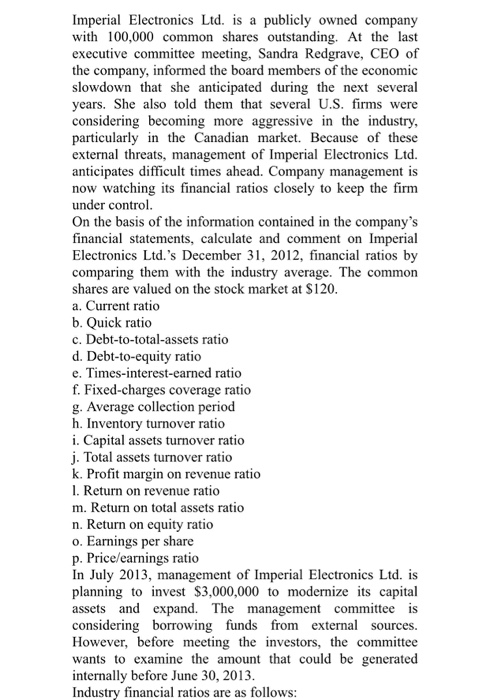

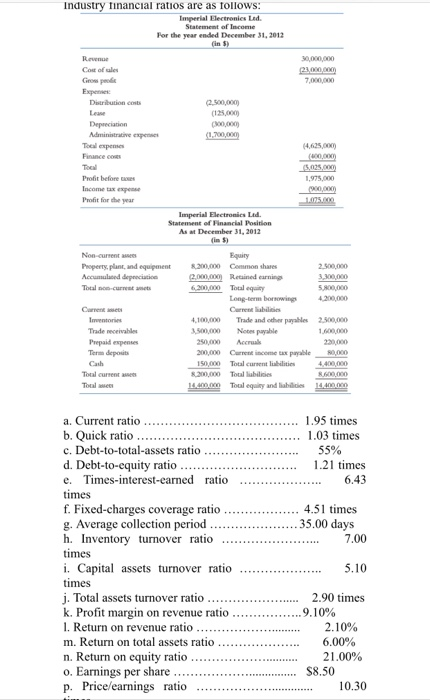

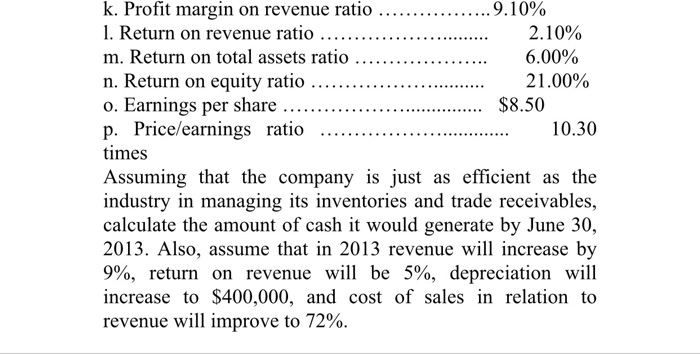

Imperial Electronics Ltd. is a publicly owned company with 100,000 common shares outstanding. At the last executive committee meeting, Sandra Redgrave, CEO of the company, informed the board members of the economic slowdown that she anticipated during years. She also told them that several U.S. firms were considering becoming more aggressive in the industry, particularly in the Canadian market. Because of these external threats, management of Imperial Electronics Ltd. anticipates difficult times ahead. Company management is now watching its financial ratios closely to keep the firm under control On the basis of the information contained in the company's financial statements, calculate and comment on Imperial Electronics Ltd.'s December 31, 2012, financial ratios by comparing them with the industry average. The common shares are valued on the stock market at $120 a. Current ratio b. Quick ratio c. Debt-to-total-assets ratio d. Debt-to-equity ratio e. Times-interest-earned ratio f. Fixed-charges coverage ratio g. Average collection period h. Inventory turnover ratio i. Capital assets turnover ratio j. Total assets turnover ratio k. Profit margin on revenue ratio 1. Return on revenue ratio m. Return on total assets ratio n. Return on equity ratio o. Earnings per share p. Price/earnings ratio In July 2013, management of Imp planning to invest $3,000,000 to modernize its capital assets and expand. The management committee is considering borrowing funds from external sources. However, before meeting the investors, the committee wants to examine the amount that could be generated internally before June 30, 201 Industry financial ratios are as follows the next several Electronics Ltd. is Industry financial ratios are as follows: Imperial Electronics Led Statement of Income For the year ended December 31, 2012 Cos of ules Grom peo 7,000,000 Lease Tocl expemes Finance co 4,625,000 Profit before ee Income tax expese Profit for the year 1975,000 Imperial Electronics Ltd. Statement of Financial Position As at December 31, 2012 Equiry Property, plant, and equipment 8200,000 Common shares 2.500,000 2.000,000 Reained earning 6200,000 Total eqy Long-term bonowings 42000 Cerrent abiliies Trade receivahles Prepaid expenses Term deposits 100,000 Trade and other payables 2,500,000 1,600,000 220,000 200,000 Cnent income eax paypble 80,00 150,000 Total cueent liabilities4 400,000 500,000 Notes ayable 250,000 cal Total curnentae Total ae 8200,000 Total liabilicies equity and liabiliies c. Debt-to-total-assets ratio d. Debt-to-equity ratio... imes 55% g. Average collection period 4.51 times 35.00 days h. Inventory turnover ratio 7.00 times i. Capital assets turnover ratio times j. Total assets turnover ratio...............2.90 times k, Profit margin on revenue ratio 9.10% 1. Return on revenue ratio 2.10% m. Return on total assets ratio 5.10 6.00% 2 1.00% n. Return on equity ratio p. Price/earnings ratio 10.30 k. Profit margin on revenue ratio 1. Return on revenue ratio m. Return on total assets ratio n, Return on equity ratio ....9 1 0% . . . 2. I 0% 6.00% 21.00% p. Price/earnings ratio times Assuming that the company is just as efficient as the industry in managing its inventories and trade receivables, calculate the amount of cash it would generate by June 30, 2013. Also, assume that in 2013 revenue will increase by 9%, return on revenue will be 5%, depreciation will increase to $400,000, and cost of sales in relation to revenue will improve to 72%. 10.30