Answered step by step

Verified Expert Solution

Question

1 Approved Answer

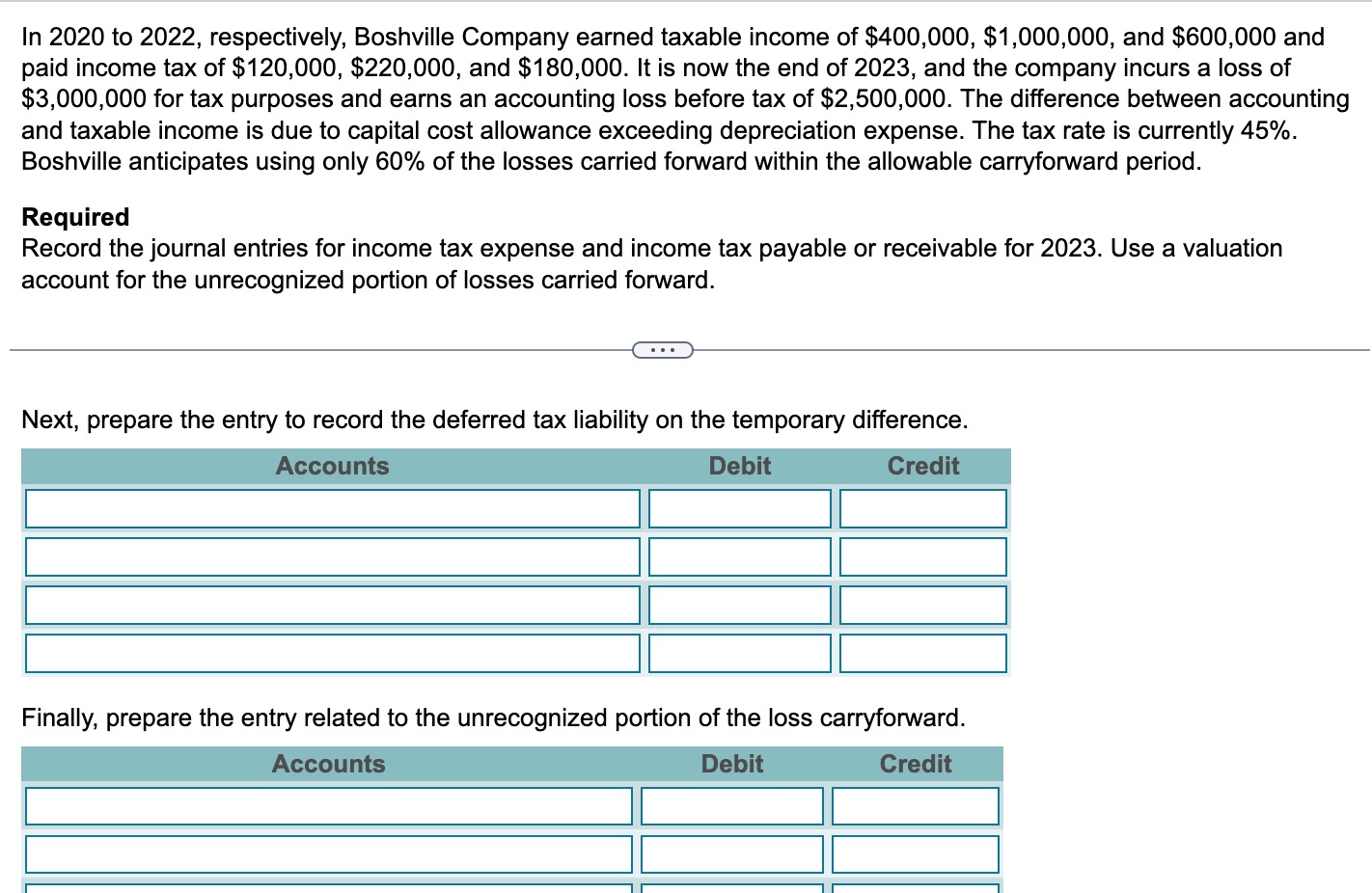

In 2 0 2 0 to 2 0 2 2 , respectively, Boshville Company earned taxable income of $ 4 0 0 , 0 0

In to respectively, Boshville Company earned taxable income of $$ and $ and paid income tax of $$ and $ It is now the end of and the company incurs a loss of $ for tax purposes and earns an accounting loss before tax of $ The difference between accounting and taxable income is due to capital cost allowance exceeding depreciation expense. The tax rate is currently Boshville anticipates using only of the losses carried forward within the allowable carryforward period.

Required

Record the journal entries for income tax expense and income tax payable or receivable for Use a valuation account for the unrecognized portion of losses carried forward.

Next, prepare the entry to record the deferred tax liability on the temporary difference.

Accounts

Debit

Credit

Finally, prepare the entry related to the unrecognized portion of the loss carryforward.

Accounts

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started