Answered step by step

Verified Expert Solution

Question

1 Approved Answer

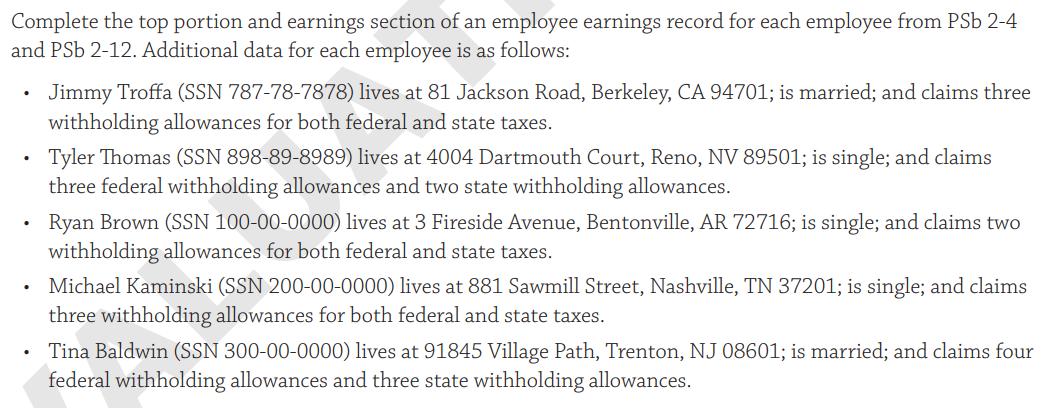

Complete the top portion and earnings section of an employee earnings record for each employee from PSb 2-4 and PSb 2-12. Additional data for

Complete the top portion and earnings section of an employee earnings record for each employee from PSb 2-4 and PSb 2-12. Additional data for each employee is as follows: Jimmy Troffa (SSN 787-78-7878) lives at 81 Jackson Road, Berkeley, CA 94701; is married; and claims three withholding allowances for both federal and state taxes. Tyler Thomas (SSN 898-89-8989) lives at 4004 Dartmouth Court, Reno, NV 89501; is single; and claims three federal withholding allowances and two state withholding allowances. Ryan Brown (SSN 100-00-0000) lives at 3 Fireside Avenue, Bentonville, AR 72716; is single; and claims two withholding allowances for both federal and state taxes. Michael Kaminski (SSN 200-00-0000) lives at 881 Sawmill Street, Nashville, TN 37201; is single; and claims three withholding allowances for both federal and state taxes. Tina Baldwin (SSN 300-00-0000) lives at 91845 Village Path, Trenton, NJ 08601; is married; and claims four federal withholding allowances and three state withholding allowances.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution Calculation of Weekly Gross Pay for Jimmy Troffa Gross Pay regular pay for 40 hours overtime pay for additional hours worked above 40 Hourly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started