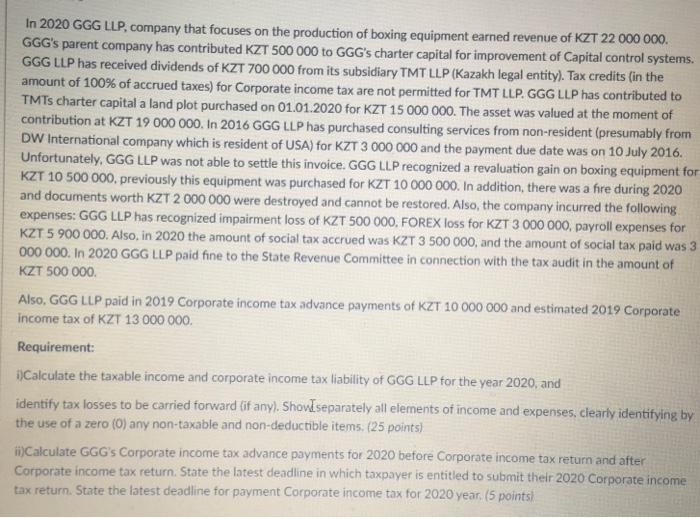

In 2020 GGG LLP, company that focuses on the production of boxing equipment earned revenue of KZT 22 000 000 GGG's parent company has contributed KZT 500 000 to GGG's charter capital for improvement of Capital control systems. GGG LLP has received dividends of KZT 700 000 from its subsidiary TMT LLP (Kazakh legal entity). Tax credits (in the amount of 100% of accrued taxes) for Corporate income tax are not permitted for TMT LLP. GGG LLP has contributed to TMTs charter capital a land plot purchased on 01.01.2020 for KZT 15 000 000. The asset was valued at the moment of contribution at KZT 19 000 000. In 2016 GGG LLP has purchased consulting services from non-resident (presumably from DW International company which is resident of USA) for KZT 3 000 000 and the payment due date was on 10 July 2016. Unfortunately, GGG LLP was not able to settle this invoice. GGG LLP recognized a revaluation gain on boxing equipment for KZT 10 500 000, previously this equipment was purchased for KZT 10 000 000. In addition, there was a fre during 2020 and documents worth KZT 2 000 000 were destroyed and cannot be restored. Also, the company incurred the following expenses: GGG LLP has recognized impairment loss of KZT 500 000, FOREX loss for KZT 3 000 000, payroll expenses for KZT 5 900 000. Also, in 2020 the amount of social tax accrued was KZT 3 500 000, and the amount of social tax paid was 3 000 000. In 2020 GGG LLP paid fine to the State Revenue Committee in connection with the tax audit in the amount of KZT 500 000 Also, GGG LLP paid in 2019 Corporate income tax advance payments of KZT 10 000 000 and estimated 2019 Corporate income tax of KZT 13 000 000 Requirement: 1)Calculate the taxable income and corporate income tax liability of GGG LLP for the year 2020, and identify tax losses to be carried forward (if any), Show.separately all elements of income and expenses. clearly identifying by the use of a zero (O) any non-taxable and non-deductible items. (25 points) ti)Calculate GGG's Corporate income tax advance payments for 2020 before Corporate income tax return and after Corporate income tax return. State the latest deadline in which taxpayer is entitled to submit their 2020 Corporate income tax return. State the latest deadline for payment Corporate income tax for 2020 year, (5 points) In 2020 GGG LLP, company that focuses on the production of boxing equipment earned revenue of KZT 22 000 000 GGG's parent company has contributed KZT 500 000 to GGG's charter capital for improvement of Capital control systems. GGG LLP has received dividends of KZT 700 000 from its subsidiary TMT LLP (Kazakh legal entity). Tax credits (in the amount of 100% of accrued taxes) for Corporate income tax are not permitted for TMT LLP. GGG LLP has contributed to TMTs charter capital a land plot purchased on 01.01.2020 for KZT 15 000 000. The asset was valued at the moment of contribution at KZT 19 000 000. In 2016 GGG LLP has purchased consulting services from non-resident (presumably from DW International company which is resident of USA) for KZT 3 000 000 and the payment due date was on 10 July 2016. Unfortunately, GGG LLP was not able to settle this invoice. GGG LLP recognized a revaluation gain on boxing equipment for KZT 10 500 000, previously this equipment was purchased for KZT 10 000 000. In addition, there was a fre during 2020 and documents worth KZT 2 000 000 were destroyed and cannot be restored. Also, the company incurred the following expenses: GGG LLP has recognized impairment loss of KZT 500 000, FOREX loss for KZT 3 000 000, payroll expenses for KZT 5 900 000. Also, in 2020 the amount of social tax accrued was KZT 3 500 000, and the amount of social tax paid was 3 000 000. In 2020 GGG LLP paid fine to the State Revenue Committee in connection with the tax audit in the amount of KZT 500 000 Also, GGG LLP paid in 2019 Corporate income tax advance payments of KZT 10 000 000 and estimated 2019 Corporate income tax of KZT 13 000 000 Requirement: 1)Calculate the taxable income and corporate income tax liability of GGG LLP for the year 2020, and identify tax losses to be carried forward (if any), Show.separately all elements of income and expenses. clearly identifying by the use of a zero (O) any non-taxable and non-deductible items. (25 points) ti)Calculate GGG's Corporate income tax advance payments for 2020 before Corporate income tax return and after Corporate income tax return. State the latest deadline in which taxpayer is entitled to submit their 2020 Corporate income tax return. State the latest deadline for payment Corporate income tax for 2020 year, (5 points)