Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2013, Assigned to audit the cash and related accounts of Merdeliza a manufacturer of construction and industrial equipment, as of and for the year

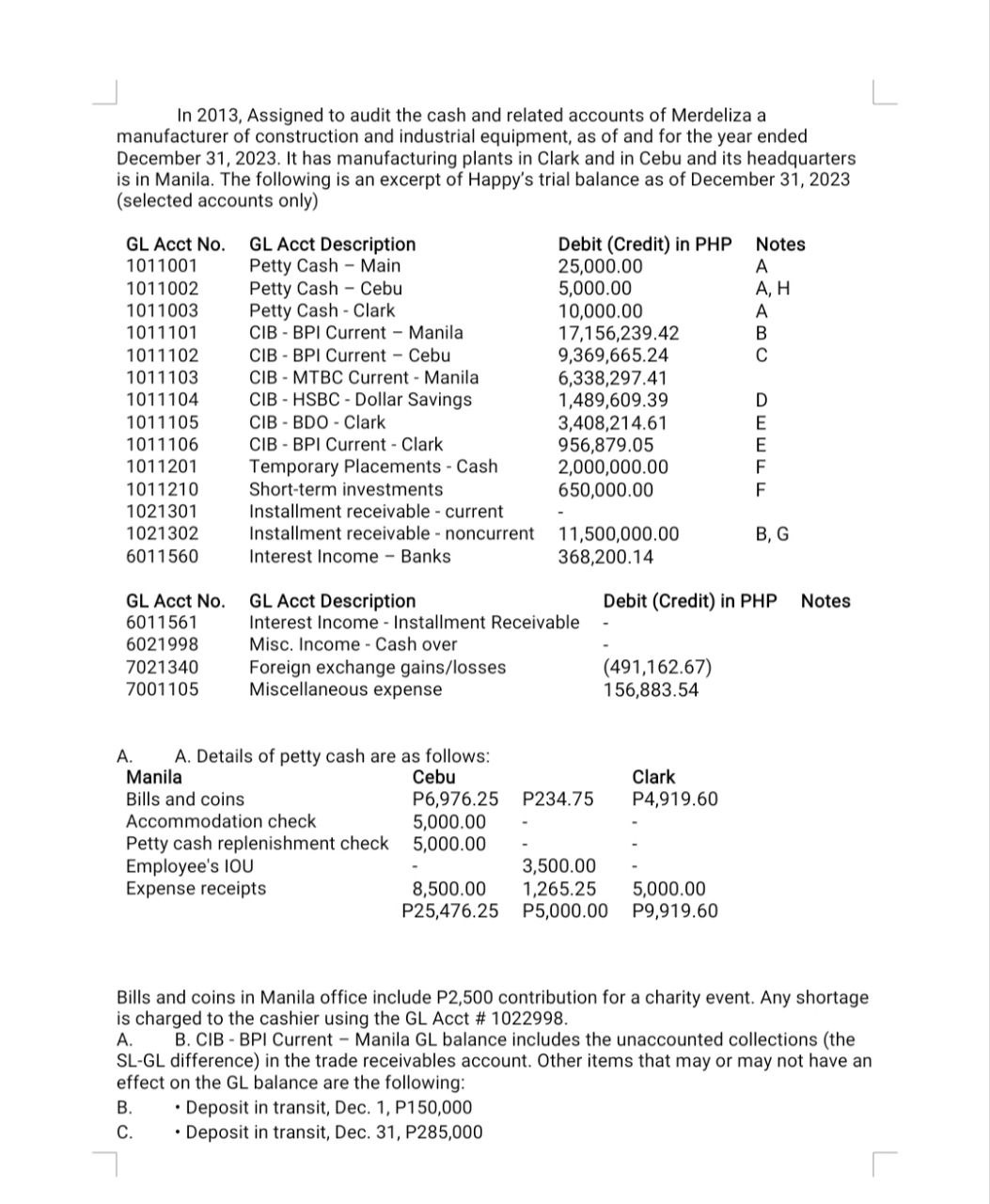

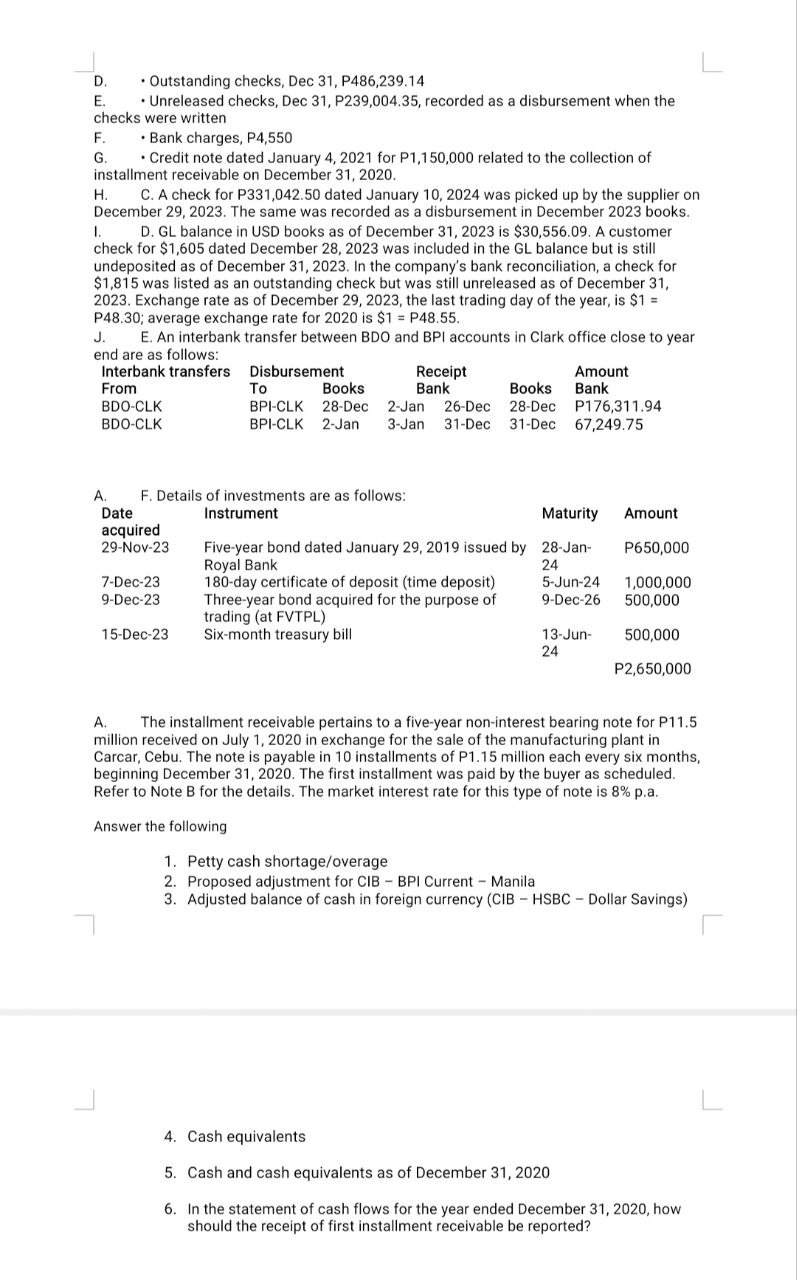

In 2013, Assigned to audit the cash and related accounts of Merdeliza a manufacturer of construction and industrial equipment, as of and for the year ended December 31, 2023. It has manufacturing plants in Clark and in Cebu and its headquarters is in Manila. The following is an excerpt of Happy's trial balance as of December 31, 2023 (selected accounts only) A A netails of nettv cash are as follnws. Bills and coins in Manila office include P2,500 contribution for a charity event. Any shortage is charged to the cashier using the GL Acct \# 1022998. A. B. CIB - BPI Current - Manila GL balance includes the unaccounted collections (the SL-GL difference) in the trade receivables account. Other items that may or may not have an effect on the GL balance are the following: B. Deposit in transit, Dec. 1, P150,000 C. Deposit in transit, Dec. 31, P285,000 D. - Outstanding checks, Dec 31, P486,239.14 E. Unreleased checks, Dec 31, P239,004.35, recorded as a disbursement when the checks were written F. Bank charges, P4,550 G. Credit note dated January 4, 2021 for P1,150,000 related to the collection of installment receivable on December 31, 2020. H. C. A check for P331,042.50 dated January 10, 2024 was picked up by the supplier on December 29, 2023. The same was recorded as a disbursement in December 2023 books. I. D. GL balance in USD books as of December 31,2023 is $30,556.09. A customer check for $1,605 dated December 28,2023 was included in the GL balance but is still undeposited as of December 31,2023. In the company's bank reconciliation, a check for $1,815 was listed as an outstanding check but was still unreleased as of December 31, 2023. Exchange rate as of December 29,2023 , the last trading day of the year, is $1= P48.30; average exchange rate for 2020 is $1=P48.55. J. E. An interbank transfer between BDO and BPI accounts in Clark office close to year A. The installment receivable pertains to a five-year non-interest bearing note for P11.5 million received on July 1,2020 in exchange for the sale of the manufacturing plant in Carcar, Cebu. The note is payable in 10 installments of P1.15 million each every six months, beginning December 31,2020 . The first installment was paid by the buyer as scheduled. Refer to Note B for the details. The market interest rate for this type of note is 8% p.a. Answer the following 1. Petty cash shortage/overage 2. Proposed adjustment for CIB - BPI Current - Manila 3. Adjusted balance of cash in foreign currency (CIB - HSBC - Dollar Savings) 4. Cash equivalents 5. Cash and cash equivalents as of December 31,2020 6. In the statement of cash flows for the year ended December 31, 2020, how should the receipt of first installment receivable be reported

In 2013, Assigned to audit the cash and related accounts of Merdeliza a manufacturer of construction and industrial equipment, as of and for the year ended December 31, 2023. It has manufacturing plants in Clark and in Cebu and its headquarters is in Manila. The following is an excerpt of Happy's trial balance as of December 31, 2023 (selected accounts only) A A netails of nettv cash are as follnws. Bills and coins in Manila office include P2,500 contribution for a charity event. Any shortage is charged to the cashier using the GL Acct \# 1022998. A. B. CIB - BPI Current - Manila GL balance includes the unaccounted collections (the SL-GL difference) in the trade receivables account. Other items that may or may not have an effect on the GL balance are the following: B. Deposit in transit, Dec. 1, P150,000 C. Deposit in transit, Dec. 31, P285,000 D. - Outstanding checks, Dec 31, P486,239.14 E. Unreleased checks, Dec 31, P239,004.35, recorded as a disbursement when the checks were written F. Bank charges, P4,550 G. Credit note dated January 4, 2021 for P1,150,000 related to the collection of installment receivable on December 31, 2020. H. C. A check for P331,042.50 dated January 10, 2024 was picked up by the supplier on December 29, 2023. The same was recorded as a disbursement in December 2023 books. I. D. GL balance in USD books as of December 31,2023 is $30,556.09. A customer check for $1,605 dated December 28,2023 was included in the GL balance but is still undeposited as of December 31,2023. In the company's bank reconciliation, a check for $1,815 was listed as an outstanding check but was still unreleased as of December 31, 2023. Exchange rate as of December 29,2023 , the last trading day of the year, is $1= P48.30; average exchange rate for 2020 is $1=P48.55. J. E. An interbank transfer between BDO and BPI accounts in Clark office close to year A. The installment receivable pertains to a five-year non-interest bearing note for P11.5 million received on July 1,2020 in exchange for the sale of the manufacturing plant in Carcar, Cebu. The note is payable in 10 installments of P1.15 million each every six months, beginning December 31,2020 . The first installment was paid by the buyer as scheduled. Refer to Note B for the details. The market interest rate for this type of note is 8% p.a. Answer the following 1. Petty cash shortage/overage 2. Proposed adjustment for CIB - BPI Current - Manila 3. Adjusted balance of cash in foreign currency (CIB - HSBC - Dollar Savings) 4. Cash equivalents 5. Cash and cash equivalents as of December 31,2020 6. In the statement of cash flows for the year ended December 31, 2020, how should the receipt of first installment receivable be reported Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started