Question

In 2020, ABC Online Mart Ltd. had sales of Tk. 280,000. Selling and Administration expenses represented 8% of sales. Preferred stock dividend paid Tk.

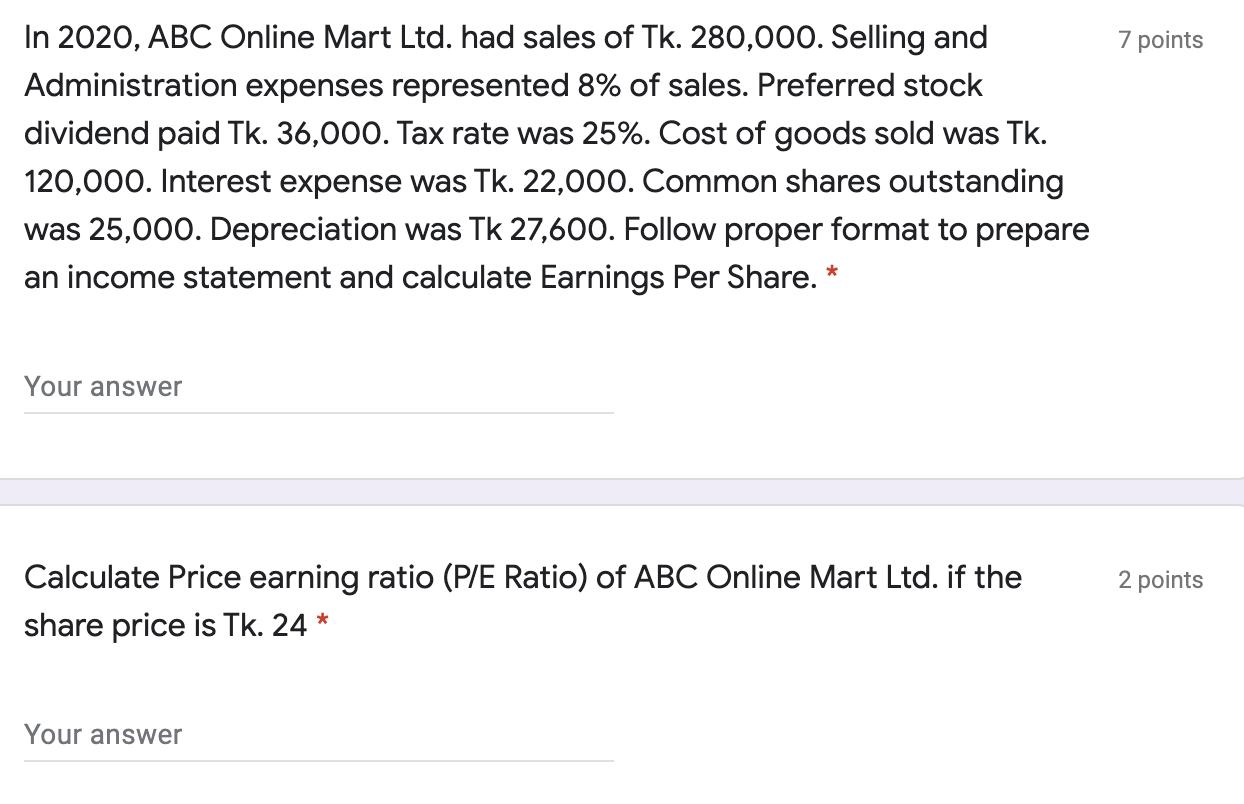

In 2020, ABC Online Mart Ltd. had sales of Tk. 280,000. Selling and Administration expenses represented 8% of sales. Preferred stock dividend paid Tk. 36,000. Tax rate was 25%. Cost of goods sold was Tk. 120,000. Interest expense was Tk. 22,000. Common shares outstanding was 25,000. Depreciation was Tk 27,600. Follow proper format to prepare an income statement and calculate Earnings Per Share. * Your answer Calculate Price earning ratio (P/E Ratio) of ABC Online Mart Ltd. if the share price is Tk. 24 * Your answer 7 points 2 points

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Sales Tk 280000 COGS Tk 120000 Gross profit Sales COGS Tk 160000 Selling and admin exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting an introduction to concepts, methods and uses

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis

13th Edition

978-0538776080, 324651147, 538776080, 9780324651140, 978-0324789003

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App