Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Improvements and revision of depreciation GST version The financial statements for Sotherby Ltd at 30 June 2022, presented a building with a cost of

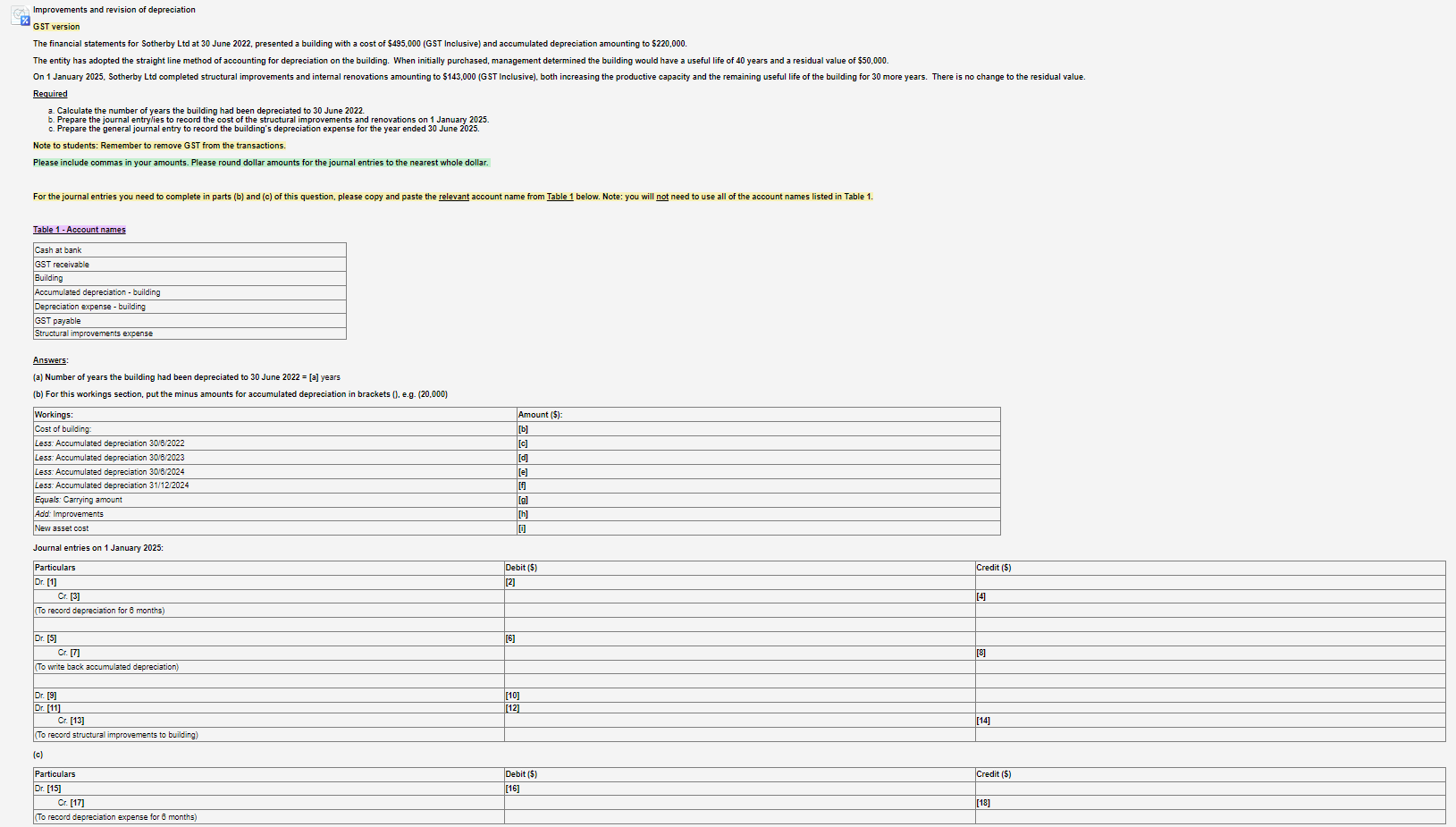

Improvements and revision of depreciation GST version The financial statements for Sotherby Ltd at 30 June 2022, presented a building with a cost of $495,000 (GST Inclusive) and accumulated depreciation amounting to $220,000. The entity has adopted the straight line method of accounting for depreciation on the building. When initially purchased, management determined the building would have a useful life of 40 years and a residual value of $50,000. On 1 January 2025, Sotherby Ltd completed structural improvements and internal renovations amounting to $143,000 (GST Inclusive), both increasing the productive capacity and the remaining useful life of the building for 30 more years. There is no change to the residual value. Required a. Calculate the number of years the building had been depreciated to 30 June 2022. Prepare the journal entry/ies to record the cost of the structural improvements and renovations on 1 January 2025. c. Prepare the general journal entry to record the building's depreciation expense for the year ended 30 June 2025. Note to students: Remember to remove GST from the transactions. Please include commas in your amounts. Please round dollar amounts for the journal entries to the nearest whole dollar. For the journal entries you need to complete in parts (b) and (c) of this question, please copy and paste the relevant account name from Table 1 below. Note: you will not need to use all of the account names listed in Table 1. Table 1- Account names Cash at bank GST receivable Building Accumulated depreciation - building Depreciation expense - building Depred GST payable Structural improvements expense Answers: (a) Number of years the building had been depreciated to 30 June 2022 = [a] years (b) For this workings section, put the minus amounts for accumulated depreciation in brackets (), e.g. (20,000) Workings: Cost of building: Less: Accumulated depreciation 30/6/2022 Less: Accumulated depreciation 30/6/2023 Less: Accumulated depreciation 30/8/2024 Less: Accumulated depreciation 31/12/2024 Equals: Carrying amount Add: Improvements New asset cost Journal entries on 1 January 2025: Particulars Dr. [1] Cr. [3] (To record depreciation for 8 months) Dr. [5] Cr. [7] (To write back accumulated depreciation) Dr. [9] Dr. [11] Cr. [13] (To record structural improvements to building) (c) Particulars Dr. [15] Cr. [17] (To record depreciation expense for 6 months) Amount ($): [b] [c] [6] [d] [e] [f [g] [h] 0 Debit ($) [2] [101 [12] Debit ($) [16] Credit ($) [4] [8] [14] Credit ($) [18]

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Number of years the building had been depreciated to 3...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started