Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2017, Herald and Megan purchased Series EE bonds, and in 2021 redeemed the bonds, receiving $660 of interest and $2.940 of principal. Their

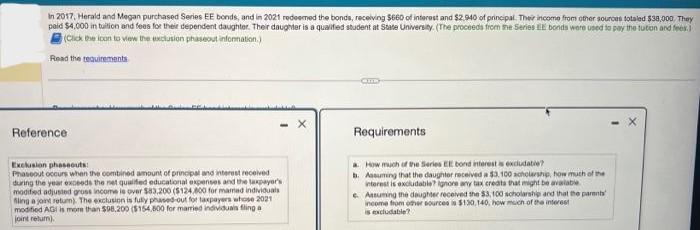

In 2017, Herald and Megan purchased Series EE bonds, and in 2021 redeemed the bonds, receiving $660 of interest and $2.940 of principal. Their income from other sources totaled $38,000. They paid $4,000 in tuition and fees for their dependent daughter. Their daughter is a qualified student at State University. (The proceeds from the Series EE bonds were used to pay the tution and fees. (Click the icon to view the exclusion phaseout information.) Read the requirements www Reference Exclusion phaseouts Phaseout occurs when the combined amount of principal and interest received t during the year exceeds the net qualified educational expenses and the taxpayer's modified adjusted gross income is over $83,200 ($124,000 for mamad individuals Sling a joint return). The exclusion is fully phased-out for taxpayers whose 2021 modified AGI is more than $98,200 ($154,800 for married individuals fling a joint return). Requirements a. How much of the Series EE bond interest is excludatie? b. Assuming that the daughter received a $3.100 scholarship, how much of the interest is excludable? ignore any tax credits that might be available e. Assuming the daughter received the $3,100 scholarship and that the parents income from other sources is $130,140, how much of the interest is excludable?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started