Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2014, PEACE COMPANY received interest income of 100,000 on government obligations and P600,000 in royalties under a licensing agreement. Royalties are reported as

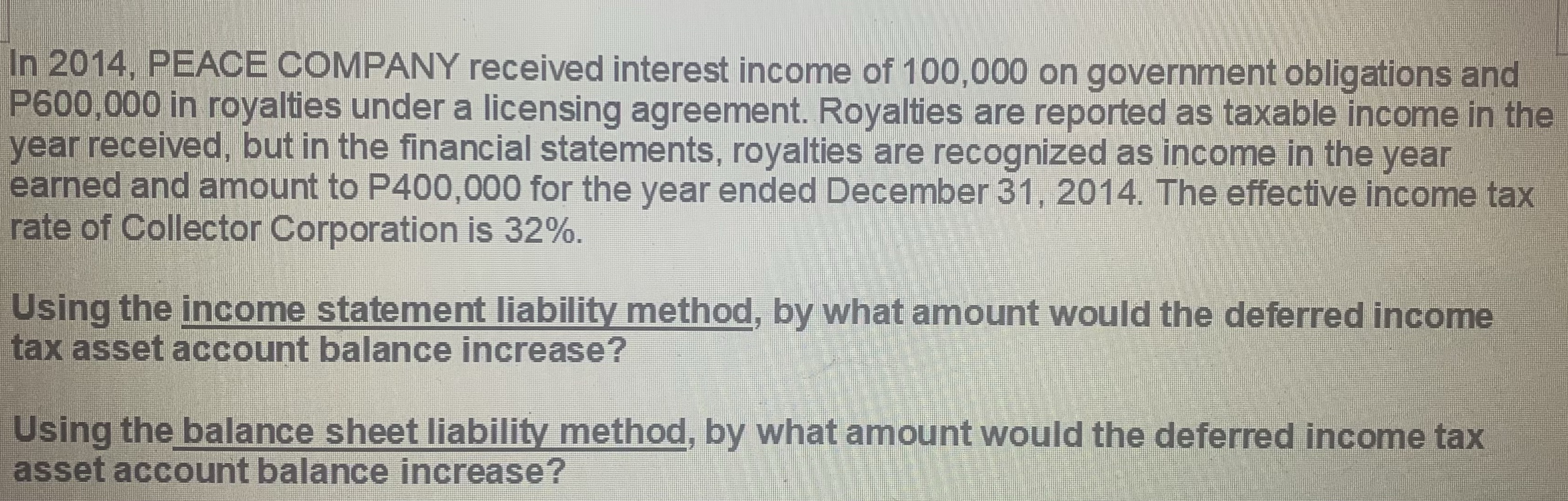

In 2014, PEACE COMPANY received interest income of 100,000 on government obligations and P600,000 in royalties under a licensing agreement. Royalties are reported as taxable income in the year received, but in the financial statements, royalties are recognized as income in the year earned and amount to P400,000 for the year ended December 31, 2014. The effective income tax rate of Collector Corporation is 32%. Using the income statement liability method, by what amount would the deferred income tax asset account balance increase? Using the balance sheet liability method, by what amount would the deferred income tax asset account balance increase?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the increase in the deferred income tax asset account balance using both the income statement liability method and the balance sheet liab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started