Answered step by step

Verified Expert Solution

Question

1 Approved Answer

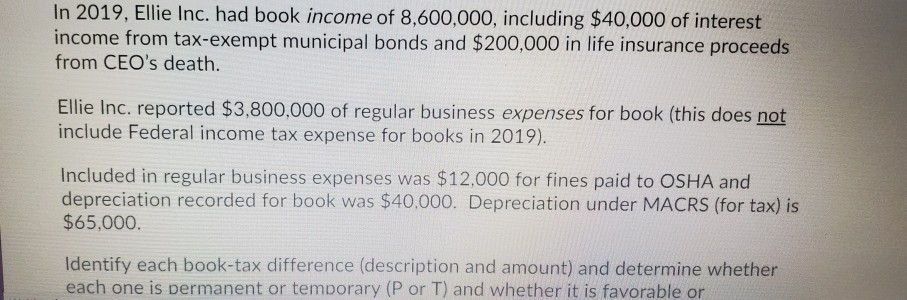

In 2019, Ellie Inc. had book income of 8,600,000, including $40,000 of interest income from tax-exempt municipal bonds and $200,000 in life insurance proceeds from

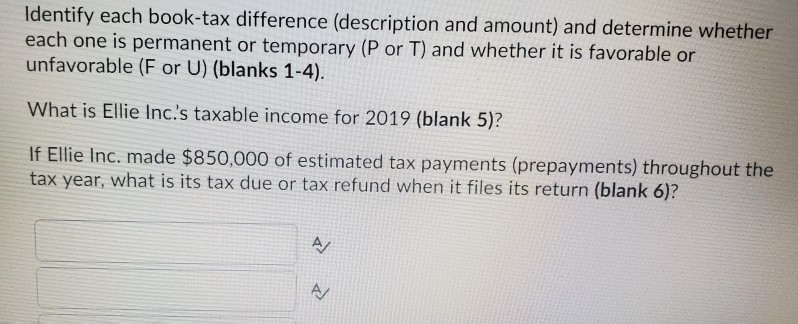

In 2019, Ellie Inc. had book income of 8,600,000, including $40,000 of interest income from tax-exempt municipal bonds and $200,000 in life insurance proceeds from CEO's death. Ellie Inc. reported $3,800,000 of regular business expenses for book (this does not include Federal income tax expense for books in 2019). Included in regular business expenses was $12,000 for fines paid to OSHA and depreciation recorded for book was $40,000. Depreciation under MACRS (for tax) is $65,000. Identify each book-tax difference (description and amount) and determine whether each one is permanent or temporary (P or T) and whether it is favorable or Identify each book-tax difference (description and amount) and determine whether each one is permanent or temporary (P or T) and whether it is favorable or unfavorable (F or U) (blanks 1-4). What is Ellie Inc.'s taxable income for 2019 (blank 5)? If Ellie Inc. made $850,000 of estimated tax payments (prepayments) throughout the tax year, what is its tax due or tax refund when it files its return (blank 6)? A AL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started