Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2012, XYZ Inc., a medical equipment distributor, sold 10,000 units of its hospital beds at an average price of $500 per unit. The

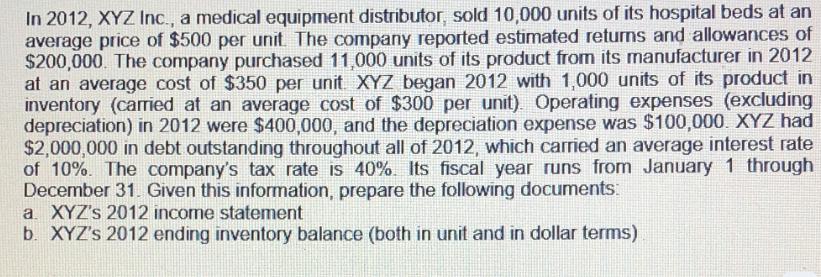

In 2012, XYZ Inc., a medical equipment distributor, sold 10,000 units of its hospital beds at an average price of $500 per unit. The company reported estimated returns and allowances of $200,000. The company purchased 11,000 units of its product from its manufacturer in 2012 at an average cost of $350 per unit XYZ began 2012 with 1,000 units of its product in inventory (carried at an average cost of $300 per unit). Operating expenses (excluding depreciation) in 2012 were $400,000, and the depreciation expense was $100,000. XYZ had $2,000,000 in debt outstanding throughout all of 2012, which carried an average interest rate of 10%. The company's tax rate is 40%. Its fiscal year runs from January 1 through December 31. Given this information, prepare the following documents: a. XYZ'S 2012 income statement b. XYZ's 2012 ending inventory balance (both in unit and in dollar terms)

Step by Step Solution

★★★★★

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To prepare XYZ Incs 2012 income statement and ending inventory balance we will need to calculate various financial figures using the provided informat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started