Question

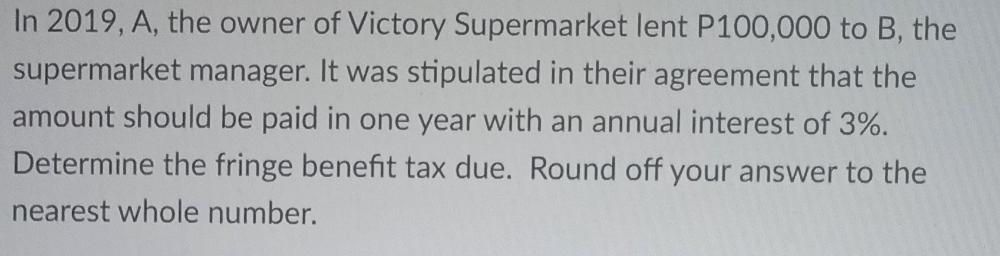

In 2019, A, the owner of Victory Supermarket lent P100,000 to B, the supermarket manager. It was stipulated in their agreement that the amount

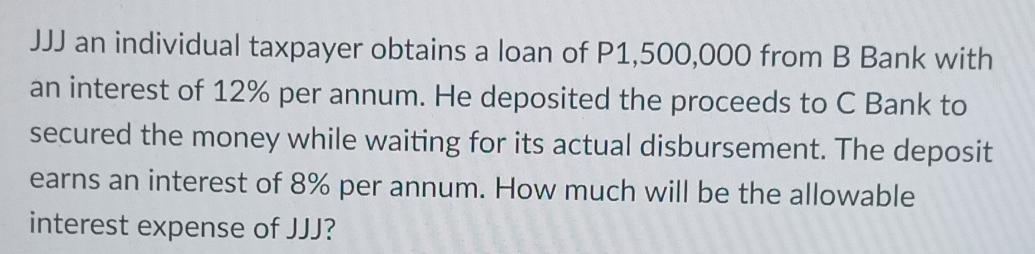

In 2019, A, the owner of Victory Supermarket lent P100,000 to B, the supermarket manager. It was stipulated in their agreement that the amount should be paid in one year with an annual interest of 3%. Determine the fringe benefit tax due. Round off your answer to the nearest whole number. JJJ an individual taxpayer obtains a loan of P1,500,000 from B Bank with an interest of 12% per annum. He deposited the proceeds to C Bank to secured the money while waiting for its actual disbursement. The deposit earns an interest of 8% per annum. How much will be the allowable interest expense of JJJ?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The formula to calculate simple interest is InterestPrincipalRateTimeIntere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

Authors: Paul Copley

14th Edition

1260570177, 978-1260570175

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App