Question

In 2016, a severe weather storm destroyed your only asset you had in Class 8. In 2017, you replaced this asset by purchasing a

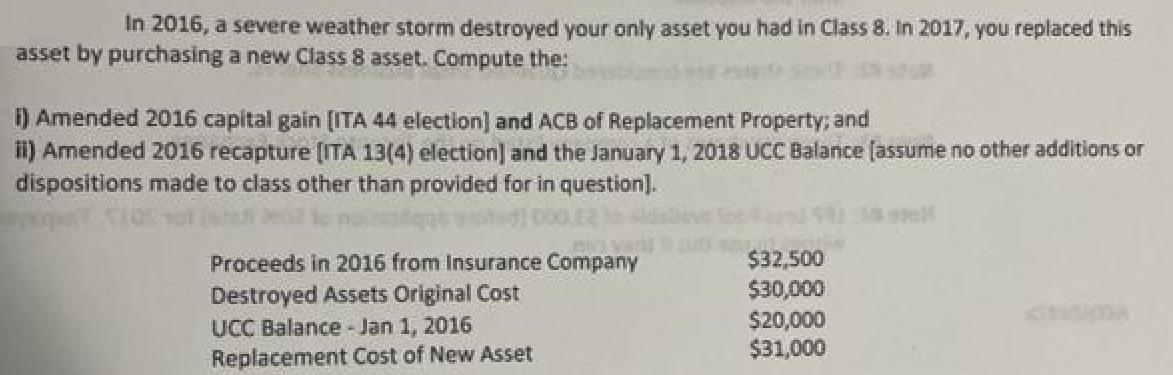

In 2016, a severe weather storm destroyed your only asset you had in Class 8. In 2017, you replaced this asset by purchasing a new Class 8 asset. Compute the: i) Amended 2016 capital gain [ITA 44 election) and ACB of Replacement Property; and i) Amended 2016 recapture (ITA 13(4) election] and the January 1, 2018 UCC Balance (assume no other additions or dispositions made to class other than provided for in question]. $32,500 $30,000 $20,000 $31,000 Proceeds in 2016 from Insurance Company Destroyed Assets Original Cost UCC Balance- Jan 1, 2016 Replacement Cost of New Asset

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App