Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020, Prime Build Inc. had $ 16 million in operating income (EBIT). The company had a net depreciation expense of $ 4 million

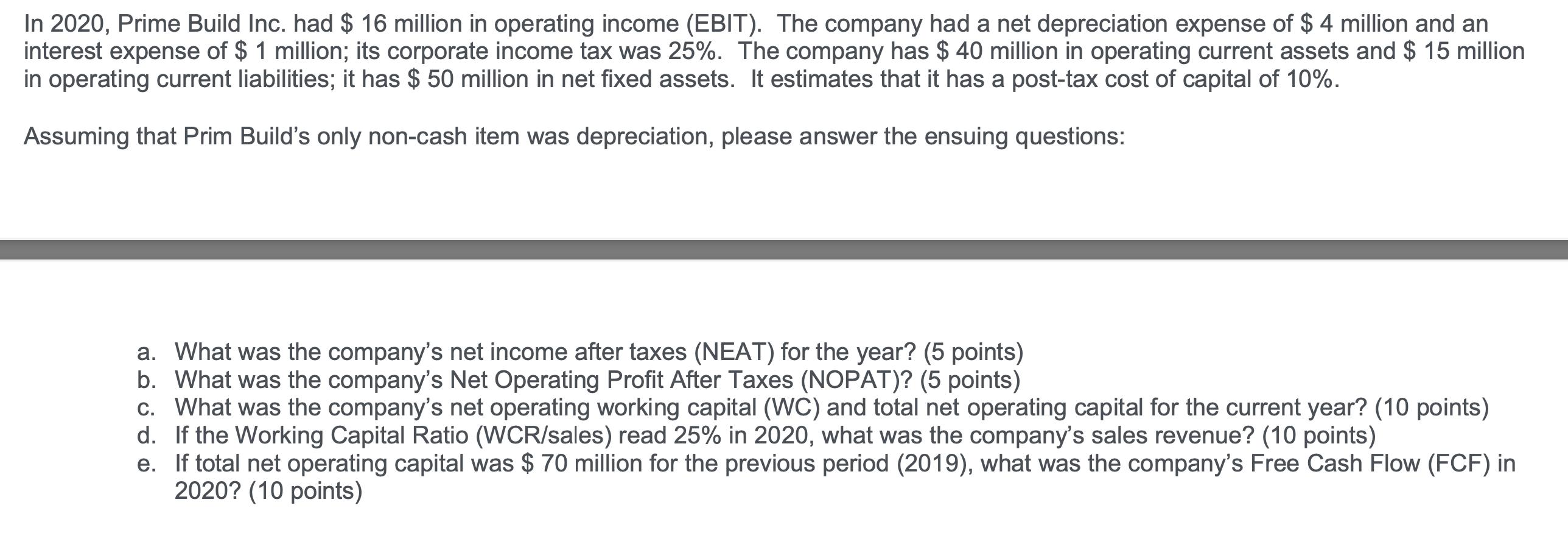

In 2020, Prime Build Inc. had $ 16 million in operating income (EBIT). The company had a net depreciation expense of $ 4 million and an interest expense of $ 1 million; its corporate income tax was 25%. The company has $ 40 million in operating current assets and $ 15 million in operating current liabilities; it has $ 50 million in net fixed assets. It estimates that it has a post-tax cost of capital of 10%. Assuming that Prim Build's only non-cash item was depreciation, please answer the ensuing questions: a. What was the company's net income after taxes (NEAT) for the year? (5 points) b. What was the company's Net Operating Profit After Taxes (NOPAT)? (5 points) c. What was the company's net operating working capital (WC) and total net operating capital for the current year? (10 points) d. If the Working Capital Ratio (WCR/sales) read 25% in 2020, what was the company's sales revenue? (10 points) e. If total net operating capital was $ 70 million for the previous period (2019), what was the company's Free Cash Flow (FCF) in 2020? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the companys net income after taxes EAT for the year we use the following formula EAT EBIT Interest Expense Corporate Income Tax Where ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started