Question

In 2020, Mason, age 35 and single, earned wages of $75,000. Mason had no exclusions, and he had adjustments of $1,000. Mason?s itemized deductions for

In 2020, Mason, age 35 and single, earned wages of $75,000. Mason had no exclusions, and he had adjustments of $1,000. Mason?s itemized deductions for the year totaled $11,000. Mason has no QBI (and thus no QBI deduction). Mason's employer withheld federal income taxes of $5,000 from Mason's paychecks, and Mason is also entitled to an additional $2,500 tax credit.

What is Mason?s AGI?

What is Mason?s taxable income?

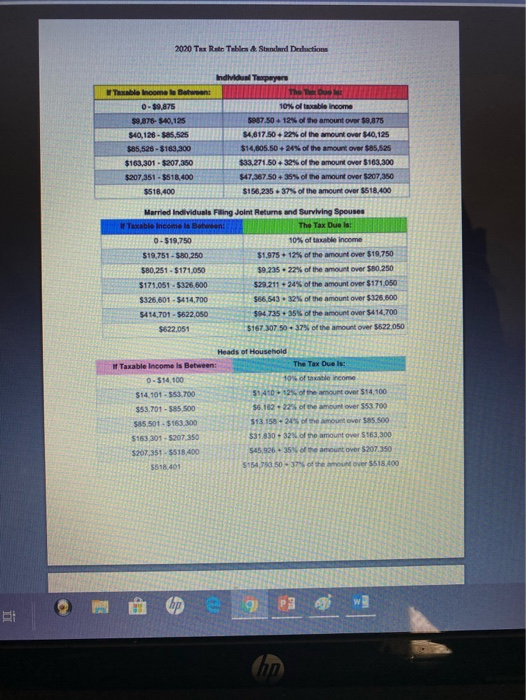

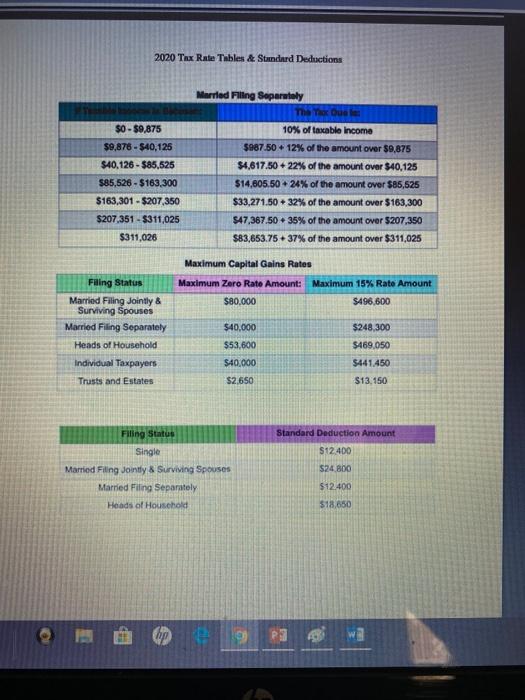

Using the 2020 single tax rates schedules (available in Module 4 folder), what is Mason?s federal income tax liability (before withholding and credits) for 2020?

What is Mason?s federal income tax liability after withholding and tax credits (i.e. the amount due or amount Mason needs to pay)?

i Et 2020 Tax Rate Tables & Standard Deductions Taxable income le Between: 0-$9,875 $9.876-$40,125 $40,126-$85,525 $85,526-$163,300 $163,301-$207,350 $207,351-$518,400 $518,400 Individual Taxpayers Married Individuals Filling Joint Returns and Surviving Spouses The Tax Due is: If Taxable income is Betesen: 0-$19,750 $19,751-$80,250 $80,251-$171,050 $171.051-5326,600 $326,601-$414,700 $414,701-$622,050 $622,051 The T 10% of taxable income 5987.50+12% of the amount over $9,875 $4,617.50+22% of the amount over $40,125 $14,605.50 +24% of the amount over $85,525 $33,271.50+32% of the amount over $163,300 $47,367.50 +35% of the amount over $207,350 $156,235 +37% of the amount over $518,400 If Taxable Income is Between: 0-$14,100 $14.101-$53.700 $53.701-$85,500 $85.501-$163.300 $163,301-5207.350 $207,351-5518.400 $518.401 10% of taxable income $1.975+ 12% of the amount over $19,750 $9.235 22% of the amount over $80,250 $29.211+24% of the amount over $171,050 $66,543 32% of the amount over $325,600 $94.735 35% of the amount over $414,700 $167.307 50 37% of the amount over $622,050 Heads of Household The Tax Due Is: 10% of taxable income $1,410-12% of the amount over $14,100 $6.162 22% of the amount over $53.700 $13.158-24% of the amount over $85.500 $31.830+32% of the amount over $163,300 $45,926 35% of the amount over $207.350 $154,790.50-37% of the amount over $518.400 2020 Tax Rate Tables & Standard Deductions $0-$9,875 $9,876-$40,125 $40,126-$85,525 $85,526-$163,300 $163,301-$207,350 $207,351-$311,025 $311,026 Filing Status Married Filing Jointly & Surviving Spouses Married Filing Separately Heads of Household Individual Taxpayers Trusts and Estates Married Filling Separately The Tax Que le: 10% of taxable income $987.50 +12% of the amount over $9,875 $4,617.50 +22% of the amount over $40,125 $14,605.50 +24% of the amount over $85,525 $33,271.50 +32% of the amount over $163,300 Filing Status Single Married Filling Jointly & Surviving Spouses Married Filling Separately Heads of Household $47,367.50+ 35% of the amount over $207,350 $83,653.75 +37% of the amount over $311,025 Maximum Capital Gains Rates Maximum Zero Rate Amount: Maximum 15% Rate Amount $80,000 $496,600 $40,000 $53,600 $40,000 $2,650 $248,300 $469,050 $441,450 $13,150 Standard Deduction Amount $12.400 $24.800 $12.400 $18,650 P3

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Earned Wages 75000 Less deduction for AGI 41000 AGI 75000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started