Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020, Irene's employer, ABC Ltd., granted her stock options that allowed her to acquire 10,000 shares of the company's common stock at a

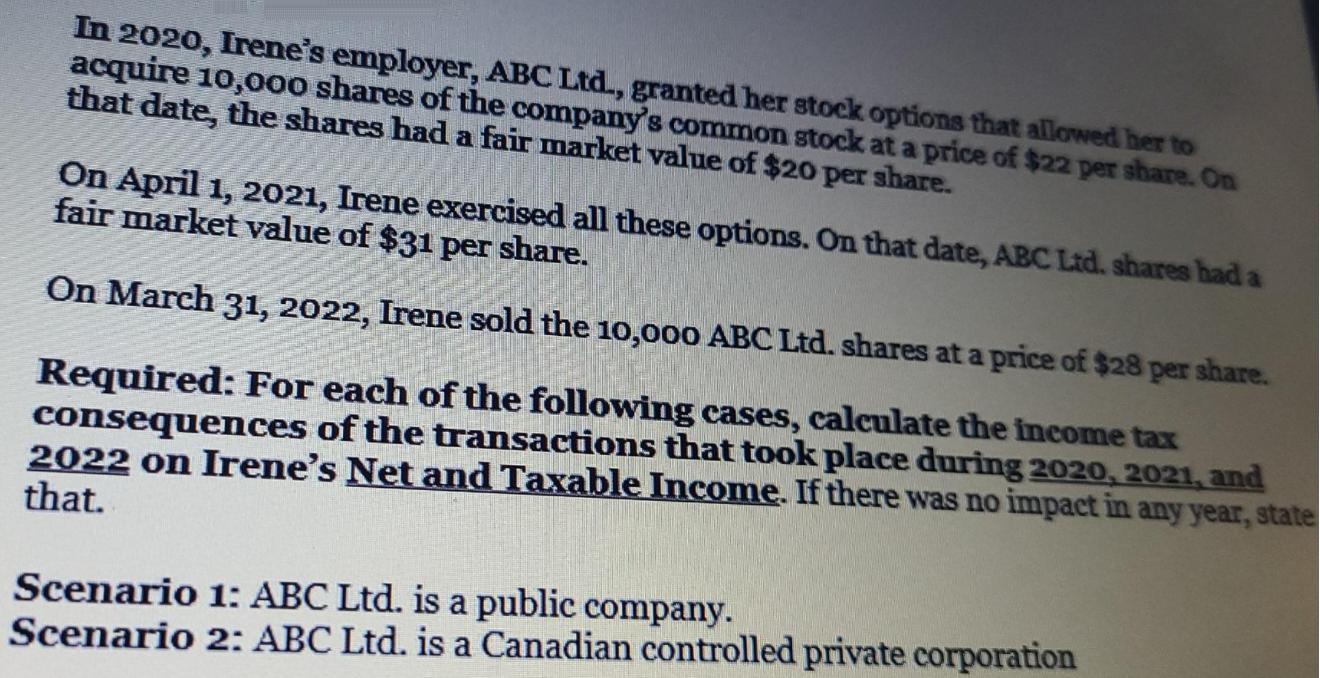

In 2020, Irene's employer, ABC Ltd., granted her stock options that allowed her to acquire 10,000 shares of the company's common stock at a price of $22 per share. On that date, the shares had a fair market value of $20 per share. On April 1, 2021, Irene exercised all these options. On that date, ABC Ltd. shares had a fair market value of $31 per share. On March 31, 2022, Irene sold the 10,000 ABC Ltd. shares at a price of $28 per share. Required: For each of the following cases, calculate the income tax consequences of the transactions that took place during 2020, 2021, and 2022 on Irene's Net and Taxable Income. If there was no impact in any year, state that. Scenario 1: ABC Ltd. is a public company. Scenario 2: ABC Ltd. is a Canadian controlled private corporation

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Scenario 1 ABC Ltd is a public company There is no income tax consequences in 2020 s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started