Question

In 2019, X Company hired a new general manager to manage its expanding operations. He required the accounting group to provide him with the financial

In 2019, X Company hired a new general manager to manage its expanding operations. He required the accounting group to provide him with the financial statements so that he can immediately assess the operations and come up with the plans.

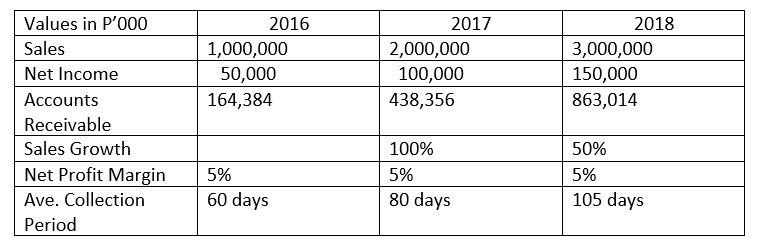

From the financial statements, the general manager found out that the firm's sales are improving and that the company had been making minimal net income. He also discovered that the accounts receivable in the balance sheet appeared to be growing. The summary of his findings are shown below:

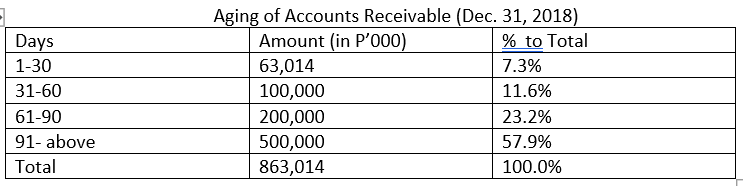

He summoned the accounting head to give light to the increasing accounts receivable, and the accountant gave him an aging of receivables. He was also informed that the rising accounts receivable appears to be alarming as the credit terms of the company is only 30 days.

A year later, the company's sales increased for the third straight year from P3B to P4B. Net Profit Margin also increased from 5% last year to 6% this year. The new manager, however, forgot to address the problem of the accounts receivable which he earlier stated that he will do something "soon". Of the P863 million accounts receivable at the end of 2018, only P163 million remained active. The other P700 million collectibles were eventually written off (considered bad debts) as the customers either declared bankruptcy, the customers could not be found anymore.

At the end of 2019, the manager was fired.

1. If you were in the shoes of the new manager, how will you interpret the financial information provided by accounting?

2. Why was the manager fired?

3. Is it possible for a company to be profitable and yet not liquid? How and why does this happen?

4. Why is it important to also focus on average collection period?

5. What is the importance of doing financial statement analysis like subjecting accounts to financial ratios?

6. If you were the manager of the company, how will you address the problem of low profit and increasing average collection period? What will be your strategy?

Values in P'000 Sales Net Income Accounts Receivable Sales Growth Net Profit Margin Ave. Collection Period 2016 1,000,000 50,000 164,384 5% 60 days 2017 2,000,000 100,000 438,356 100% 5% 80 days 2018 3,000,000 150,000 863,014 50% 5% 105 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Interpreting the Financial Information From the financial information provided its clear that the companys sales have been growing steadily over the past few years indicating positive business ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started