Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2019, Wabash Corporation purchases two assets and places them into service (both have 7-year MACRS recovery period): i (Click the icon to view

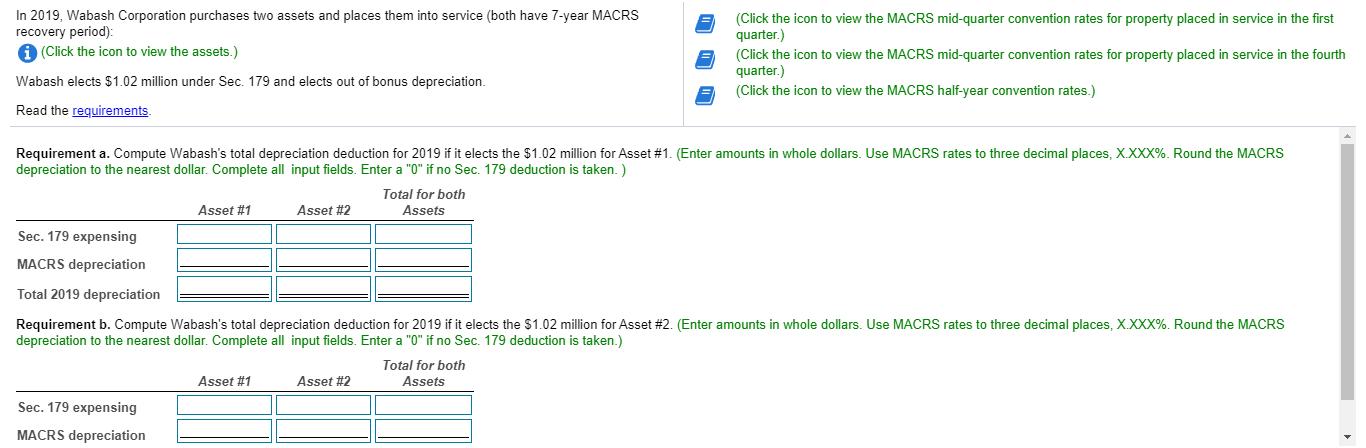

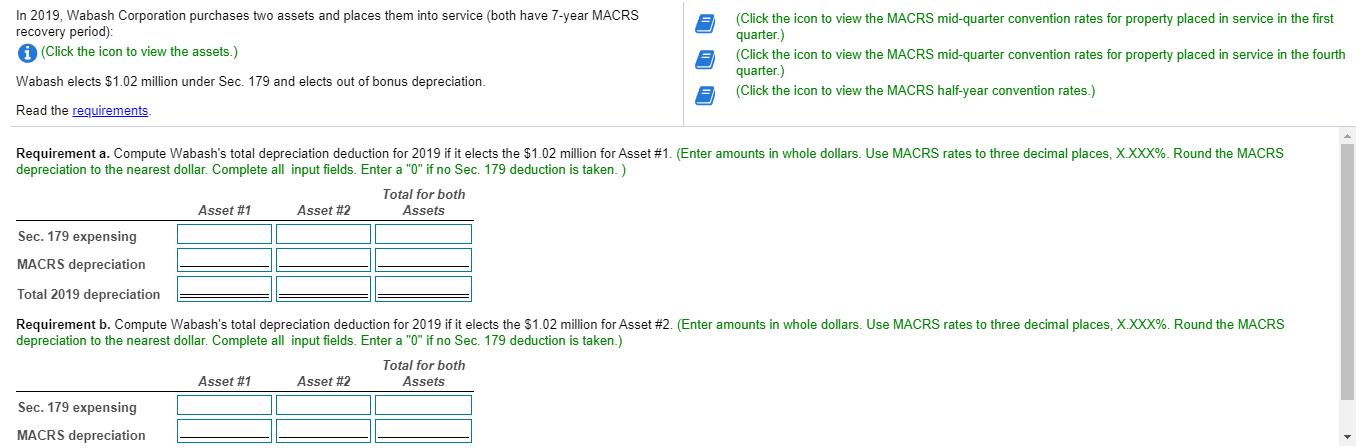

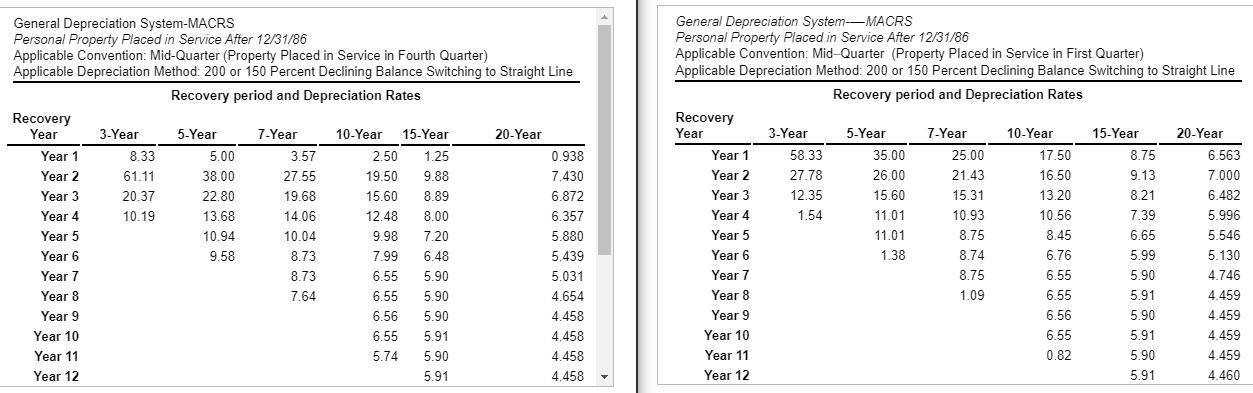

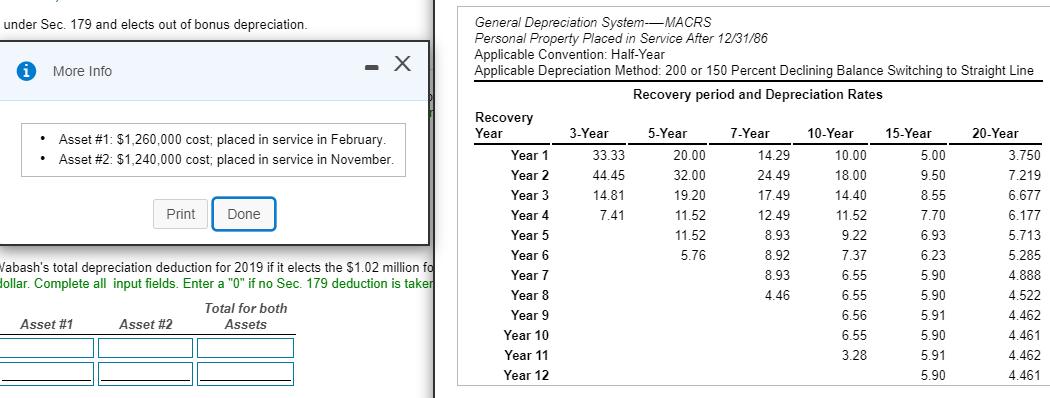

In 2019, Wabash Corporation purchases two assets and places them into service (both have 7-year MACRS recovery period): i (Click the icon to view the assets.) Wabash elects $1.02 million under Sec. 179 and elects out of bonus depreciation. Read the requirements. Requirement a. Compute Wabash's total depreciation deduction for 2019 if it elects the $1.02 million for Asset #1. (Enter amounts in whole dollars. Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taken.) Asset #1 Sec. 179 expensing MACRS depreciation Asset #2 Asset #1 Total for both Assets Sec. 179 expensing MACRS depreciation Total 2019 depreciation Requirement b. Compute Wabash's total depreciation deduction for 2019 if it elects the $1.02 million for Asset #2. (Enter amounts in whole dollars. Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taken.) Asset #2 (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the first quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) (Click the icon to view the MACRS half-year convention rates.) Total for both Assets In 2019, Wabash Corporation purchases two assets and places them into service (both have 7-year MACRS recovery period): i (Click the icon to view the assets.) Wabash elects $1.02 million under Sec. 179 and elects out of bonus depreciation. Read the requirements. Requirement a. Compute Wabash's total depreciation deduction for 2019 if it elects the $1.02 million for Asset #1. (Enter amounts in whole dollars. Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taken.) Asset #1 Sec. 179 expensing MACRS depreciation Asset #2 Asset #1 Total for both Assets Sec. 179 expensing MACRS depreciation Total 2019 depreciation Requirement b. Compute Wabash's total depreciation deduction for 2019 if it elects the $1.02 million for Asset #2. (Enter amounts in whole dollars. Use MACRS rates to three decimal places, X.XXX%. Round the MACRS depreciation to the nearest dollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taken.) Asset #2 (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the first quarter.) (Click the icon to view the MACRS mid-quarter convention rates for property placed in service in the fourth quarter.) (Click the icon to view the MACRS half-year convention rates.) Total for both Assets General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 3-Year 8.33 61.11 20.37 10.19 5-Year 5.00 38.00 22.80 13.68 10.94 9.58 7-Year 3.57 27.55 19.68 14.06 10.04 8.73 8.73 7.64 15-Year 2.50 1.25 19.50 9.88 15.60 8.89 12.48 8.00 9.98 7.20 7.99 6.48 6.55 5.90 6.55 5.90 6.56 5.90 6.55 5.91 5.74 5.90 5.91 10-Year 20-Year 0.938 7.430 6.872 6.357 5.880 5.439 5.031 4.654 4.458 4.458 4.458 4.458 General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in First Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 3-Year 58.33 27.78 12.35 1.54 5-Year 35.00 26.00 15.60 11.01 11.01 1.38 7-Year 25.00 21.43 15.31 10.93 8.75 8.74 8.75 1.09 10-Year 17.50 16.50 13.20 10.56 8.45 6.76 6.55 6.55 6.56 6.55 0.82 15-Year 8.75 9.13 8.21 7.39 6.65 5.99 5.90 5.91 5.90 5.91 5.90 5.91 20-Year 6.563 7.000 6.482 5.996 5.546 5.130 4.746 4.459 4.459 4.459 4.459 4.460 under Sec. 179 and elects out of bonus depreciation. i More Info . Asset #1: $1,260,000 cost; placed in service in February. Asset # 2: $1,240,000 cost; placed in service in November. Print Asset #1 Done Asset #2 - Vabash's total depreciation deduction for 2019 if it elects the $1.02 million fo dollar. Complete all input fields. Enter a "0" if no Sec. 179 deduction is taker X Total for both Assets General Depreciation System--MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 3-Year 33.33 44.45 14.81 7.41 5-Year 20.00 32.00 19.20 11.52 11.52 5.76 7-Year 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 10-Year 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 15-Year 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 20-Year 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer a b Property Asset 1 Asset 2 Cost recovery Asset Asset 1 Asset 2 Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started