Question

In 2019, Gary Kwok, who is single, earned the following income and incurred the following losses: Employment income $ 15,000 Business loss ($ 5,500) Taxable

In 2019, Gary Kwok, who is single, earned the following income and incurred the following losses:

| Employment income | $ 15,000 |

| Business loss | ($ 5,500) |

| Taxable capital gains | $ 4,000 |

| Property income (interest) | $ 16,500 |

| Allowable capital loss from the sale of shares of public corporations | ($ 8,000) |

| Allowable capital loss from the sale of shares of a CCPC that qualifies as a small business corporation | ($ 5,000) |

At the end of 2018, Kwok had:

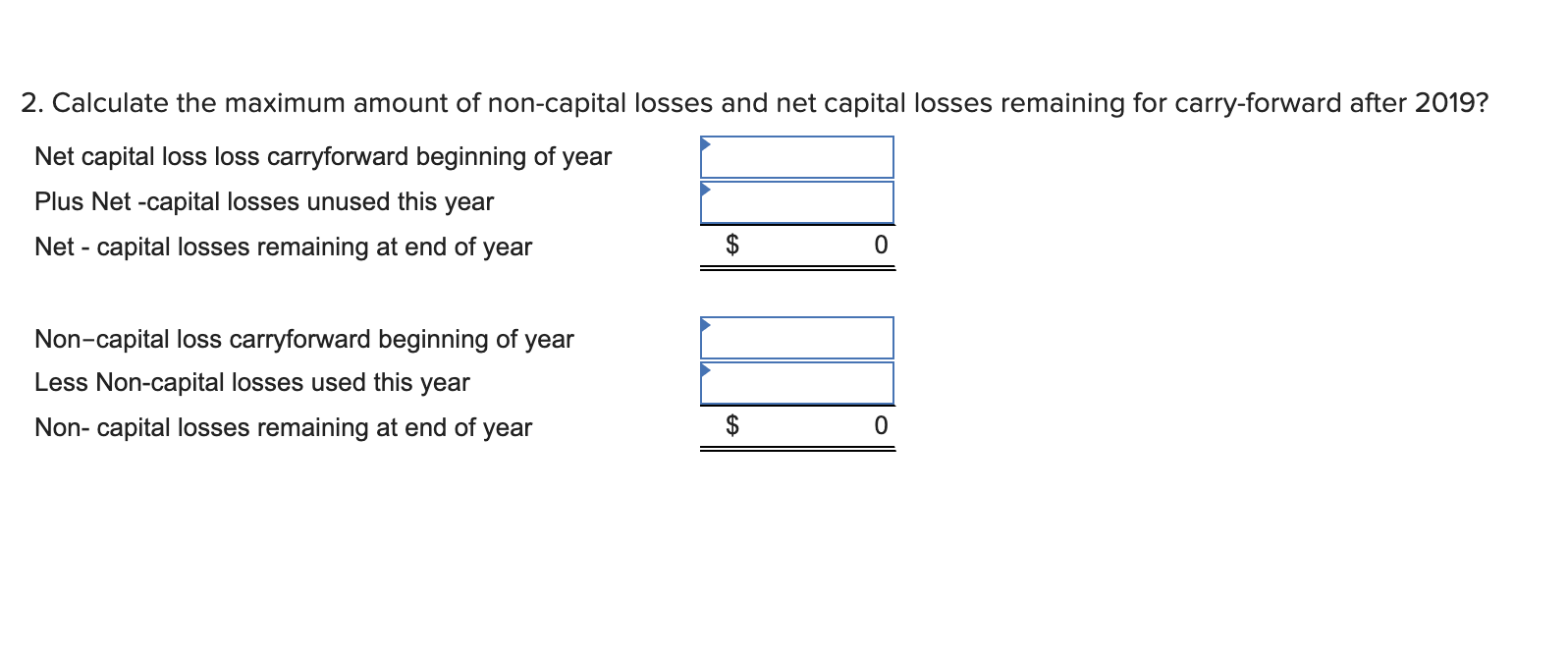

- unused net capital losses of $ 19,000 and

- unused non-capital losses of $40,000.

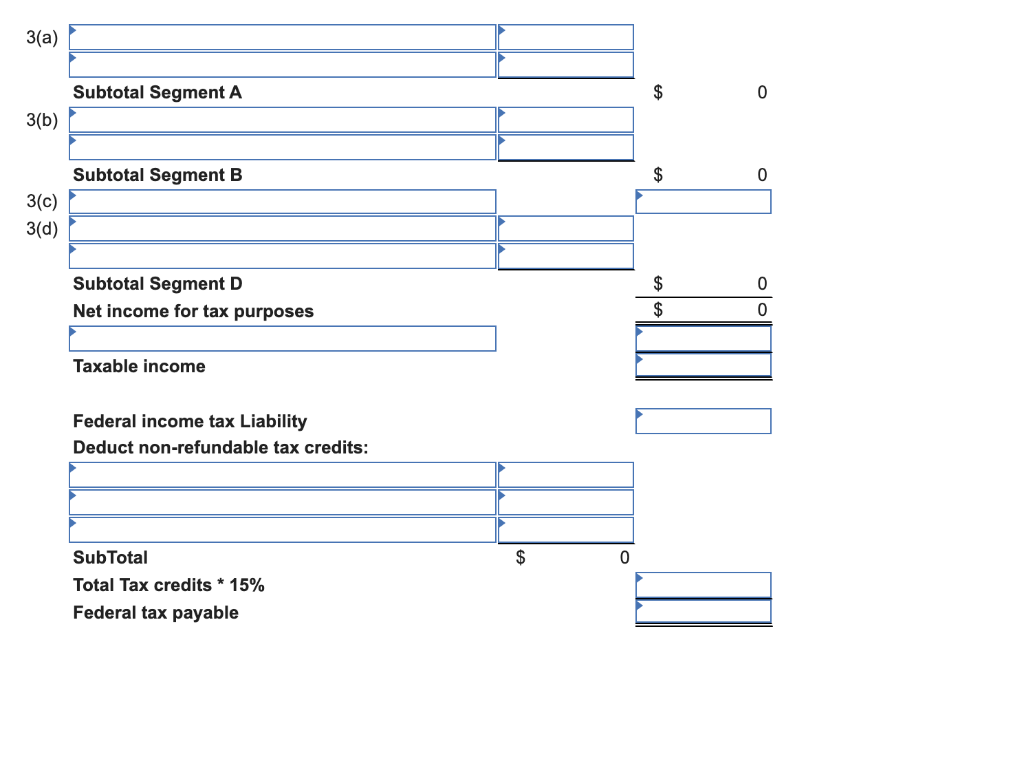

Kwok does not want to pay any federal tax in 2019. For 2019, Kwok is entitled to

- the basic personal tax credit $12,069,

- the Canada employment credit $1,222 and

- the CPP & EI credit amount of $1,228.

Required:

1. Calculate Kwoks Net income for tax purposes which would result in no tax liability after deducting tax credits.

In 2019, Gary Kwok, who is single, earned the following income and incurred the following losses:

| Employment income | $ 15,000 |

| Business loss | ($ 5,500) |

| Taxable capital gains | $ 4,000 |

| Property income (interest) | $ 16,500 |

| Allowable capital loss from the sale of shares of public corporations | ($ 8,000) |

| Allowable capital loss from the sale of shares of a CCPC that qualifies as a small business corporation | ($ 5,000) |

At the end of 2018, Kwok had:

- unused net capital losses of $ 19,000 and

- unused non-capital losses of $40,000.

Kwok does not want to pay any federal tax in 2019. For 2019, Kwok is entitled to

- the basic personal tax credit $12,069,

- the Canada employment credit $1,222 and

- the CPP & EI credit amount of $1,228.

Required:

1. Calculate Kwoks Net income for tax purposes which would result in no tax liability after deducting tax credits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started