Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sally's Spices accrued and unpaid wages are $1,800. Which of the following is the required adjusting entry? A. Credit Salaries Expense, $1,800; debit Salaries

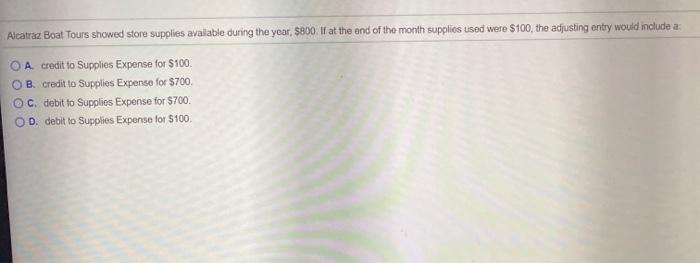

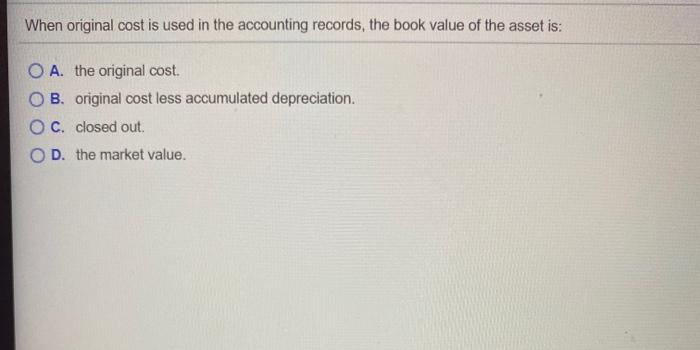

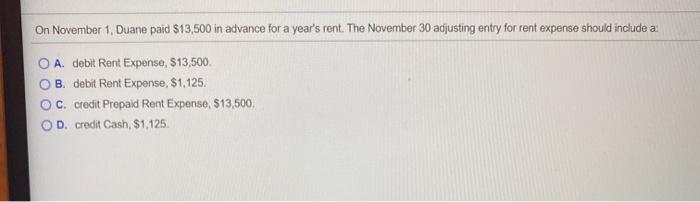

Sally's Spices accrued and unpaid wages are $1,800. Which of the following is the required adjusting entry? A. Credit Salaries Expense, $1,800; debit Salaries Payable, $1,800 B. Debit Cash, $1,800; credit Salaries Expense, $1,800 C. Debit Salaries Payable, $1,800; credit Cash, $1,800 D. Debit Salaries Expense, $1,800; credit Salaries Payable, $1,800 Alcatraz Boat Tours showed store supplies available during the year, $800. If at the end of the month supplies used were $100, the adjusting entry would include a A. credit to Supplies Expense for $100. OB. credit to Supplies Expense for $700. OC. debit to Supplies Expense for $700. OD. debit to Supplies Expense for $100. When original cost is used in the accounting records, the book value of the asset is: O A. the original cost. OB. original cost less accumulated depreciation. OC. closed out. OD. the market value. On November 1, Duane paid $13,500 in advance for a year's rent. The November 30 adjusting entry for rent expense should include a: OA. debit Rent Expense, $13,500. B. debit Rent Expense, $1,125. C. credit Prepaid Rent Expense, $13,500. OD. credit Cash, $1,125.

Step by Step Solution

★★★★★

3.57 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 D Salaries Expense 1800 credit Salaries Payable 1800 2 C deb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started