Question

Hawthorne Golf, the maker of a sought-after set of golf clubs, was formed in 2012. The selling price for each golf club set is $850,

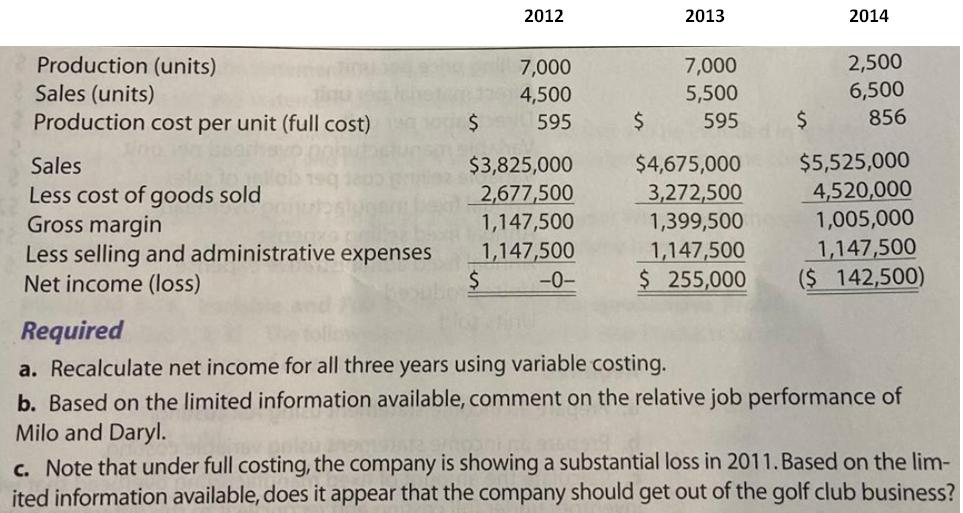

Hawthorne Golf, the maker of a sought-after set of golf clubs, was formed in 2012. The selling price for each golf club set is $850, variable production costs are $450 per unit, fixed production costs are $1,015,000 per year, and fixed selling and administrative costs are $1,147,500 per year. Data below indicate net income for 2012–2014 under full costing.

In 2012 and 2013, Milo Hawthorne, Jr., was the president of Hawthorne Golf. The board of directors was generally pleased with the company’s performance under his leadership—the company hit the break-even point in its first year of operation and had a modest profit in 2013. Milo quit at the end of 2013 and went on to buy a golf course and open a pro shop. His replacement, Daryl Selmer, was apparently not as successful as Milo. Daryl argued that he was improving the company by getting rid of excess inventory, but the board noted that the company showed a $142,500 loss in the first year of his leadership.

2012 2013 2014 Production (units) Sales (units) Production cost per unit (full cost) 2,500 7,000 4,500 2$ 7,000 5,500 6,500 595 595 $ 856 $3,825,000 2,677,500 1,147,500 1,147,500 -0- $4,675,000 3,272,500 1,399,500 $5,525,000 4,520,000 1,005,000 Sales Less cost of goods sold Gross margin Less selling and administrative expenses Net income (loss) 1,147,500 $ 255,000 1,147,500 ($ 142,500) $4 Required a. Recalculate net income for all three years using variable costing. b. Based on the limited information available, comment on the relative job performance of Milo and Daryl. c. Note that under full costing, the company is showing a substantial loss in 2011. Based on the lim- ited information available, does it appear that the company should get out of the golf club business?

Step by Step Solution

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

B Hence from the above analysis it can be seen that in 2009 there is a net loss of 362500 as per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started