Answered step by step

Verified Expert Solution

Question

1 Approved Answer

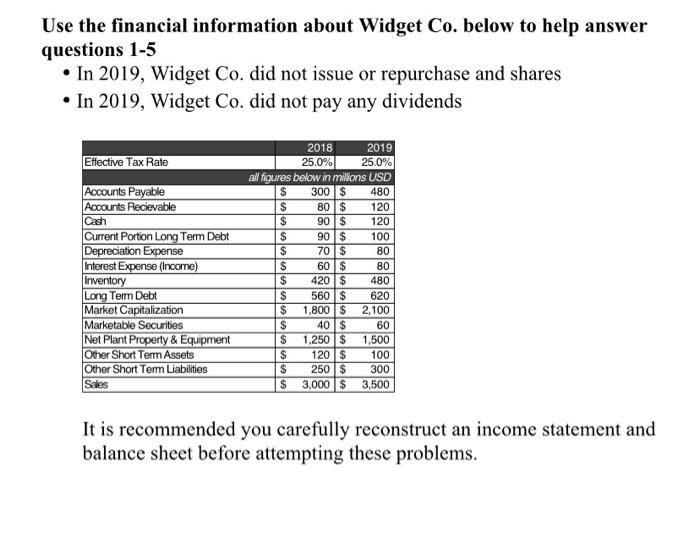

Use the financial information about Widget Co. below to help answer questions 1-5 In 2019, Widget Co. did not issue or repurchase and shares

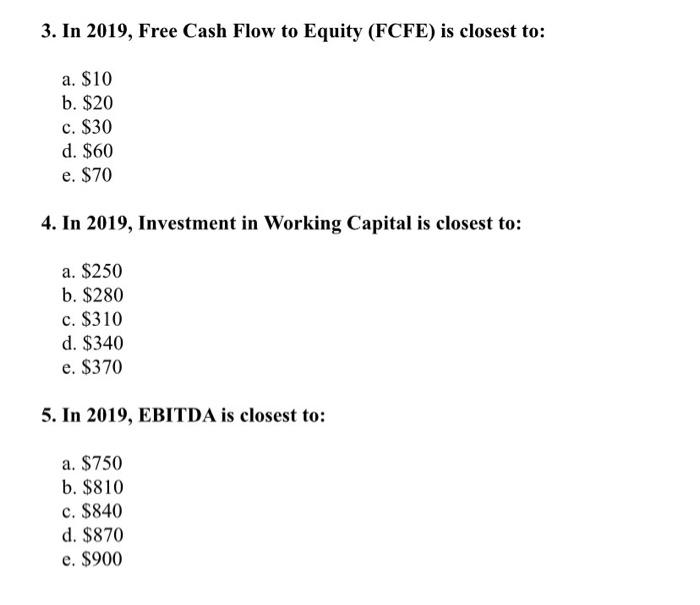

Use the financial information about Widget Co. below to help answer questions 1-5 In 2019, Widget Co. did not issue or repurchase and shares In 2019, Widget Co. did not pay any dividends Effective Tax Rate Accounts Payable Accounts Recievable Cash Current Portion Long Term Debt Depreciation Expense Interest Expense (Income) Inventory Long Term Debt Market Capitalization Marketable Securities Net Plant Property & Equipment Other Short Term Assets Other Short Term Liabilities Sales $ $ $ $ $ $ all figures below in millions USD 480 120 120 100 80 80 480 620 2,100 olu $ 2018 25.0% $ $ $ $ 300 $ 80 $ 90 $ 90 $ 70 $ 60 $ 420 $ 560 $ 1,800 $ 40 $ 1,250 $ 120 $ 250 $ 2019 25.0% $ $ $ 3,000 $ 60 1,500 100 300 3,500 It is recommended you carefully reconstruct an income statement and balance sheet before attempting these problems. 3. In 2019, Free Cash Flow to Equity (FCFE) is closest to: a. $10 b. $20 c. $30 d. $60 e. $70 4. In 2019, Investment in Working Capital is closest to: a. $250 b. $280 c. $310 d. $340 e. $370 5. In 2019, EBITDA is closest to: a. $750 b. $810 c. $840 d. $870 e. $900

Step by Step Solution

★★★★★

3.41 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 3 In 2019 Free Cash Flow to Equity FCFE is closest to d 60 The free cash flow to equity F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started