Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2017, ABC Law firm had two monthly salary employees. One is the lawyer---Gavin Rossdale, his monthly salary is $7000 and the other employee is

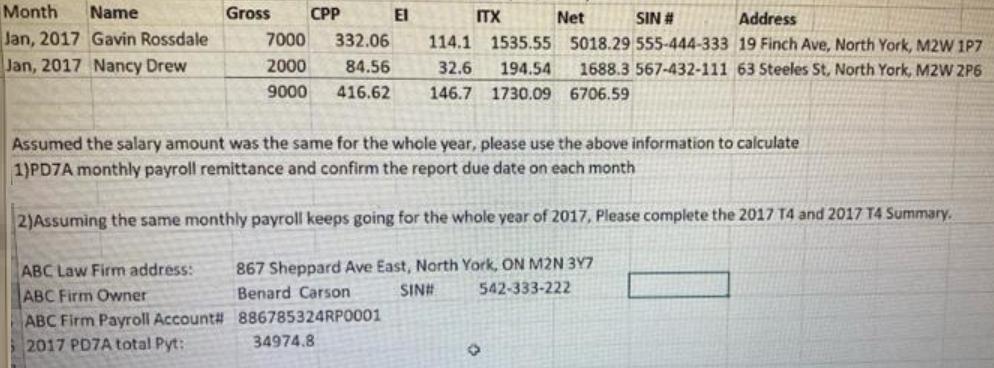

In 2017, ABC Law firm had two monthly salary employees. One is the lawyer---Gavin Rossdale, his monthly salary is $7000 and the other employee is the admin called Nancy Drew, her salary is $2000 per month.

Month Name Gross CPP El ITX Net SIN # Address Jan, 2017 Gavin Rossdale Jan, 2017 Nancy Drew 7000 332.06 114.1 1535.55 5018.29 555-444-333 19 Finch Ave, North York, M2W 1P7 2000 84.56 32.6 194.54 1688.3 567-432-111 63 Steeles St, North York, M2W ZP6 9000 416.62 146.7 1730.09 6706.59 Assumed the salary amount was the same for the whole year, please use the above information to calculate 1)PD7A monthly payroll remittance and confirm the report due date on each month 2)Assuming the same monthly payroll keeps going for the whole year of 2017, Please complete the 2017 T4 and 2017 T4 Summary. 867 Sheppard Ave East, North York, ON M2N 3Y7 542-333-222 ABC Law Firm address: ABC Firm Owner ABC Firm Payroll Account# 886785324RPO001 2017 PD7A total Pyt: Benard Carson SIN# 34974.8

Step by Step Solution

★★★★★

3.37 Rating (181 Votes )

There are 3 Steps involved in it

Step: 1

Solution Calculation of PD7A Monthly Payroll Remittence of MrGovin Rossdale and Mrs Nancy Drew Parti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started