Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2018, Juan, an office clerk of ABC Corp., earned an annual compensation of P1,500,000, inclusive of thirteenth month pay and other benefits in

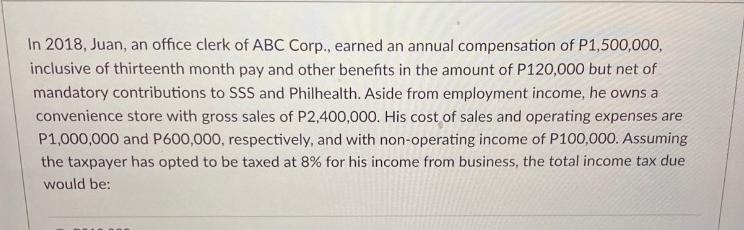

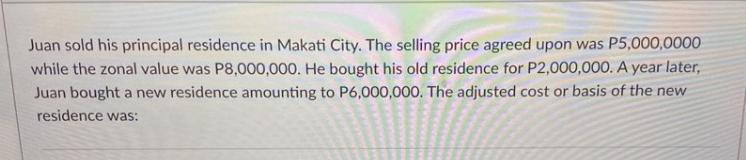

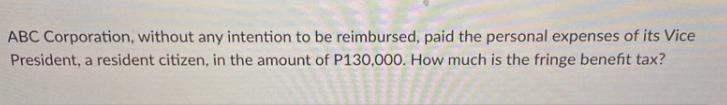

In 2018, Juan, an office clerk of ABC Corp., earned an annual compensation of P1,500,000, inclusive of thirteenth month pay and other benefits in the amount of P120,000 but net of mandatory contributions to SSS and Philhealth. Aside from employment income, he owns a convenience store with gross sales of P2,400,000. His cost of sales and operating expenses are P1,000,000 and P600,000, respectively, and with non-operating income of P100,000. Assuming the taxpayer has opted to be taxed at 8% for his income from business, the total income tax due would be: Juan sold his principal residence in Makati City. The selling price agreed upon was P5,000,0000 while the zonal value was P8,000,000. He bought his old residence for P2,000,000. A year later, Juan bought a new residence amounting to P6,000,000. The adjusted cost or basis of the new residence was: ABC Corporation, without any intention to be reimbursed, paid the personal expenses of its Vice President, a resident citizen, in the amount of P130,000. How much is the fringe benefit tax?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started