Answered step by step

Verified Expert Solution

Question

1 Approved Answer

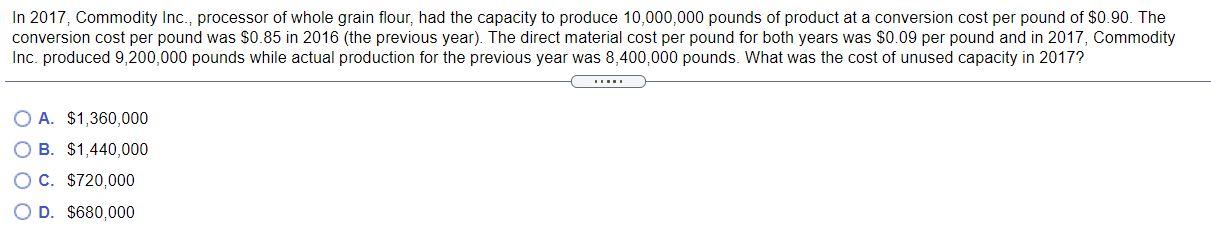

In 2017, Commodity Inc., processor of whole grain flour, had the capacity to produce 10,000,000 pounds of product at a conversion cost per pound

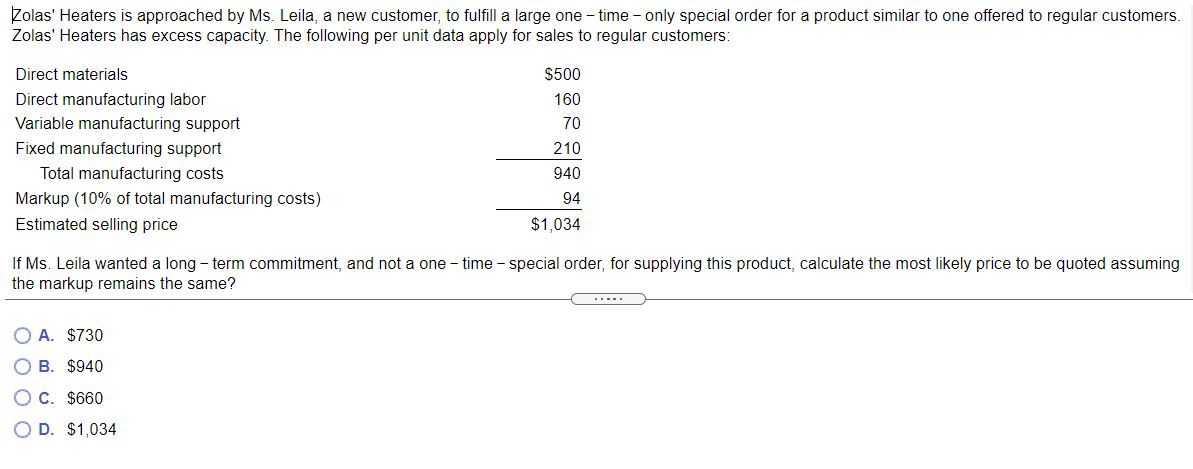

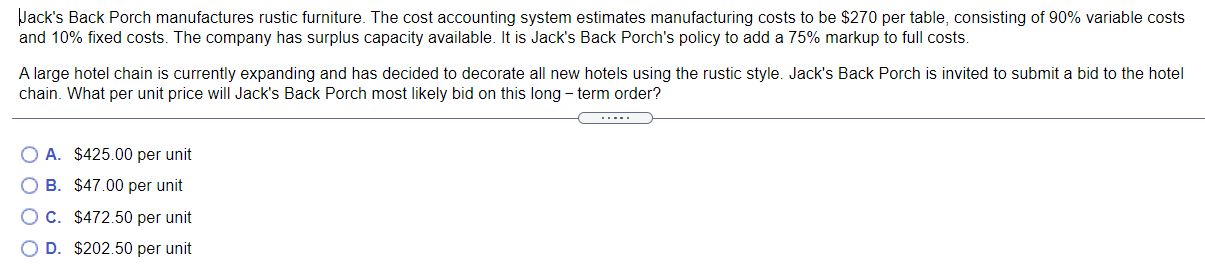

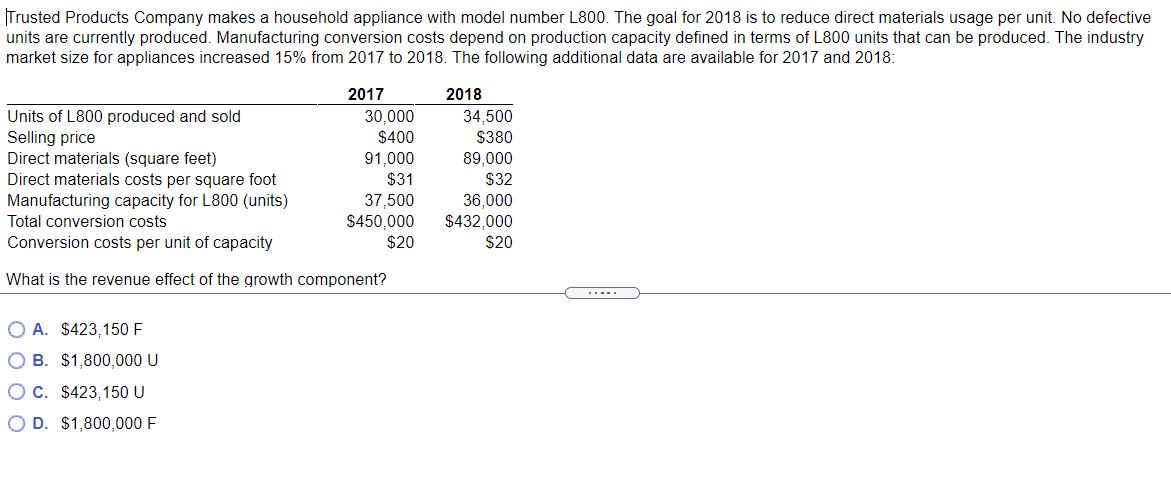

In 2017, Commodity Inc., processor of whole grain flour, had the capacity to produce 10,000,000 pounds of product at a conversion cost per pound of $0.90. The conversion cost per pound was $0.85 in 2016 (the previous year). The direct material cost per pound for both years was $0.09 per pound and in 2017, Commodity Inc. produced 9,200,000 pounds while actual production for the previous year was 8,400,000 pounds. What was the cost of unused capacity in 2017? OA. $1,360,000 B. $1,440,000 C. $720,000 OD. $680,000 Zolas' Heaters is approached by Ms. Leila, a new customer, to fulfill a large one-time - only special order for a product similar to one offered to regular customers. Zolas' Heaters has excess capacity. The following per unit data apply for sales to regular customers: Direct materials Direct manufacturing labor Variable manufacturing support Fixed manufacturing support Total manufacturing costs Markup (10% of total manufacturing costs) Estimated selling price $500 160 70 210 940 94 $1,034 If Ms. Leila wanted a long-term commitment, and not a one-time - special order, for supplying this product, calculate the most likely price to be quoted assuming the markup remains the same? A. $730 B. $940 c. $660 D. $1,034 Jack's Back Porch manufactures rustic furniture. The cost accounting system estimates manufacturing costs to be $270 per table, consisting of 90% variable costs and 10% fixed costs. The company has surplus capacity available. It is Jack's Back Porch's policy to add a 75% markup to full costs. A large hotel chain is currently expanding and has decided to decorate all new hotels using the rustic style. Jack's Back Porch is invited to submit a bid to the hotel chain. What per unit price will Jack's Back Porch most likely bid on this long-term order? OA. $425.00 per unit B. $47.00 per unit C. $472.50 per unit D. $202.50 per unit Trusted Products Company makes a household appliance with model number L800. The goal for 2018 is to reduce direct materials usage per unit. No defective units are currently produced. Manufacturing conversion costs depend on production capacity defined in terms of L800 units that can be produced. The industry market size for appliances increased 15% from 2017 to 2018. The following additional data are available for 2017 and 2018: Units of L800 produced and sold Selling price 2017 30,000 $400 2018 34,500 $380 Direct materials (square feet) 91,000 89,000 Direct materials costs per square foot $31 $32 Manufacturing capacity for L800 (units) 37,500 36,000 Total conversion costs $450,000 $432,000 Conversion costs per unit of capacity $20 $20 What is the revenue effect of the growth component? OA. $423,150 F B. $1,800,000 U C. $423,150 U OD. $1,800,000 F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started