Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2012, the press information about Enron's bankruptcy mission along with some confusion at Arthur Andersen Company, one of the five largest auditing corporations in

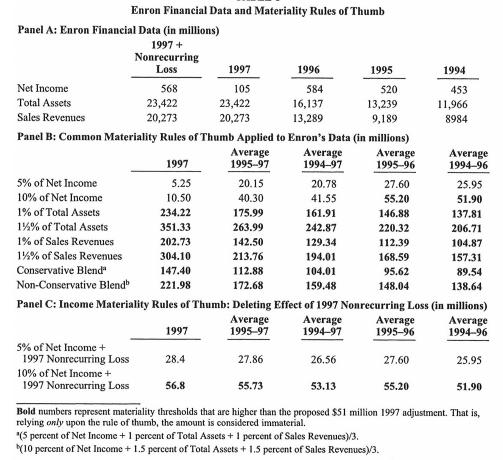

In 2012, the press information about Enron's bankruptcy mission along with some confusion at Arthur Andersen Company, one of the five largest auditing corporations in the world. How do auditors determine materiality to give an opinion on the financial statements? Are their rules of thumb and professional judgment reasonable ?

Panel A: Enron Financial Data (in millions) 1997 + Nonrecurring Loss Net Income Total Assets Sales Revenues Enron Financial Data and Materiality Rules of Thumb 5% of Net Income 10% of Net Income 1% of Total Assets 1%% of Total Assets 1% of Sales Revenues 1%% of Sales Revenues Conservative Blend Non-Conservative Blend 568 23,422 20,273 5% of Net Income + 1997 Nonrecurring Loss 10% of Net Income + 1997 Nonrecurring Loss 1997 5.25 10.50 234.22 351.33 202.73 304.10 Panel B: Common Materiality Rules of Thumb Applied to Enron's Data (in millions) Average 1995-97 147.40 221.98 1997 105 23,422 20,273 28.4 20.15 40.30 175.99 263.99 56.8 142.50 213.76 112.88 172.68 1996 584 16,137 13,289 27.86 55.73 Average 1994-97 20.78 41.55 161.91 242.87 129.34 194.01 104.01 159.48 Average 1994-97 1995 520 13,239 9,189 26.56 53.13 Average 1995-96 Panel C: Income Materiality Rules of Thumb: Deleting Effect of 1997 Nonrecurring Loss (in millions) Average Average 1997 1995-97 1994-96 27.60 55.20 146.88 220.32 112.39 168.59 95.62 148.04 Average 1995-96 27.60 55.20 Bold numbers represent materiality thresholds that are higher than the proposed $51 million 1997 adjustment. That is, relying only upon the rule of thumb, the amount is considered immaterial. 1994 *(5 percent of Net Income + 1 percent of Total Assets + 1 percent of Sales Revenues)/3. (10 percent of Net Income + 1.5 percent of Total Assets +1.5 percent of Sales Revenues)/3. 453 11,966 8984 Average 1994-96 25.95 51.90 137.81 206.71 104.87 157.31 89.54 138.64 25.95 51.90

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution Auditors determine materiality by assessing the significance of a transaction or event in r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started