Question

In 2020, TTY Co. changed its inventory cost system from weighted average to FIFO. This accounting change will be reported using the retrospective method. They

In 2020, TTY Co. changed its inventory cost system from weighted average to FIFO. This accounting change will be reported using the retrospective method.

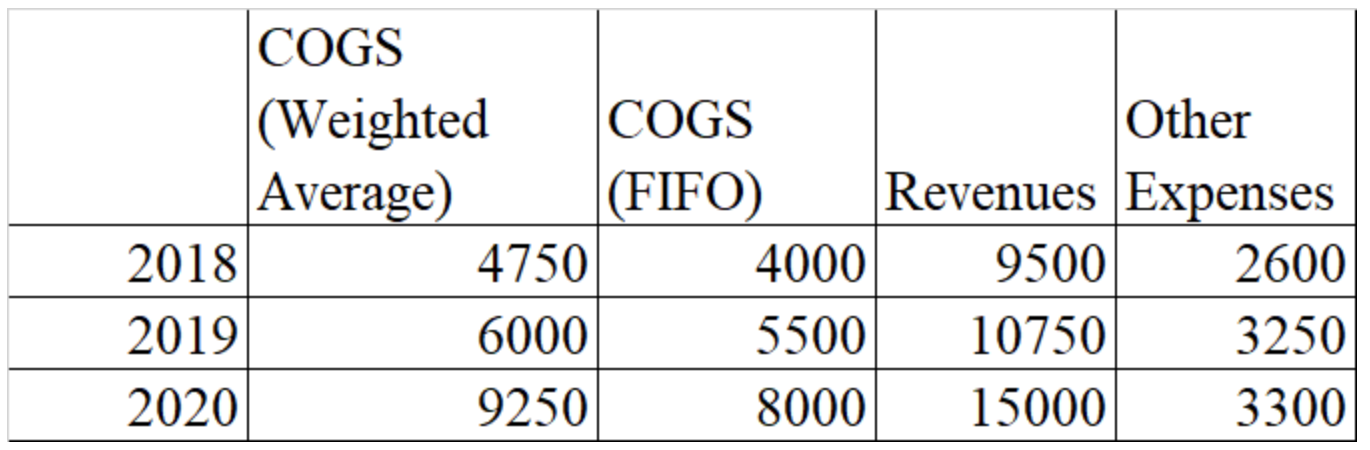

They have the following information for the last few years. 1. Calculate the restated net income for 2018 (Ignore taxes. Put 0 if you think this change is made prospectively and net income won't be restated)?

1. Calculate the restated net income for 2018 (Ignore taxes. Put 0 if you think this change is made prospectively and net income won't be restated)?

2. Calculate the restated net income for 2019 (Ignore taxes. Put 0 if you think this change is made prospectively and net income won't be restated)?

3. TTY Co. 2018 beginning balance for retained earnings was $33,000, but they calculate that it would have been $37,000 if they had always been using FIFO. Calculate TTY Co. original ending balance in retained earnings for 2019 (using weighted average). (TTY Co. paid no dividends in 2018, 2019, or 2020. Ignore taxes).

What is the 2019 Weighted Average Retained Earnings?

4. What should TTY Co. report as its ending balance in retained earnings for 2019 after changing to FIFO? (TTY Co. paid no dividends in 2018, 2019, or 2020. Ignore taxes).

What is the 2019 FIFO Retained Earnings?

5. Record the journal entry needed for TTY Co. to change from weighted average to FIFO. (Ignore taxes).

COGS (Weighted COGS Other Average) (FIFO) Revenues Expenses 2018 4750 4000 9500 2600 2019 6000 5500 10750 3250 2020 9250 8000 15000 3300 COGS (Weighted COGS Other Average) (FIFO) Revenues Expenses 2018 4750 4000 9500 2600 2019 6000 5500 10750 3250 2020 9250 8000 15000 3300Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started