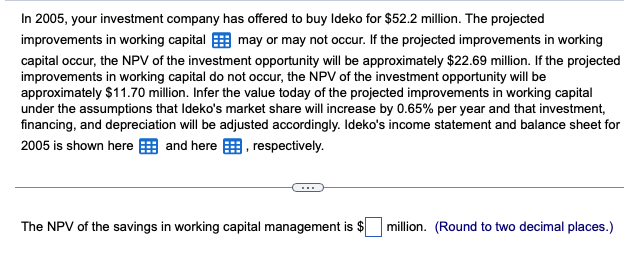

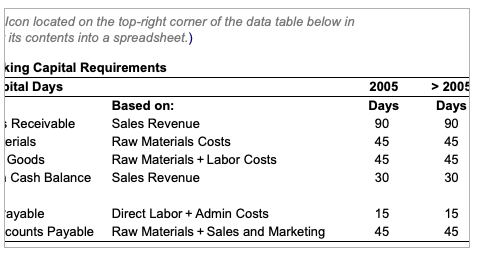

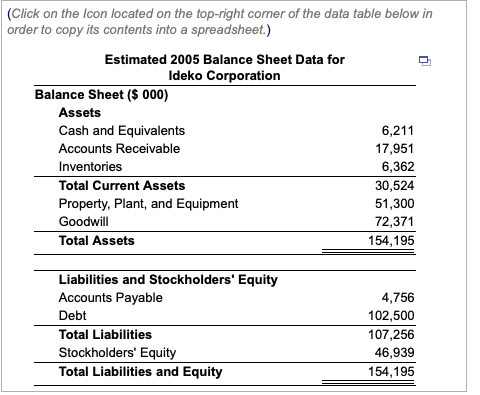

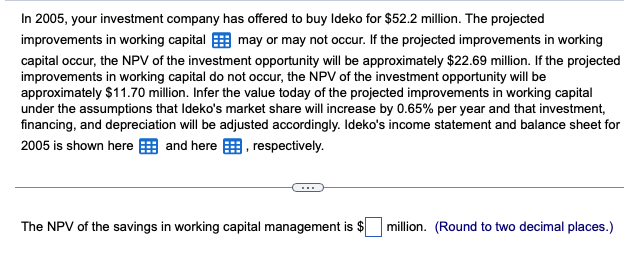

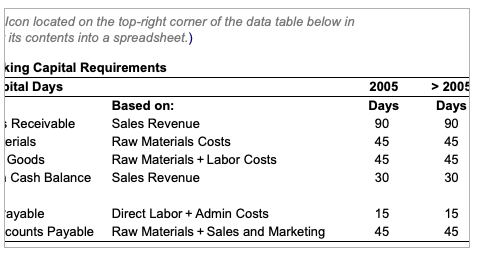

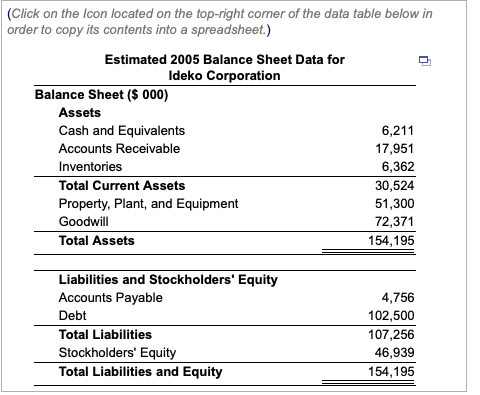

In 2005, your investment company has offered to buy Ideko for $52.2 million. The projected improvements in working capital may or may not occur. If the projected improvements in working capital occur, the NPV of the investment opportunity will be approximately $22.69 million. If the projected improvements in working capital do not occur, the NPV of the investment opportunity will be approximately $11.70 million. Infer the value today of the projected improvements in working capital under the assumptions that Ideko's market share will increase by 0.65% per year and that investment, financing, and depreciation will be adjusted accordingly. Ideko's income statement and balance sheet for 2005 is shown here and here, respectively. The NPV of the savings in working capital management is $ million. (Round to two decimal places.) Icon located on the top-right corner of the data table below in its contents into a spreadsheet.) king Capital Requirements bital Days Based on: Sales Revenue Raw Materials Costs Raw Materials + Labor Costs Sales Revenue Direct Labor + Admin Costs Raw Materials + Sales and Marketing Receivable erials Goods Cash Balance ayable counts Payable 2005 Days 90 45 45 30 15 45 > 2005 Days 90 45 45 30 15 45 (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents 6,211 17,951 Accounts Receivable Inventories 6,362 Total Current Assets 30,524 51,300 Property, Plant, and Equipment Goodwill 72,371 Total Assets 154,195 Liabilities and Stockholders' Equity Accounts Payable 4,756 Debt 102,500 Total Liabilities 107,256 Stockholders' Equity 46,939 Total Liabilities and Equity 154,195 (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Estimated 2005 Income Statement Data for Ideko Corporation Income Statement ($ 000) Sales 72,800 Cost of Goods Sold Raw Materials (16,700) Direct Labor Costs (18,200) Gross Profit 37,900 Sales and Marketing (11,310) Administrative (13,500) EBITDA 13,090 Depreciation (5,700) EBIT 7,390 Interest Expense (net) (78) Pretax Income 7,312 Income Tax (2,559) Net Income 4,753 In 2005, your investment company has offered to buy Ideko for $52.2 million. The projected improvements in working capital may or may not occur. If the projected improvements in working capital occur, the NPV of the investment opportunity will be approximately $22.69 million. If the projected improvements in working capital do not occur, the NPV of the investment opportunity will be approximately $11.70 million. Infer the value today of the projected improvements in working capital under the assumptions that Ideko's market share will increase by 0.65% per year and that investment, financing, and depreciation will be adjusted accordingly. Ideko's income statement and balance sheet for 2005 is shown here and here, respectively. The NPV of the savings in working capital management is $ million. (Round to two decimal places.) Icon located on the top-right corner of the data table below in its contents into a spreadsheet.) king Capital Requirements bital Days Based on: Sales Revenue Raw Materials Costs Raw Materials + Labor Costs Sales Revenue Direct Labor + Admin Costs Raw Materials + Sales and Marketing Receivable erials Goods Cash Balance ayable counts Payable 2005 Days 90 45 45 30 15 45 > 2005 Days 90 45 45 30 15 45 (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet ($ 000) Assets Cash and Equivalents 6,211 17,951 Accounts Receivable Inventories 6,362 Total Current Assets 30,524 51,300 Property, Plant, and Equipment Goodwill 72,371 Total Assets 154,195 Liabilities and Stockholders' Equity Accounts Payable 4,756 Debt 102,500 Total Liabilities 107,256 Stockholders' Equity 46,939 Total Liabilities and Equity 154,195 (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Estimated 2005 Income Statement Data for Ideko Corporation Income Statement ($ 000) Sales 72,800 Cost of Goods Sold Raw Materials (16,700) Direct Labor Costs (18,200) Gross Profit 37,900 Sales and Marketing (11,310) Administrative (13,500) EBITDA 13,090 Depreciation (5,700) EBIT 7,390 Interest Expense (net) (78) Pretax Income 7,312 Income Tax (2,559) Net Income 4,753