Answered step by step

Verified Expert Solution

Question

1 Approved Answer

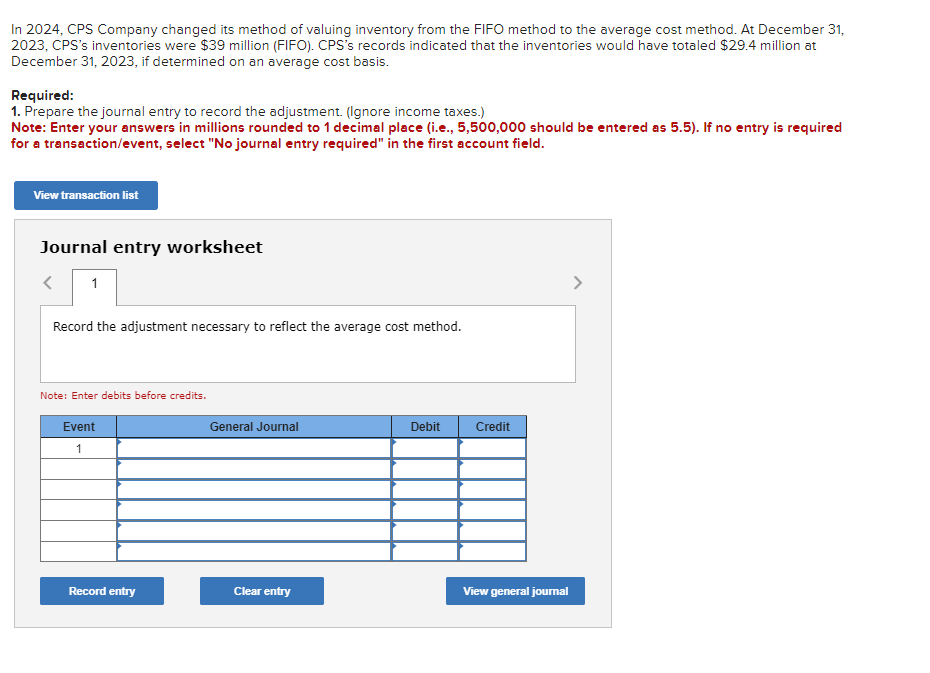

In 2 0 2 4 , CPS Company changed its method of valuing inventory from the FIFO method to the average cost method. At December

In CPS Company changed its method of valuing inventory from the FIFO method to the average cost method. At December

CPSs inventories were $ million FIFO CPSs records indicated that the inventories would have totaled $ million at

December if determined on an average cost basis.

Required:

Prepare the journal entry to record the adjustment. Ignore income taxes.

Note: Enter your answers in millions rounded to decimal place ie should be entered as If no entry is required

for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the adjustment necessary to reflect the average cost method.

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started