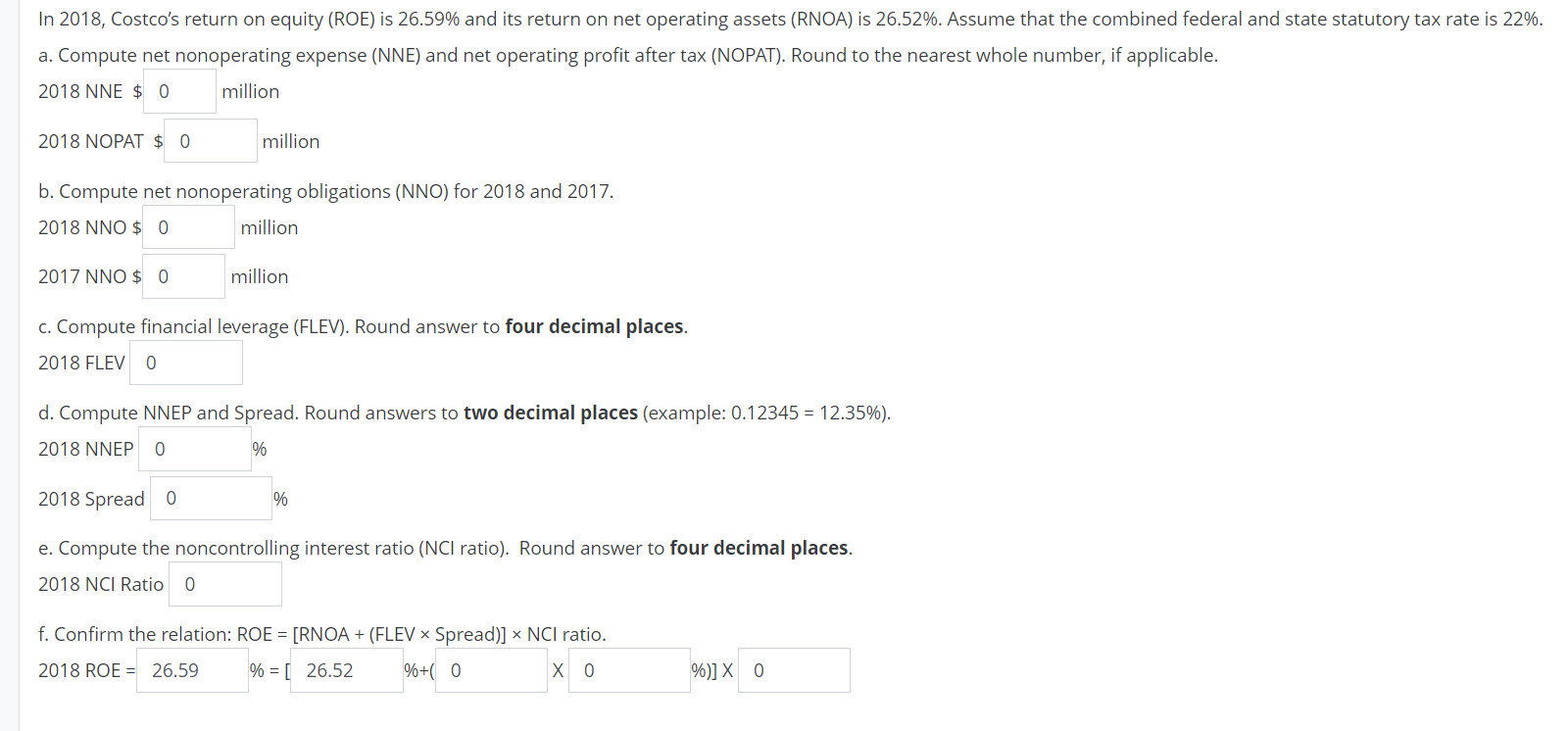

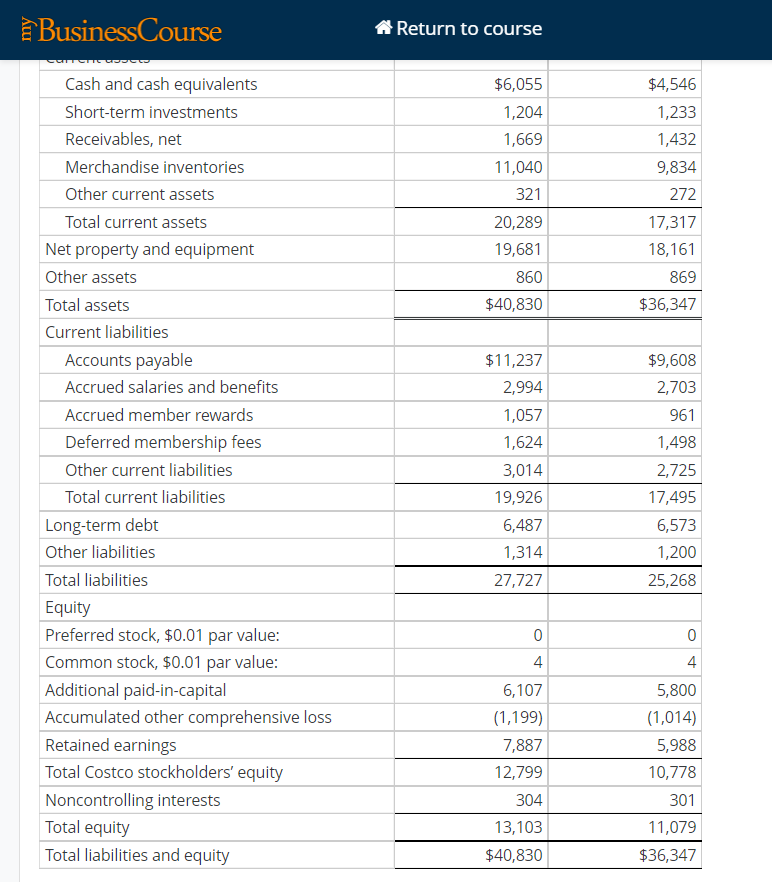

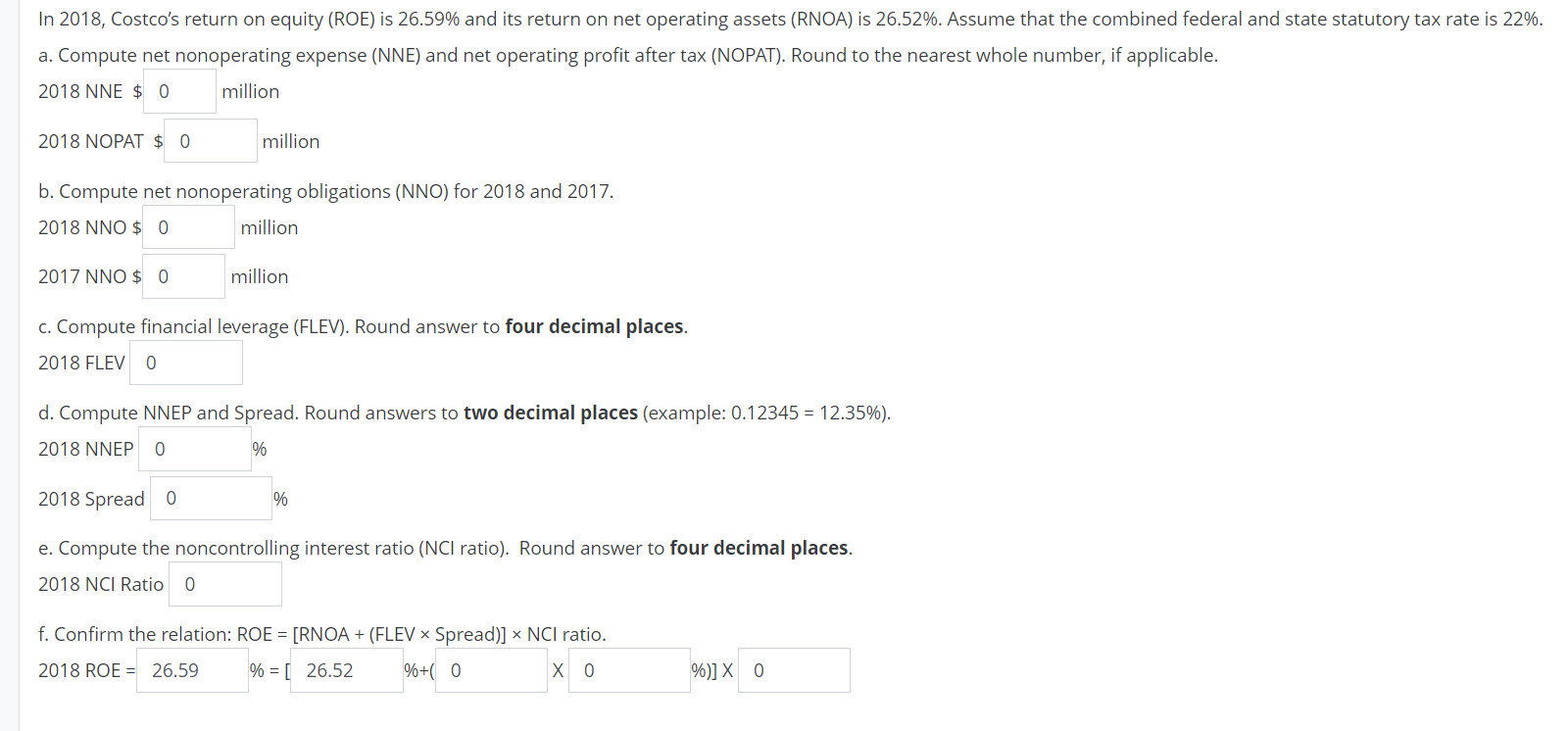

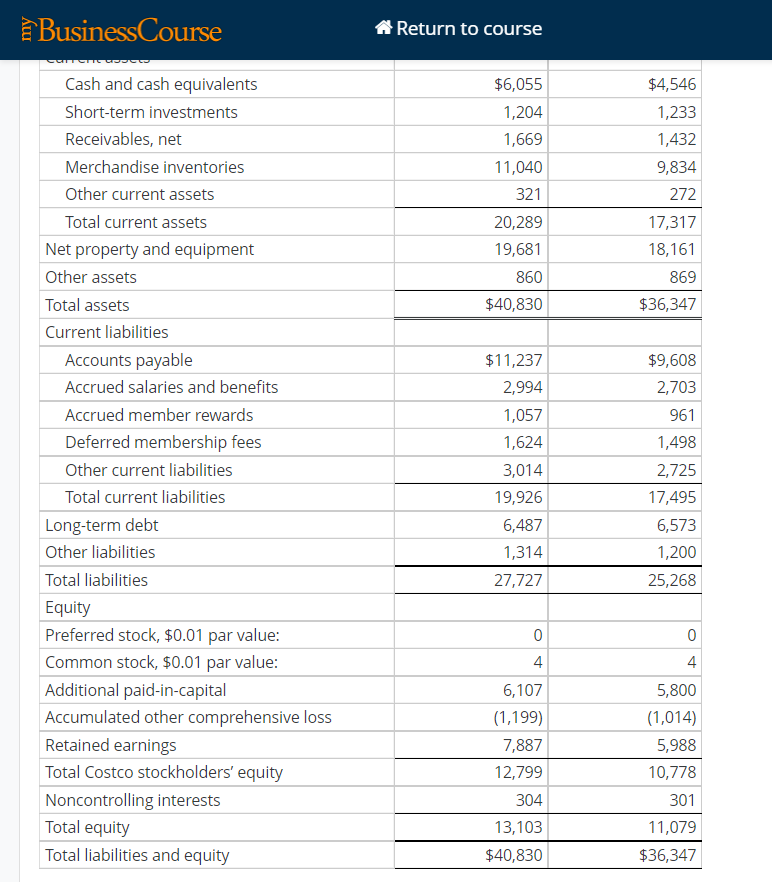

In 2018, Costco's return on equity (ROE) is 26.59% and its return on net operating assets (RNOA) is 26.52%. Assume that the combined federal and state statutory tax rate is 22%. a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Round to the nearest whole number, if applicable. 2018 NNE $ 0 million 2018 NOPAT $ 0 million b. Compute net nonoperating obligations (NNO) for 2018 and 2017. 2018 NNO $ 0 million 2017 NNO $ 0 million c. Compute financial leverage (FLEV). Round answer to four decimal places. 2018 FLEV 0 d. Compute NNEP and Spread. Round answers to two decimal places (example: 0.12345 = 12.35%). 2018 NNEP 0 % 2018 Spread 0 % e. Compute the noncontrolling interest ratio (NCI ratio). Round answer to four decimal places. 2018 NCI Ratio 0 f. Confirm the relation: ROE = [RNOA + (FLEV ~ Spread)] NCI ratio. 2018 ROE = 26.59 % = [ 26.52 %+ 0 %)] x 0 Business Course * Return to course HITTOOS Cash and cash equivalents $6,055 $4,546 Short-term investments 1,204 1,233 Receivables, net 1,669 1,432 Merchandise inventories 11,040 9,834 Other current assets 321 272 Total current assets 20,289 17,317 Net property and equipment 19,681 18,161 Other assets 860 869 Total assets $40,830 $36,347 Current liabilities $11,237 $9,608 Accounts payable Accrued salaries and benefits 2,994 2,703 Accrued member rewards 1,057 961 Deferred membership fees 1,624 1,498 Other current liabilities 3,014 2,725 Total current liabilities 19,926 17,495 Long-term debt 6,487 6,573 Other liabilities 1,314 1,200 Total liabilities 27,727 25,268 0 0 4 4 6,107 5,800 (1,199) (1,014) Equity Preferred stock, $0.01 par value: Common stock, $0.01 par value: Additional paid-in-capital Accumulated other comprehensive loss Retained earnings Total Costco stockholders' equity Noncontrolling interests Total equity Total liabilities and equity 7,887 5,988 12,799 10,778 304 301 13,103 11,079 $40,830 $36,347 In 2018, Costco's return on equity (ROE) is 26.59% and its return on net operating assets (RNOA) is 26.52%. Assume that the combined federal and state statutory tax rate is 22%. a. Compute net nonoperating expense (NNE) and net operating profit after tax (NOPAT). Round to the nearest whole number, if applicable. 2018 NNE $ 0 million 2018 NOPAT $ 0 million b. Compute net nonoperating obligations (NNO) for 2018 and 2017. 2018 NNO $ 0 million 2017 NNO $ 0 million c. Compute financial leverage (FLEV). Round answer to four decimal places. 2018 FLEV 0 d. Compute NNEP and Spread. Round answers to two decimal places (example: 0.12345 = 12.35%). 2018 NNEP 0 % 2018 Spread 0 % e. Compute the noncontrolling interest ratio (NCI ratio). Round answer to four decimal places. 2018 NCI Ratio 0 f. Confirm the relation: ROE = [RNOA + (FLEV ~ Spread)] NCI ratio. 2018 ROE = 26.59 % = [ 26.52 %+ 0 %)] x 0 Business Course * Return to course HITTOOS Cash and cash equivalents $6,055 $4,546 Short-term investments 1,204 1,233 Receivables, net 1,669 1,432 Merchandise inventories 11,040 9,834 Other current assets 321 272 Total current assets 20,289 17,317 Net property and equipment 19,681 18,161 Other assets 860 869 Total assets $40,830 $36,347 Current liabilities $11,237 $9,608 Accounts payable Accrued salaries and benefits 2,994 2,703 Accrued member rewards 1,057 961 Deferred membership fees 1,624 1,498 Other current liabilities 3,014 2,725 Total current liabilities 19,926 17,495 Long-term debt 6,487 6,573 Other liabilities 1,314 1,200 Total liabilities 27,727 25,268 0 0 4 4 6,107 5,800 (1,199) (1,014) Equity Preferred stock, $0.01 par value: Common stock, $0.01 par value: Additional paid-in-capital Accumulated other comprehensive loss Retained earnings Total Costco stockholders' equity Noncontrolling interests Total equity Total liabilities and equity 7,887 5,988 12,799 10,778 304 301 13,103 11,079 $40,830 $36,347