Answered step by step

Verified Expert Solution

Question

1 Approved Answer

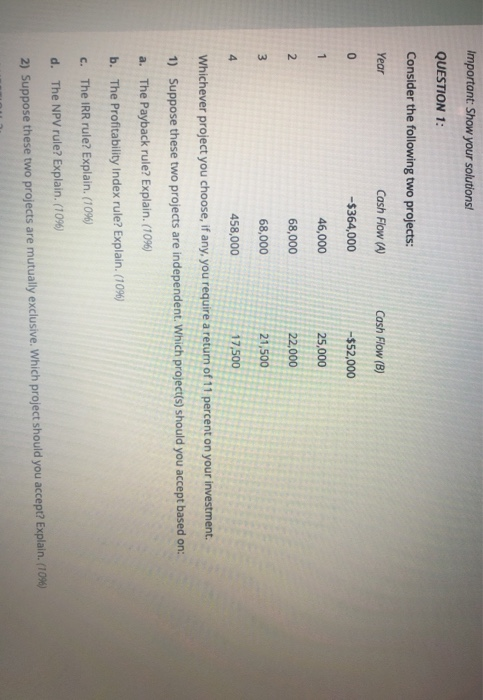

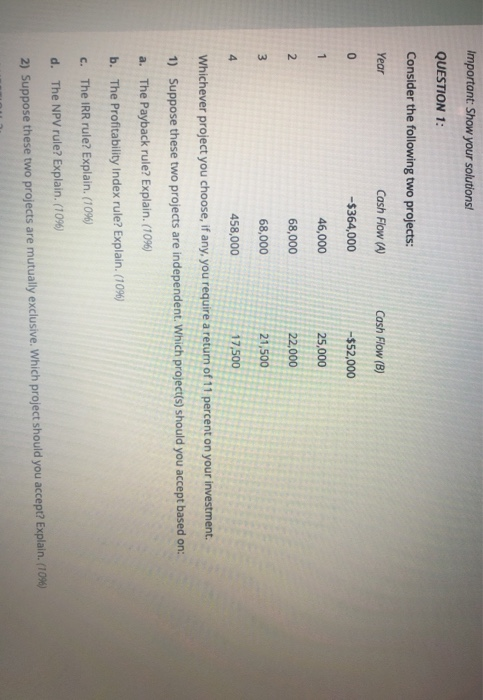

Important: Show your solutions! QUESTION 1: Consider the following two projects: Year Cash Flow (A) Cash Flow (B) -$364,000 -$52,000 25,000 46,000 68,000 22,000 68,000

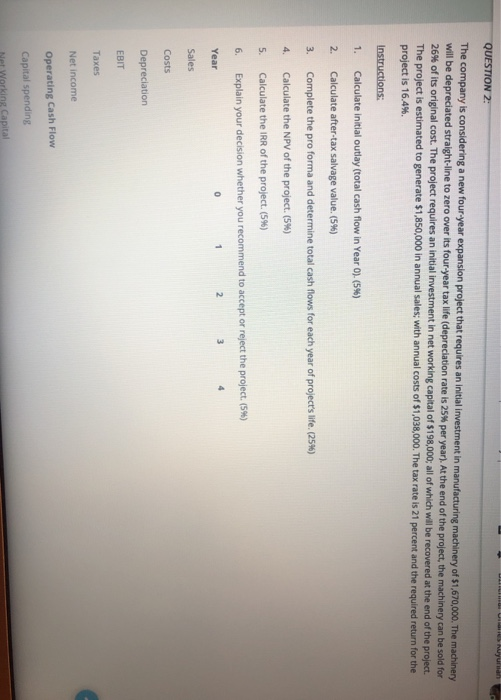

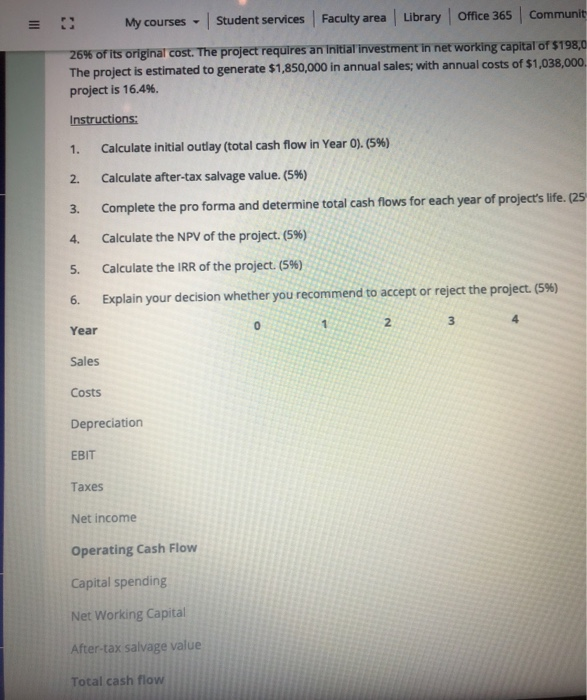

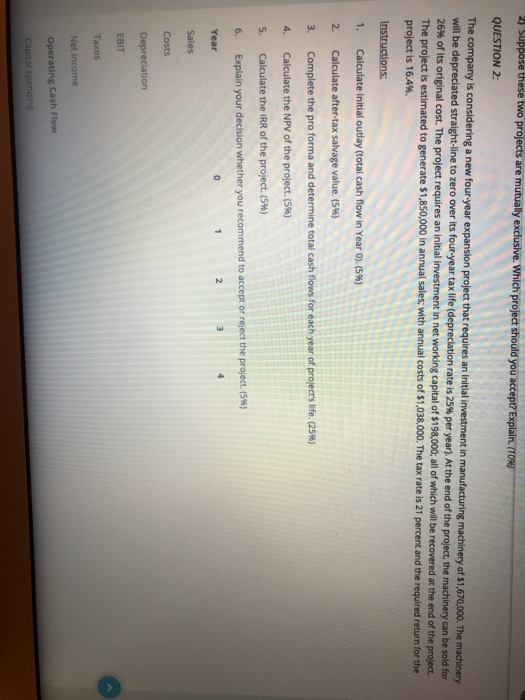

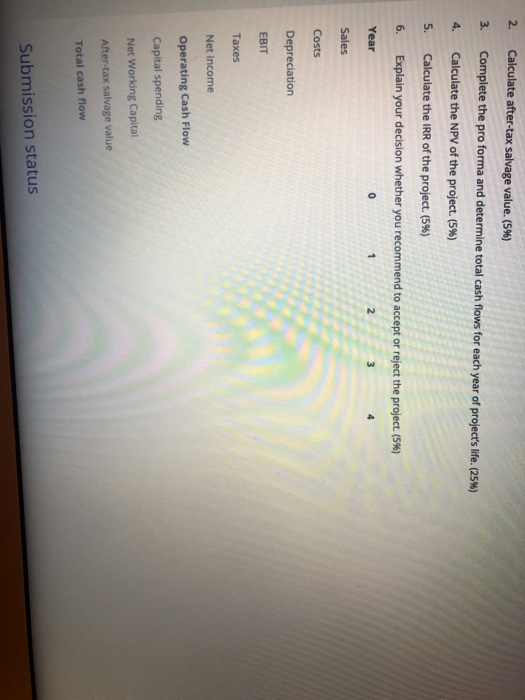

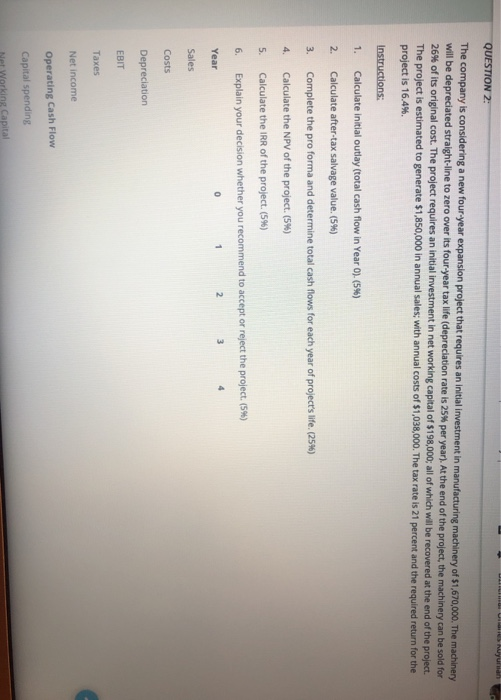

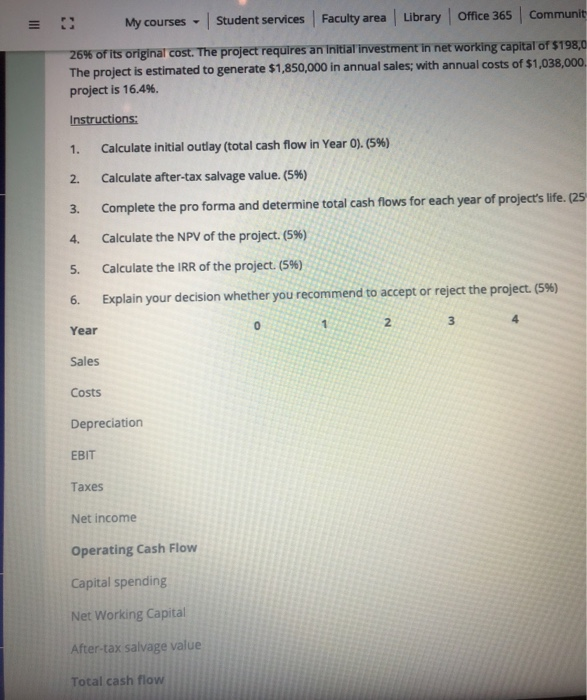

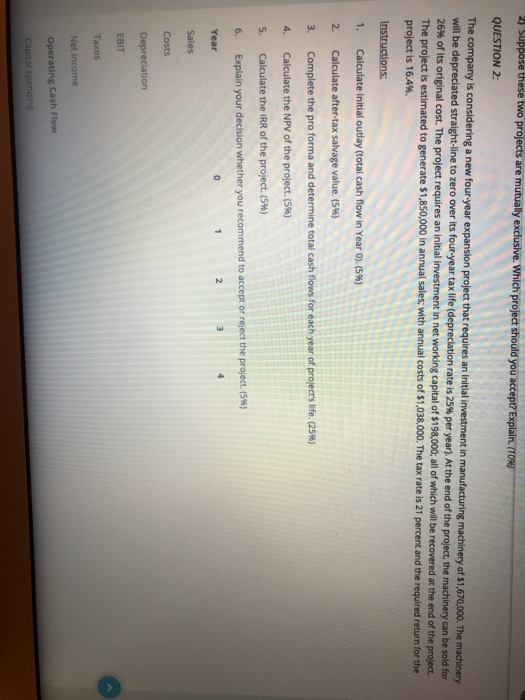

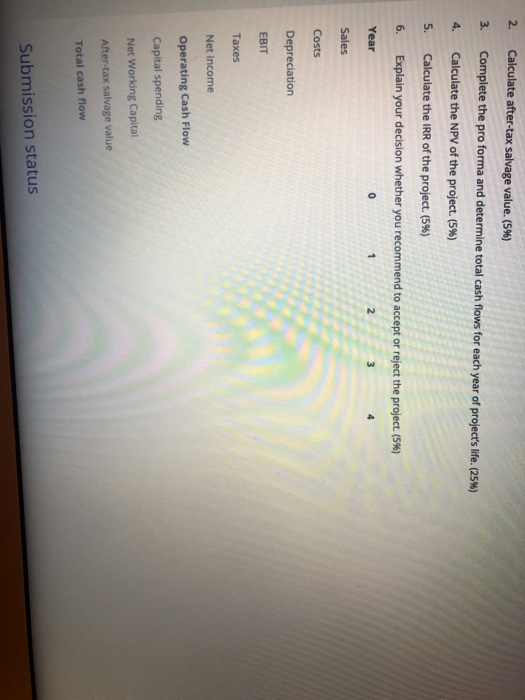

Important: Show your solutions! QUESTION 1: Consider the following two projects: Year Cash Flow (A) Cash Flow (B) -$364,000 -$52,000 25,000 46,000 68,000 22,000 68,000 21,500 458,000 17,500 Whichever project you choose, if any, you require a return of 11 percent on your investment. 1) Suppose these two projects are independent. Which project(s) should you accept based on: a. The Payback rule? Explain. (1096) b. The Profitability Index rule? Explain. (10%) c. The IRR rule? Explain. (10%) d. The NPV rule? Explain. (1096) 2) Suppose these two projects are mutually exclusive. Which project should you accept? Explain. (10%) QUESTION 2: The company is considering a new four year expansion project that requires an initial investment in manufacturing machinery of $1,670,000. The machinery will be depreciated straight-line to zero over its four year tax life (depreciation rate is 25% per year). At the end of the project, the machinery can be sold for 26% of its original cost. The project requires an initial investment in net working capital of $198,000; all of which will be recovered at the end of the project The project is estimated to generate $1,850,000 in annual sales, with annual costs of $1,038,000. The tax rate is 21 percent and the required return for the project is 16.4%. Instructions: 1. Calculate initial outlay (total cash flow in Year O). (5%) 2. Calculate after-tax salvage value. (5%) 3. Complete the pro forma and determine total cash flows for each year of project's life. (25%) Calculate the NPV of the project. (5%) 5. Calculate the IRR of the project.(5%) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital My courses - Student services Faculty area Library Office 365 Communit 26% of its original cost. The project requires an initial investment in net working capital of $198,0 The project is estimated to generate $1,850,000 in annual sales; with annual costs of $1,038,000. project is 16.4%. Instructions: 1. Calculate initial outlay (total cash flow in Year O). (5%) Calculate after-tax salvage value. (5%) Complete the pro forma and determine total cash flows for each year of project's life. (25 Calculate the NPV of the project. (5%) 5. Calculate the IRR of the project. (596) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year 2 3 Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital After-tax salvage value Total cash flow 2) suppose these two projects are mutually exclusive. Which project should you accept? Explain. /TOX QUESTION 2: The company is considering a new four year expansion project that requires an initial investment in manufacturing machinery of $1,670,000. The machinery will be depreciated straight-line to zero over its four-year tax life (depreciation rate is 25% per year). At the end of the project, the machinery can be sold for 26% of its original cost. The project requires an initial investment in net working capital of $198,000; all of which will be recovered at the end of the project. The project is estimated to generate 51,850,000 in annual sales; with annual costs of 51,038,000. The tax rate is 21 percent and the required return for the project is 16.4%. Instructions: 1. Calculate initial outlay (total cash flow in Year O).(5%) 2. Calculate after-tax salvage value. (596) 3. Complete the pro forma and determine total cash flows for each year of project's life. (25%) 4. Calculate the NPV of the project.(5%) 5. Calculate the IRR of the project. (5%) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending 2. Calculate after-tax salvage value. (59) 3. Complete the pro forma and determine total cash flows for each year of project's life. (25%) 4. Calculate the NPV of the project. (5%) 5. Calculate the IRR of the project. (5%) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital After-tax salvage value Total cash flow Submission status

Important: Show your solutions! QUESTION 1: Consider the following two projects: Year Cash Flow (A) Cash Flow (B) -$364,000 -$52,000 25,000 46,000 68,000 22,000 68,000 21,500 458,000 17,500 Whichever project you choose, if any, you require a return of 11 percent on your investment. 1) Suppose these two projects are independent. Which project(s) should you accept based on: a. The Payback rule? Explain. (1096) b. The Profitability Index rule? Explain. (10%) c. The IRR rule? Explain. (10%) d. The NPV rule? Explain. (1096) 2) Suppose these two projects are mutually exclusive. Which project should you accept? Explain. (10%) QUESTION 2: The company is considering a new four year expansion project that requires an initial investment in manufacturing machinery of $1,670,000. The machinery will be depreciated straight-line to zero over its four year tax life (depreciation rate is 25% per year). At the end of the project, the machinery can be sold for 26% of its original cost. The project requires an initial investment in net working capital of $198,000; all of which will be recovered at the end of the project The project is estimated to generate $1,850,000 in annual sales, with annual costs of $1,038,000. The tax rate is 21 percent and the required return for the project is 16.4%. Instructions: 1. Calculate initial outlay (total cash flow in Year O). (5%) 2. Calculate after-tax salvage value. (5%) 3. Complete the pro forma and determine total cash flows for each year of project's life. (25%) Calculate the NPV of the project. (5%) 5. Calculate the IRR of the project.(5%) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital My courses - Student services Faculty area Library Office 365 Communit 26% of its original cost. The project requires an initial investment in net working capital of $198,0 The project is estimated to generate $1,850,000 in annual sales; with annual costs of $1,038,000. project is 16.4%. Instructions: 1. Calculate initial outlay (total cash flow in Year O). (5%) Calculate after-tax salvage value. (5%) Complete the pro forma and determine total cash flows for each year of project's life. (25 Calculate the NPV of the project. (5%) 5. Calculate the IRR of the project. (596) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year 2 3 Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital After-tax salvage value Total cash flow 2) suppose these two projects are mutually exclusive. Which project should you accept? Explain. /TOX QUESTION 2: The company is considering a new four year expansion project that requires an initial investment in manufacturing machinery of $1,670,000. The machinery will be depreciated straight-line to zero over its four-year tax life (depreciation rate is 25% per year). At the end of the project, the machinery can be sold for 26% of its original cost. The project requires an initial investment in net working capital of $198,000; all of which will be recovered at the end of the project. The project is estimated to generate 51,850,000 in annual sales; with annual costs of 51,038,000. The tax rate is 21 percent and the required return for the project is 16.4%. Instructions: 1. Calculate initial outlay (total cash flow in Year O).(5%) 2. Calculate after-tax salvage value. (596) 3. Complete the pro forma and determine total cash flows for each year of project's life. (25%) 4. Calculate the NPV of the project.(5%) 5. Calculate the IRR of the project. (5%) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending 2. Calculate after-tax salvage value. (59) 3. Complete the pro forma and determine total cash flows for each year of project's life. (25%) 4. Calculate the NPV of the project. (5%) 5. Calculate the IRR of the project. (5%) 6. Explain your decision whether you recommend to accept or reject the project. (5%) Year Sales Costs Depreciation EBIT Taxes Net income Operating Cash Flow Capital spending Net Working Capital After-tax salvage value Total cash flow Submission status

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started