Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in 2017. Andrew, who acordat watery rojob well as his report. However hayo ning her om tam did not fire 2017 ore tax retum Decomber

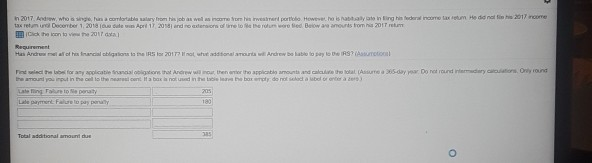

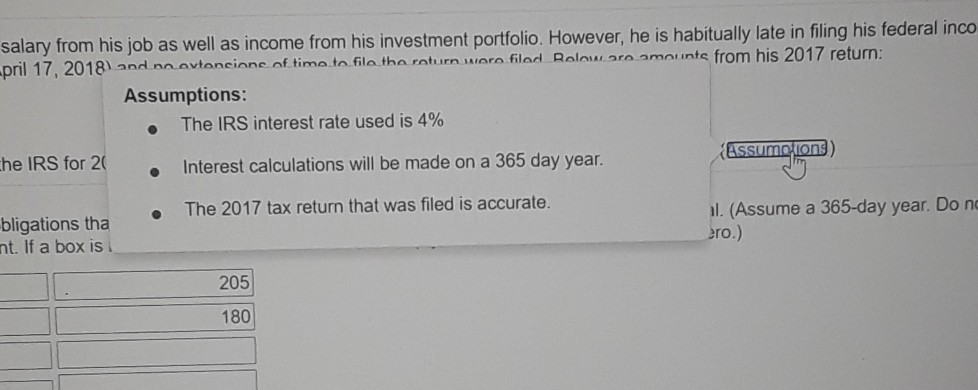

in 2017. Andrew, who acordat watery rojob well as his report. However hayo ning her om tam did not fire 2017 ore tax retum Decomber 1, 2018 1 de Apel 17 20 and recorre loon word. Below are amounts from 2017 rem Click the icon to the 2017 Requirement Has Andrell of his facial bliquota nel 2017 Hotutut additional tour will Andrew balable to say to DRS (surto Pied with for any applicatie store that Andrew w mour, then are the applicatio amounts and calculate the totala daw Do retroud diary Orly on the amoun you put in the cell to the marcant la balance in the bebom donosed abortera 205 Lang Falur praty Latent Fato pay porn 180 11 Total additional amount due O salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal inco pril 17, 2018 and nn avtoncione of time to fila the return woro filad Roloworo amount from his 2017 return; Assumptions: The IRS interest rate used is 4% Assumptions che IRS for 20 Interest calculations will be made on a 365 day year. The 2017 tax return that was filed is accurate. bligations tha nt. If a box is al. (Assume a 365-day year. Do nc ero.) 205 180 in 2017. Andrew, who acordat watery rojob well as his report. However hayo ning her om tam did not fire 2017 ore tax retum Decomber 1, 2018 1 de Apel 17 20 and recorre loon word. Below are amounts from 2017 rem Click the icon to the 2017 Requirement Has Andrell of his facial bliquota nel 2017 Hotutut additional tour will Andrew balable to say to DRS (surto Pied with for any applicatie store that Andrew w mour, then are the applicatio amounts and calculate the totala daw Do retroud diary Orly on the amoun you put in the cell to the marcant la balance in the bebom donosed abortera 205 Lang Falur praty Latent Fato pay porn 180 11 Total additional amount due O salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal inco pril 17, 2018 and nn avtoncione of time to fila the return woro filad Roloworo amount from his 2017 return; Assumptions: The IRS interest rate used is 4% Assumptions che IRS for 20 Interest calculations will be made on a 365 day year. The 2017 tax return that was filed is accurate. bligations tha nt. If a box is al. (Assume a 365-day year. Do nc ero.) 205 180

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started