Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2017, Herald and Megan purchased Series EE bonds, and in 2021 redeemed the bonds, receiving $660 of interest and $2,940 of principal. Their income

In 2017, Herald and Megan purchased Series EE bonds, and in 2021 redeemed the bonds, receiving $660 of interest and $2,940 of principal. Their income from other sources totaled $38,000. They paid $4,000 in tuition and fees for their dependent daughter. Their daughter is a qualified student at State University. (The EE bonds were used to pay the tuition and fees.)

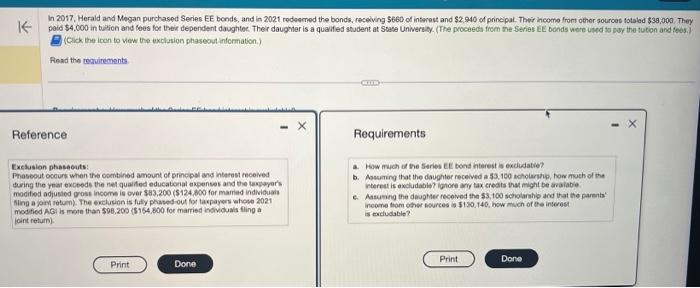

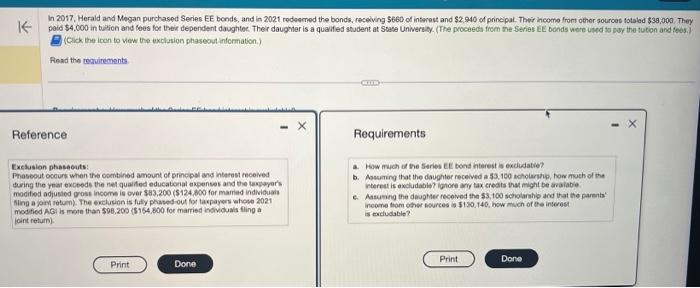

(Cick the ican to wew the exchation phaseout information.) Resd the tecaitements Reference Requirements Fixelusion phasesouts: a. How much of the Sieries EL tond nterest is excludatie? Phaseout occurs when the oombined ambunt of princpal and interest eeceived b. Assuming that the daughter received a 53.100 acholarshi, nor mash of the turing the yeat exceeds the ret quaifed educatonal expenses and the texpyer's modifed adjusied pose income is over \$83,2006 $124,600 for marrad indivicuais a. Asterest is awcludabie? Ighore ary tax creats that might be avaiable ming a jart setum). The enciusin is fuly phases-out for taxpayers uhose 2021 e. Aasuring the deuphtee recoived the $3,100 scholarahl ard that the parenta' modied AGi is mote than 598,200 \{5 164,600 for married incividuals fling a iscome thom artiontate? (oint return). (Cick the ican to wew the exchation phaseout information.) Resd the tecaitements Reference Requirements Fixelusion phasesouts: a. How much of the Sieries EL tond nterest is excludatie? Phaseout occurs when the oombined ambunt of princpal and interest eeceived b. Assuming that the daughter received a 53.100 acholarshi, nor mash of the turing the yeat exceeds the ret quaifed educatonal expenses and the texpyer's modifed adjusied pose income is over \$83,2006 $124,600 for marrad indivicuais a. Asterest is awcludabie? Ighore ary tax creats that might be avaiable ming a jart setum). The enciusin is fuly phases-out for taxpayers uhose 2021 e. Aasuring the deuphtee recoived the $3,100 scholarahl ard that the parenta' modied AGi is mote than 598,200 \{5 164,600 for married incividuals fling a iscome thom artiontate? (oint return)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started