exempt interest. $ 1,000 Salary expense $ 44,000 Depreciation $ 8,000 Property taxes ..... $ 7,000 Supplies $ 4,000 Interest expense paid on a margin account maintained with S Corp.'s stock broker ............ $ 6,000 Gain from the sale of equipment held for two years: $ 1245 gain ...... $ 7,000 $ 1231 gain ..... $ 12,000 STCG from the sale of AT&T stock $ 7,500 LTCG from the sale of Chrysler stock held for booba two years ..... $ 15,000 LTCL from the sale of investment real estate $ 9,000 held for two years...... $ 6,000 Bribe of government official $ 4,500 Recovery of a bad debt previously deducted... (a) How will S Corporation, A and B report these events? Compared $ (b) What is A's basis in his S stock at the end of the current year? ..... on stock and debt S CORPORATIONS PART 4 (C) Whose accounting method will control the timing of income and deductions? (d) If S realizes a gain upon an involuntary conversion, who makes the election under $ 1033 to limit recognition of gain? (e) Would it matter if the equipment would have been property described in $ 1221(a)(1) if held by A