Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2010, ABC Company bought a bond with a face value of $7,500, 5.75% coupon rate and 20 years of maturity. After 7 years,

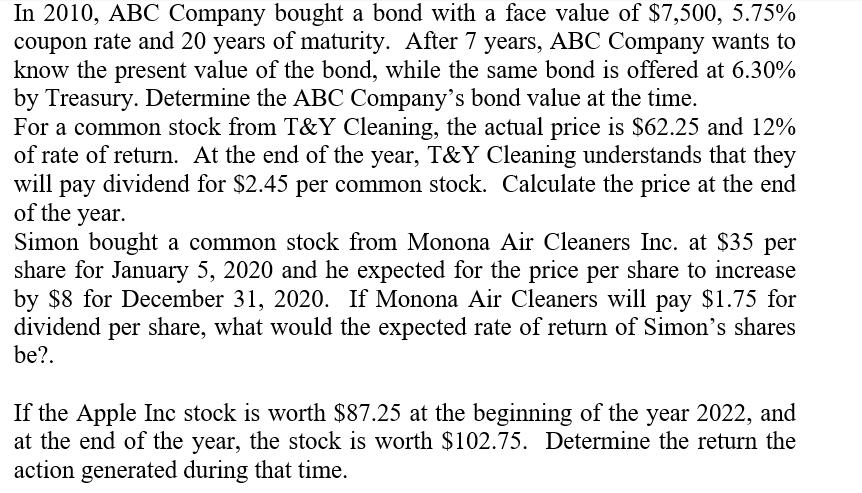

In 2010, ABC Company bought a bond with a face value of $7,500, 5.75% coupon rate and 20 years of maturity. After 7 years, ABC Company wants to know the present value of the bond, while the same bond is offered at 6.30% by Treasury. Determine the ABC Company's bond value at the time. For a common stock from T&Y Cleaning, the actual price is $62.25 and 12% of rate of return. At the end of the year, T&Y Cleaning understands that they will pay dividend for $2.45 per common stock. Calculate the price at the end of the year. Simon bought a common stock from Monona Air Cleaners Inc. at $35 per share for January 5, 2020 and he expected for the price per share to increase by $8 for December 31, 2020. If Monona Air Cleaners will pay $1.75 for dividend per share, what would the expected rate of return of Simon's shares be?. If the Apple Inc stock is worth $87.25 at the beginning of the year 2022, and at the end of the year, the stock is worth $102.75. Determine the return the action generated during that time.

Step by Step Solution

★★★★★

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing the Scenarios 1 ABC Company Bond Value Unfortunately calculating the present value of ABC ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started