Question: Implied Volatility. Replicate the Implied Volatility Smile Figure on Page 12 of LN3, using current Call options data on the S&P500 (SPX) maturing on

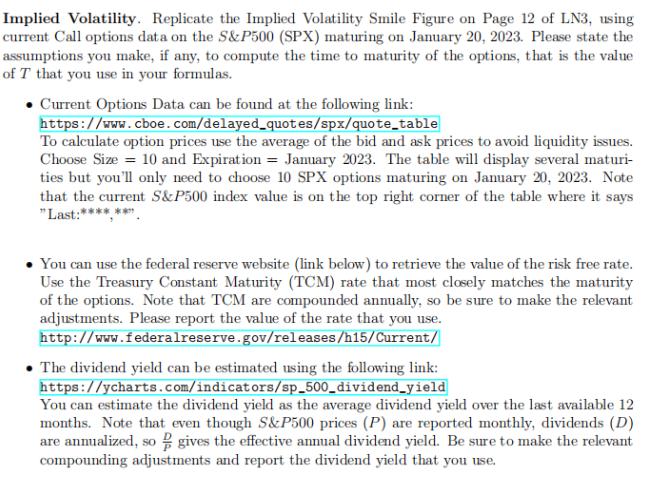

Implied Volatility. Replicate the Implied Volatility Smile Figure on Page 12 of LN3, using current Call options data on the S&P500 (SPX) maturing on January 20, 2023. Please state the assumptions you make, if any, to compute the time to maturity of the options, that is the value of T that you use in your formulas. Current Options Data can be found at the following link: https://www.cboe.com/delayed_quotes/spx/quote_table To calculate option prices use the average of the bid and ask prices to avoid liquidity issues. Choose Size = 10 and Expiration = January 2023. The table will display several maturi- ties but you'll only need to choose 10 SPX options maturing on January 20, 2023. Note that the current S&P500 index value is on the top right corner of the table where it says "Last:***** *** You can use the federal reserve website (link below) to retrieve the value of the risk free rate. Use the Treasury Constant Maturity (TCM) rate that most closely matches the maturity of the options. Note that TCM are compounded annually, so be sure to make the relevant adjustments. Please report the value of the rate that you use. http://www.federalreserve.gov/releases/h15/Current/ The dividend yield can be estimated using the following link: https://ycharts.com/indicators/sp_500_dividend_yield You can estimate the dividend yield as the average dividend yield over the last available 12 months. Note that even though S&P500 prices (P) are reported monthly, dividends (D) are annualized, so gives the effective annual dividend yield. Be sure to make the relevant compounding adjustments and report the dividend yield that you use.

Step by Step Solution

3.53 Rating (170 Votes )

There are 3 Steps involved in it

Using the call option data now available for the SP500 SPX maturing on January 20 2023 we may duplicate the implied volatility smile figure on page 12 of LN3 by performing the following steps 1 Select ... View full answer

Get step-by-step solutions from verified subject matter experts