Question

In 2017, HD had reported a deferred tax asset of $58 million with no valuation allowance. At December 31, 2018, the account balances of HD

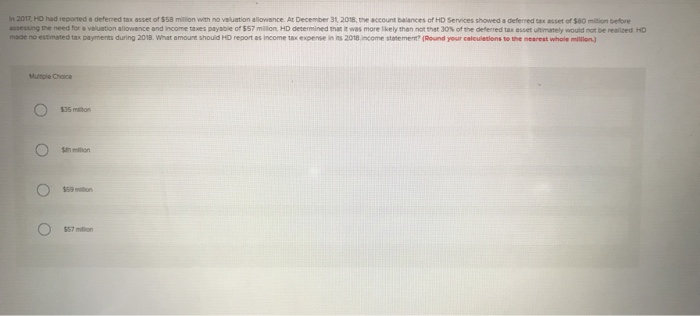

In 2017, HD had reported a deferred tax asset of $58 million with no valuation allowance. At December 31, 2018, the account balances of HD Services showed a deferred tax asset of $80 million before assessing the need for a valuation allowance and income taxes payable of $57 million. HD determined that it was more likely than not that 30% of the deferred tax asset ultimately would not be realized. HD made no estimated tax payments during 2018. What amount should HD report as income tax expense in its 2018 income statement? (Round your calculations to the nearest whole million.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started